-

Maine Harvest Federal Credit Union, which will serve farmers and the food industry, opened this week and aims to make $12 million in loans over the next six years.

October 9 -

On Jun. 30, 2019. Dollars in thousands.

September 16 -

Banks are taking back more farmland through foreclosure than at any point in the past three years as low crop prices, epic flooding and the Trump administration’s trade spat with China have left many farmers struggling to pay their debts.

September 11 -

The Unity, Maine-based institution, which should open in the fall, will provide member business loans and other products to local farmers.

August 23 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

Growers Edge is adapting retail financial technology to compete with traditional banks in ag lending and crop insurance.

August 8 -

County Bancorp is a small dairy lender in Wisconsin with an exposure to milk prices, and Bank OZK is a larger bank in Arkansas coping with out-of-market real estate trends. Their stories show how market sensitivities can vex specialists.

July 19 -

America's farms have taken on near-record levels of debt in recent years, and commodity prices and trade wars are putting pressure on farm country. That could spell bad news for bankers that lend to them.

July 18 -

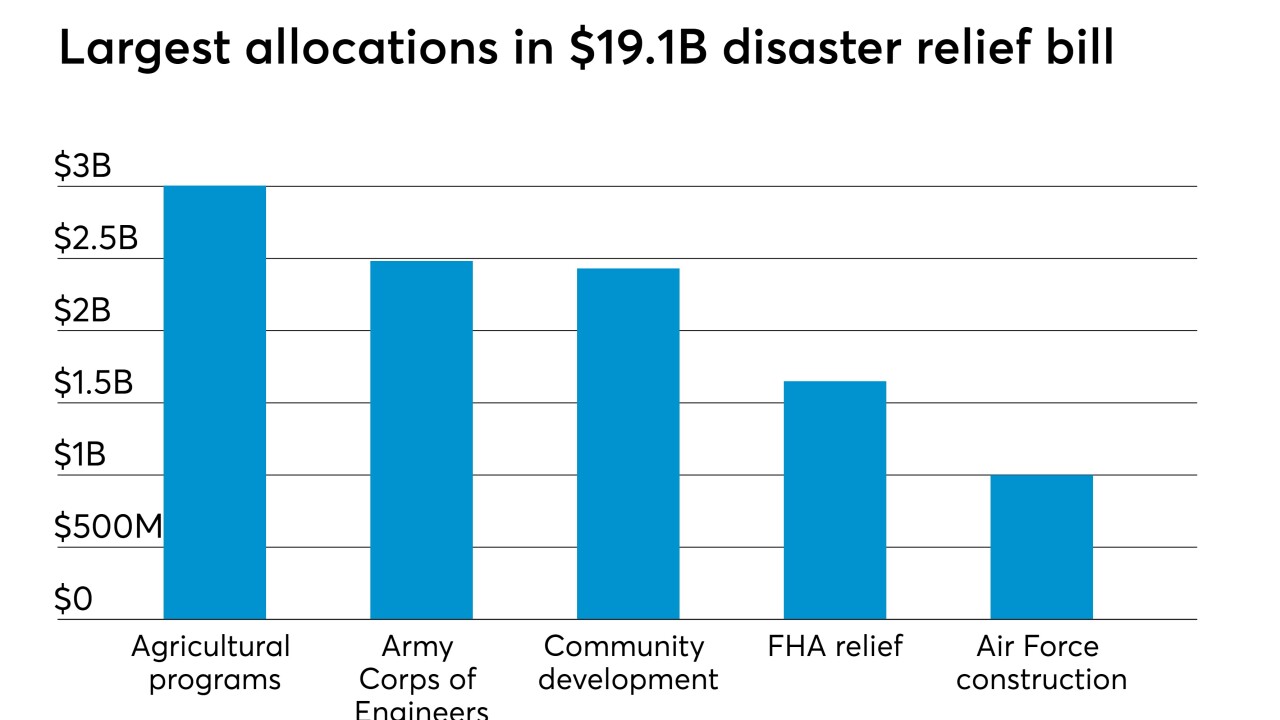

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

On Mar. 31, 2019. Dollars in thousands.

June 17 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Nominated for a full term at the central bank, Michelle Bowman told senators that bankers should not fear repercussions for servicing hemp growers after the crop was legalized.

June 6 -

Farmers were already taking on more debt to cover losses from falling crop prices. New tariffs and other retaliatory moves could hurt ag borrowers further and lead to loan losses and tighter underwriting.

May 16 -

Banks that serve U.S. farmers are increasingly restructuring existing loans and boosting the collateral needed for new ones as the numbers of late and missed payments have risen.

May 3 -

The latest World Council of Credit Unions project in the Caribbean will see the island nation working alongside Indiana CUs to share best practices, strategic initiatives and more.

April 23 -

On Dec. 31, 2018. Dollars in thousands.

March 25 -

Rising waters in the Cornhusker State have already caused in excess of $1 billion in damages.

March 22 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

A recent proposal to allow the government-sponsored enterprise to offer more credit in agricultural regions is deeply flawed.

January 15United Bank & Trust