-

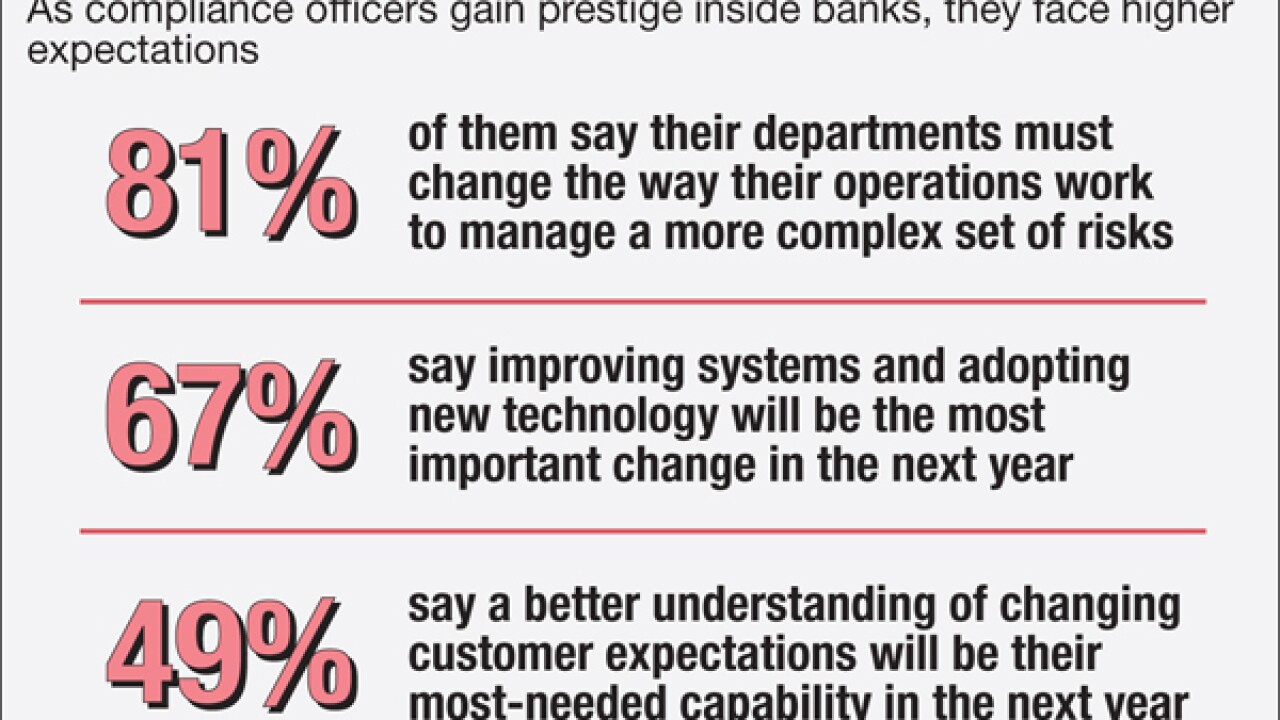

Bankers are increasingly turning to their compliance teams to gain insights about customers for business purposes. Compliance officers, meanwhile, are turning to technology to fulfill their heightened roles.

April 4 -

Add U.S. Bank to the list of companies allowing its customers to access its mobile app through their thumbprint.

April 1 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

April 1 -

An 11-page paper by the agency signaled its intent to take a higher-profile role in ensuring that regulators are not inappropriately hampering banks' adoption of new technologies to reach customers, while also keeping an eye out that institutions are able to handle the risks involved.

March 31 -

Despite email filters and training programs, bank customers still click on fake emails and malicious links at an alarming rate. Newer technologies and methods hold promise for getting phishing under control.

March 31 -

Bank of America appears to be retaining more deposits from recent branch sales, using technological advancements to keep customers despite the lack of a physical location.

March 31 -

First Data paid Chief Executive Frank Bisignano $51.6 million in 2015, almost twice what his former boss, JPMorgan Chase CEO Jamie Dimon, received last year.

March 31 -

A white paper released Thursday said the agency might issue new guidance on fintech product development, third-party risk management and new products targeting the underbanked; streamline its licensing procedures; and appoint experts on "responsible innovation." It is still deciding whether to open an office dedicated to monitoring the fintech sector.

March 31 -

To help make instant payments a reality, regulators here and abroad should encourage multiple approaches, thus avoiding the temptation to mandate a single solution.

March 31

-

Regulators are right to target overdraft and other fees as obstacles to banks offering affordable checking account options, but thats just the beginning in developing transactional products that work for consumers.

March 31