-

The Consumer Financial Protection Bureau has implemented a new rule that broadens the ability of lenders in rural and underserved areas to originate qualified mortgages.

March 22 -

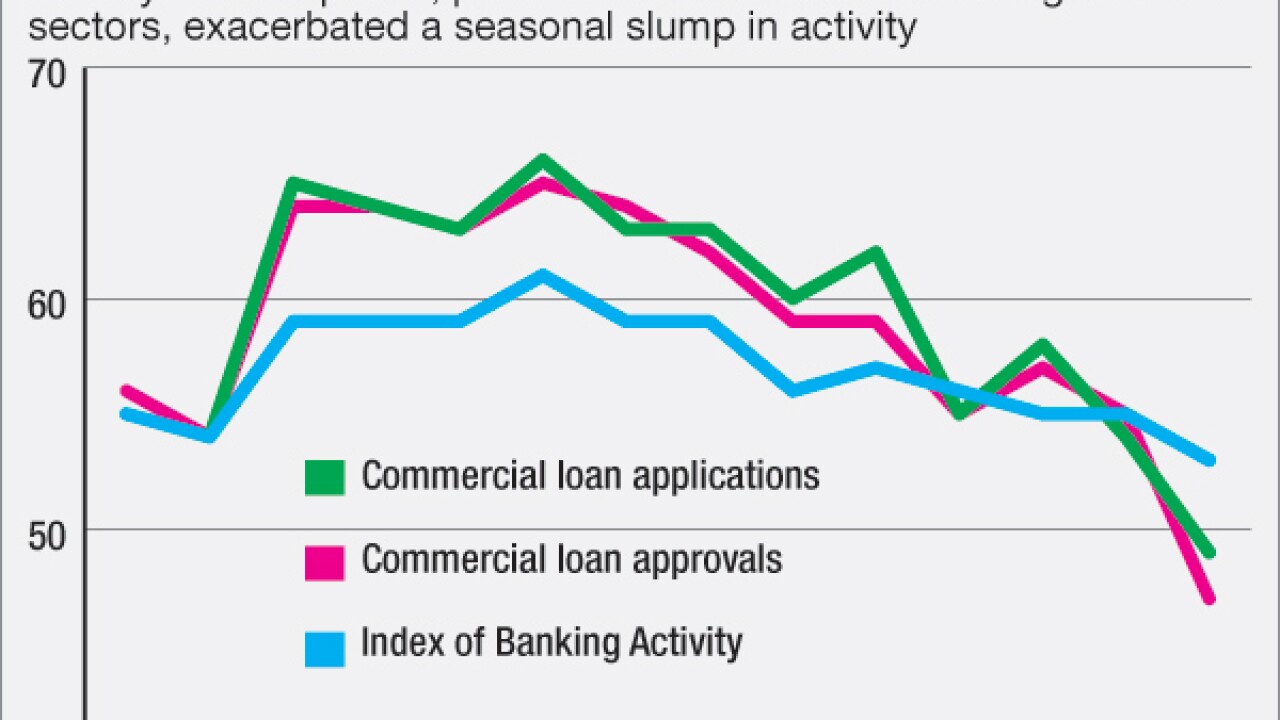

American Banker Research's Index of Banking Activity, which had the lowest reading in its nearly four-year history in January, revealed that issues in oil-producing states are contributing to decreases in commercial loan applications and approvals.

March 16 -

Ag lenders enjoyed solid credit metrics and an increase in farms loans in 2015. Those results could come under pressure this year, requiring bankers to become more vigilant in talking to their agricultural clients.

January 25 -

A proposal issued two weeks ago by the FHFA calls on the two government-sponsored enterprises to identify opportunities to increase their purchases of small multifamily properties in rural areas, sparking some concern among lenders.

December 28 -

ChoiceOne Bank in Sparta, Mich., has appointed Bradley Henion chief lending officer.

December 3 -

Bankers need to show they are in control of relationships with outside vendors, must be ready to respond to M&A-related protests and should be as concerned about economic growth as interest rates, according to the St. Louis Fed's supervisory chief.

September 30 -

Suncrest Bank is hoping that its team of experienced executives, combined with organic growth and acquisitions, will help more than double its assets in the next few years.

August 31 -

First National Bank of Pana in Illinois has agreed to buy The State Bank of Blue Mound in Illinois.

August 17 -

Farmer Mac reported higher second-quarter profit, citing an increase in the value of financial derivatives and hedged assets.

August 10 -

The U.S. Department of Agriculture's Rural Housing Service is raising the cost of its home-loan guarantees that enable borrowers to purchase homes in certain areas without down payments.

June 26 -

Steve Apodaca, who recently joined the American Bankers Association, hopes to help farmers navigate falling commodity prices, compete against the Farm Credit System and find ways to lend on new farming technology.

June 16 -

Californians are entering the fourth year of drought, forcing bankers to seriously consider the long-term implications for farmers and other industries. In some instances, banks are reviewing and changing underwriting practices to address risk.

April 20 -

Farm banks have enjoyed several years of robust loan volume, but declining farm income has them on guard for increases in delinquencies and more eager to use government-guarantee programs.

March 26 -

A recent research paper found that community banks' assets, along with market share in most types of commercial lending, have fallen since the Dodd-Frank Act was passed. The report is giving advocates of smaller institutions more data to rally around.

February 13 -

Great Western Bancorp in Sioux Falls, S.D., reported lower profit in its first quarter since completing its initial public offering.

January 30 -

A federal agency's plan to tighten membership rules for Federal Home Loan banks would hurt community banks and credit unions and could endanger the financial system, according to a broad array of stakeholders, including state regulators, lawmakers and institutions.

January 14 -

Lawmakers in state capitals across the country are increasingly intrigued by arguments for public banks. With the financial crisis fueling disdain for the banking industry in general, some view these banks as an appealing alternative to a system they consider to be broken. But Eric Hardmeyer, president and chief executive of the Bank of North Dakota, is not so sure.

April 1