-

Banks and startups compete for the same clients, as customers want one source for online checking and investment accounts.

June 12 -

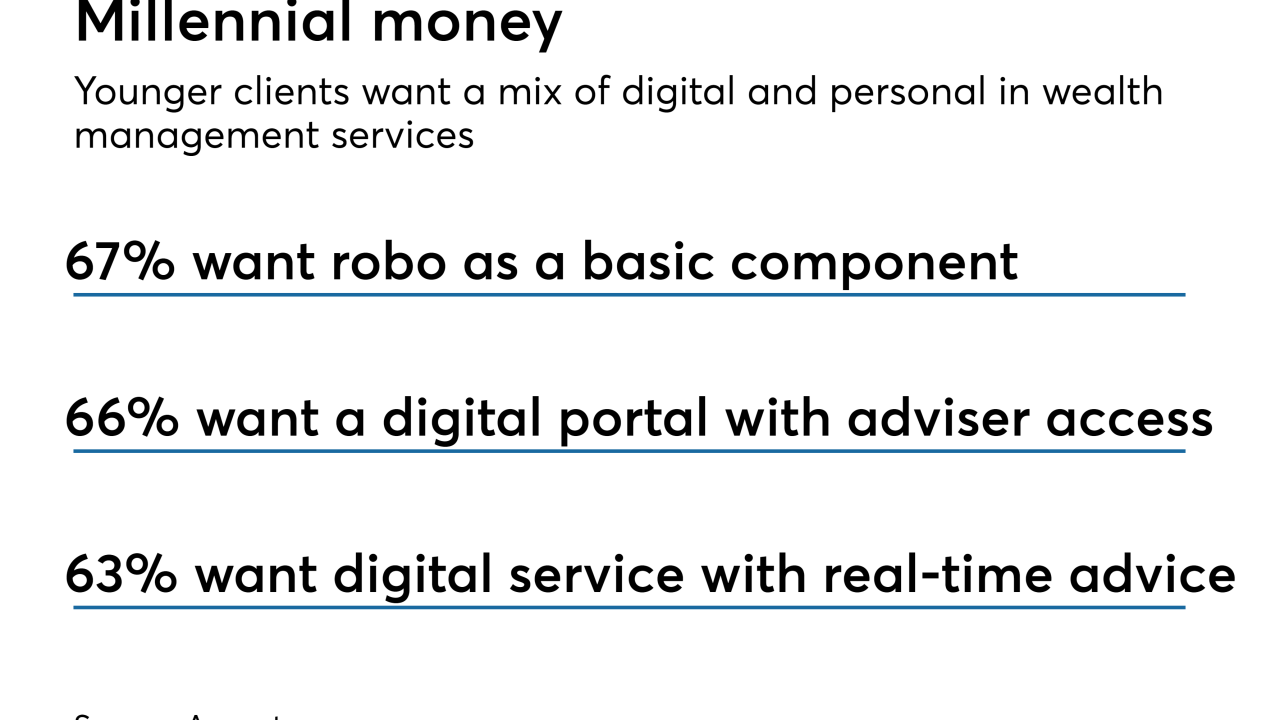

Most big banks are launching robo-advisers to compete for a new breed of wealth management customer. The risk is that automated services will disappoint traditional customers.

June 5 -

Venu Krishnamurthy is joining the asset management giant at a time when it is reorganizing itself and tinkering with product offerings to ward off fintechs and other challengers.

May 23 -

There's no reason that today's millennial-friendly microinvesting apps can't switch focus from spare change to real assets, industry executives warn.

May 16 -

The $3 billion sale of Financial Engines to Edelman Financial Services puts every investment adviser on notice that the future is in digital wealth management. More deals like it are expected.

April 30 -

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

Overstock will offer automated investing to its millions of shoppers. Some financial advisers reacted with a shrug, but are they underestimating the move?

February 5 -

Executives point out while they are fixing the online lender's very public problems, loan originations are still in the billions and it has expanded into wealth management.

January 24 -

Banks' online advice platforms are just the face of a deeper effort to restructure client data and adapt to a digital era.

December 21 -

Jon Stein plans to make Betterment's robo-adviser as personalized and intelligent as the online retailer's recommendation engine.

December 18