-

Early adopters of The Clearing House’s Real Time Payments network have built gateways and accelerated fraud detection systems.

February 12 -

For many newcomers to the U.S., establishing credit is a big challenge. A handful of entrepreneurs are developing tools to help verify their financial histories.

February 9 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

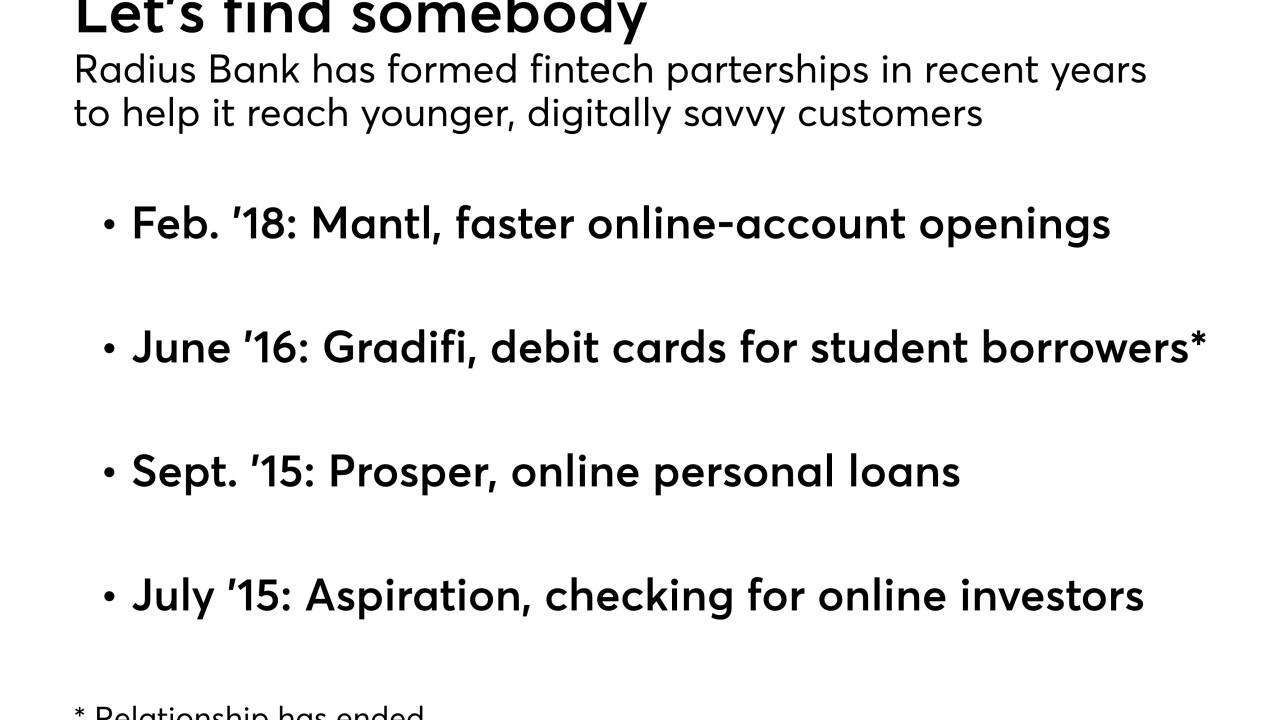

Its latest partner, Mantl, has built software that lets consumers open accounts in four minutes. In such alliances Radius seeks expertise it lacks, gets heavily involved in product development, and tries to balance the spirit of innovation with the demands of compliance.

February 7 -

Overstock will offer automated investing to its millions of shoppers. Some financial advisers reacted with a shrug, but are they underestimating the move?

February 5 -

Digit, which launched as an automated savings app in 2015, has decided chatbots are a flawed interface. Now it’s redesigning its popular app to reflect its new vision.

February 5 -

Large banks have begun sharing their adjusted gender pay gap ratios — how much women are paid versus men for similar jobs. The trouble is, they don’t have similar jobs.

February 2 -

The nation’s two largest banks don't want the credit risk associated with the transactions.

February 2 -

The few U.S. banks embracing data sharing say the industry is moving toward the standard.

February 1 -

Regulatory scrutiny of Tether and Bitfinex is spooking investors, though others argue the industry remains strong.

January 31