-

Banks must use analytics rather than customer surveys to determine what does and what does not inspire prospects to become customers.

August 5 Liberty Bank

Liberty Bank -

At its launch in 2004, ThankYou had its own separate identity, customer base and website from the rest of Citi even logging into the program was difficult.

August 5 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

August 5 -

Green Dot profits more than doubled to $8 million in the second quarter as revenues rose slightly and expenses ticked down.

August 4 -

The transactions look so ordinary that most banks' fraud filters aren't able to detect them. And the perpetrators aren't typical hackers they are middle-aged churchgoers who believe they are taking back what's rightfully theirs.

August 4 -

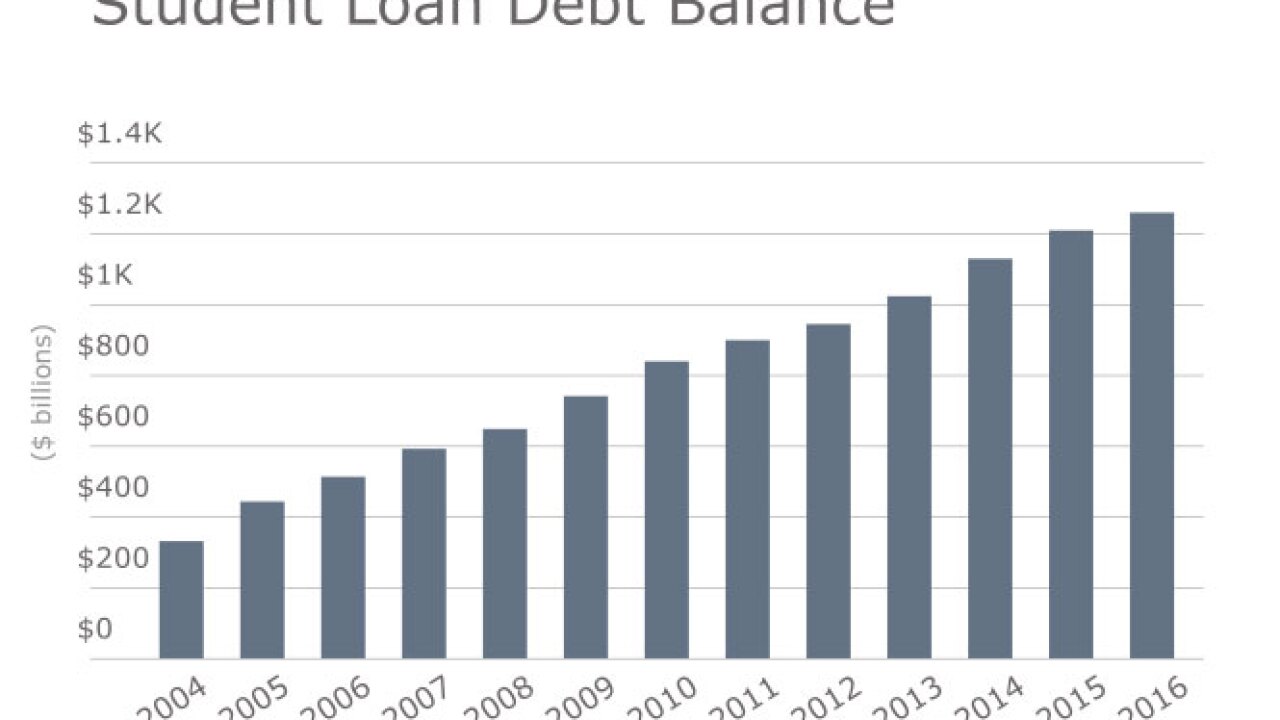

Fintech firms and millennial-focused advisers are providing advice on student loan refinancing, with the expectation that over time it will eventually lead to new business, in the form of brokerage and retirement accounts.

August 4 -

Bank of America, which spends about $1 billion a year handling cash, will save money and require fewer employees as more customers make payments electronically, Chief Executive Officer Brian Moynihan said.

August 4 -

In the wake of the Bitfinex heist, protecting consumers must again be at the forefront of the digital currency community.

August 4 Consumers' Research

Consumers' Research -

Elliptic, a startup that monitors the bitcoin network for suspicious patterns, has introduced anti-money-laundering data into its service through a partnership with LexisNexis Risk Solutions.

August 3 -

The situation turns on whether the CFTC inadvertently pushed Bitfinex to adopt a weaker security system than it had been using. However, the way the bitcoin exchange used the new system was significantly flawed, security experts said.

August 3 -

The startup firm Paymency is seeking to offer an API-driven "banking-as-a-platform" service to the U.S. financial services industry.

August 3 -

The recklessness of pioneers like The DAO and the need for learning are not unique to the blockchain ecosystem, pessimists notwithstanding. This technology is living through turbulent early days. It is bound to become safer and more powerful.

August 3 DataArt

DataArt -

Bots have slowly begun to creep onto the online payments scene, and they could offer a whole new, simpler way to part with our cash.

August 3 SecurionPay.com

SecurionPay.com -

Digital Asset Holdings has hired a former RBS executive to be its chief financial officer. The hire was one of several new recruits the New York blockchain startup announced Tuesday.

August 2 -

TouchID, facial recognition, behavior patterns, knowledge-based authentication, SMS codes the means of authenticating continue to proliferate. The smart minds in security have yet to settle on one which is the most effective.

August 2 -

What was true in the late 1700s, the 1970s and the 1980s is still true today: bank customers want to interact with real-life people when managing finances.

August 2 K.H. Thomas Associates

K.H. Thomas Associates -

A handful of banks and fintech companies are letting bank customers connect via chat bots on platforms like Slack of Facebook messenger. Some say this is the next big thing, while others say the technology still has a ways to go.

August 1 -

The linchpin of the federal government's payday lending proposal is a credit-reporting system for small-dollar loans created by the private sector, but the kinds of companies that could create it haven't stepped forward.

August 1 -

Banks should assess a customer's full financial picture before deciding to sell a debt to a third-party collection agent.

August 1 Oracle Financial Services

Oracle Financial Services -

As chief operating officers see their roles altered through industry consolidation, they are also taking the lead of implementing banks' technological and strategic overhauls.

July 31