-

Ralph Hamers, CEO of ING Group in Amsterdam, sat down with American Banker to talk about the company's future in the U.S., plans to grow mobile users and banks' relationship with fintech.

December 13 -

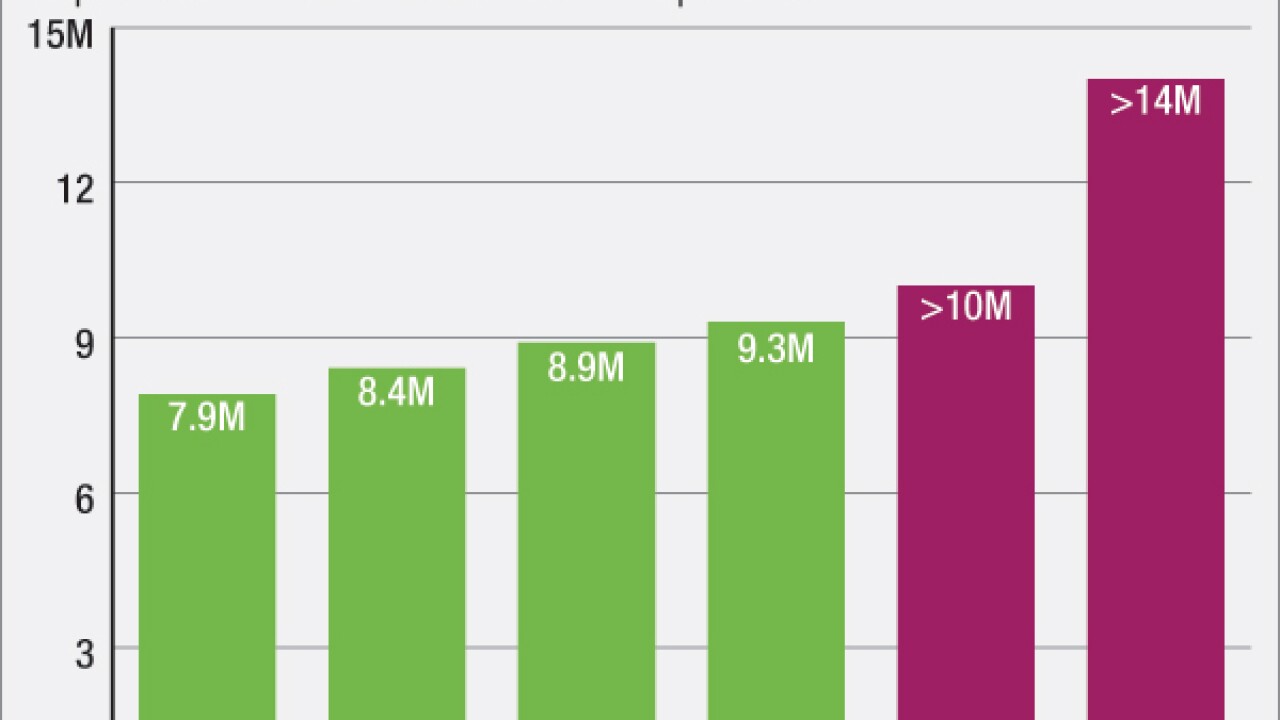

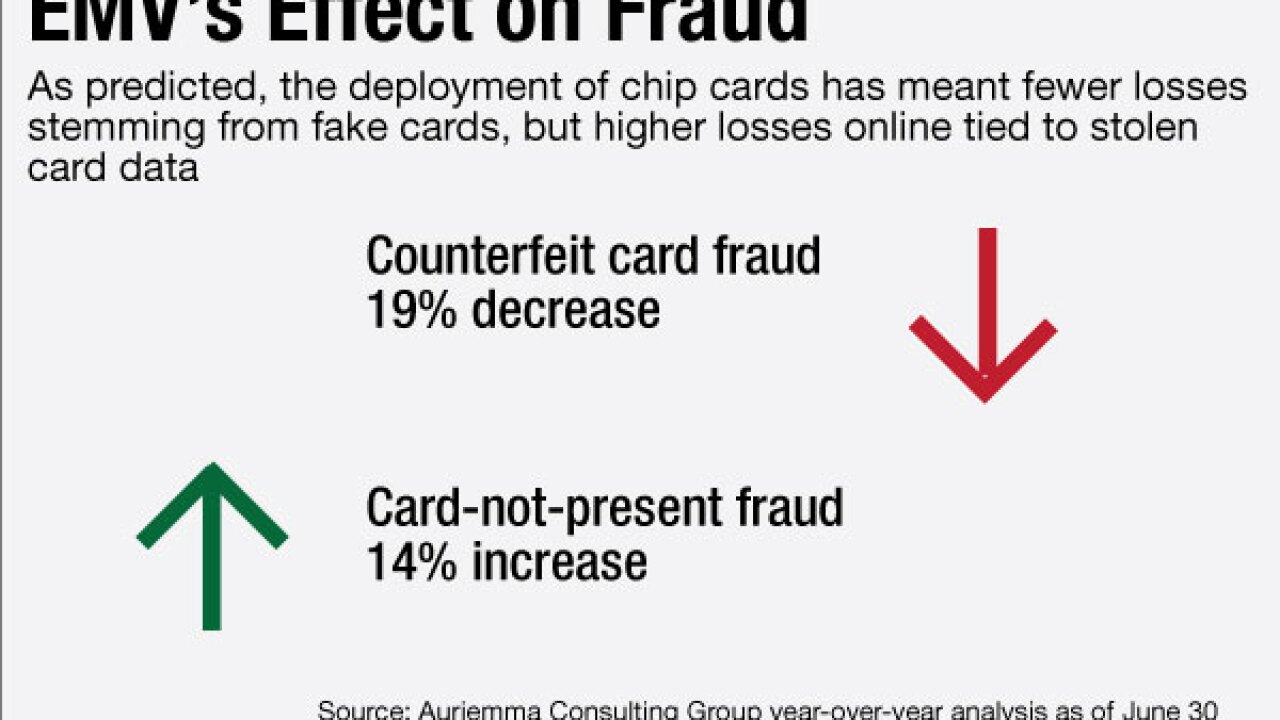

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Fifth Third Bancorp has invested in an online lending firm that makes loans to franchisees of popular retail chains.

December 13 -

Some are replacing legends, others are overseeing major mergers or product launches, and at least one big-bank CEO is on the hot seat. These are the industry executives to keep an eye on in the new year.

December 13 -

Both major brands are accelerating a move away from traditional checkout, and all retailers need to make adjustments for the future.

December 13 Judo Payments

Judo Payments -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated and it is here to stay."

December 12 -

Banks and data aggregators agree that screen scraping is a practice probably best left behind. In the coming year, the two might get better at sharing data via APIs.

December 12 -

First Republic Bank in San Francisco has bought Gradifi, a two-year old firm that works with small and large companies to help their employees pay down student debt.

December 12 -

Banks aiming to market internally developed products to other banks are also taking steps to become better vendors. Leader Bank, for instance, took more than a year to get its technology and staffing up to snuff before pitching its rent-payment program.

December 12 -

The core-tech vendor Fiserv has agreed to buy Online Banking Solutions in Atlanta.

December 12