-

U.S. Bank's steep price for instant payments risks limiting the feature's appeal. Rather than overcharging, banks need to think longer-term about how to drive payments volume.

April 5

-

Delaware, whose business-friendly laws have lured more than half the country's publicly traded corporations and more than 60% of the Fortune 500 to incorporate in the state, is now vying to become a hub for blockchain technology.

April 5 -

As they look to cut costs, banks are looking across the globe for cheap spots to host parts of their operations. A new report identifies the best back-office bargains.

April 4 -

R3 CEV, the blockchain consortium backed by some of the largest global banks, has partnered with Microsoft to accelerate the deployment of distributed ledger technology.

April 4 -

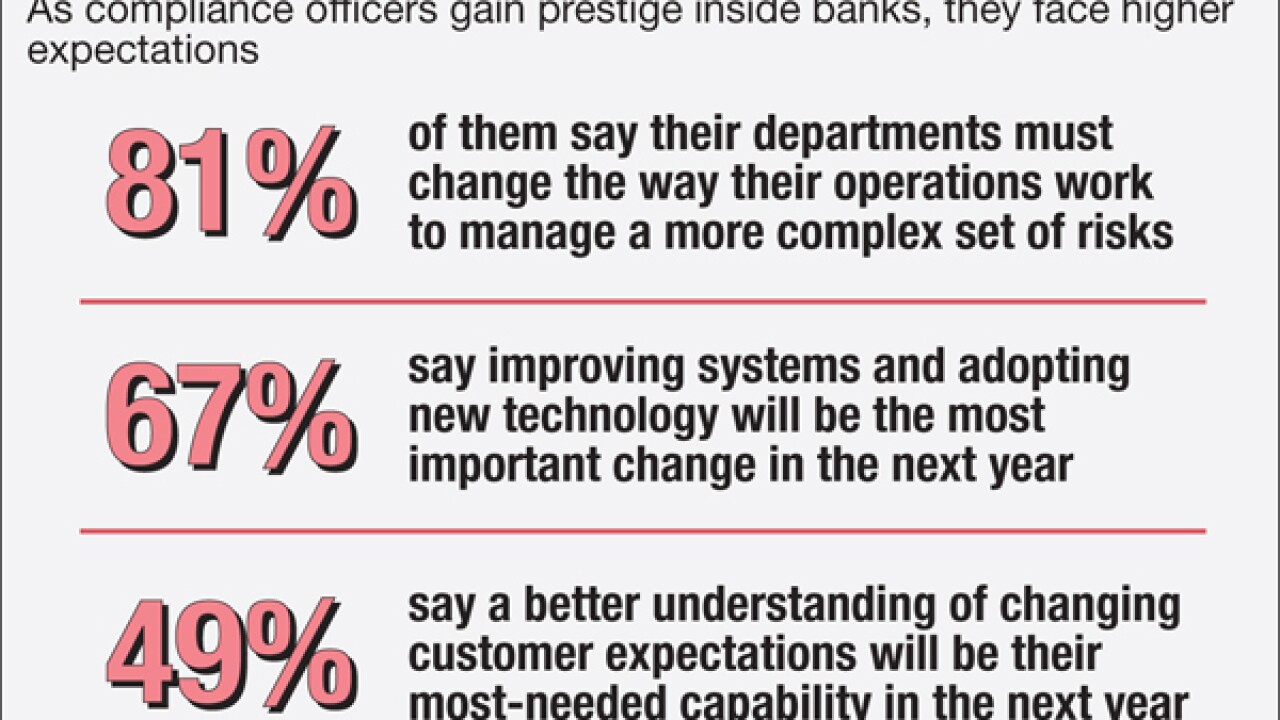

Bankers are increasingly turning to their compliance teams to gain insights about customers for business purposes. Compliance officers, meanwhile, are turning to technology to fulfill their heightened roles.

April 4 -

Add U.S. Bank to the list of companies allowing its customers to access its mobile app through their thumbprint.

April 1 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

April 1 -

An 11-page paper by the agency signaled its intent to take a higher-profile role in ensuring that regulators are not inappropriately hampering banks' adoption of new technologies to reach customers, while also keeping an eye out that institutions are able to handle the risks involved.

March 31 -

Despite email filters and training programs, bank customers still click on fake emails and malicious links at an alarming rate. Newer technologies and methods hold promise for getting phishing under control.

March 31 -

Bank of America appears to be retaining more deposits from recent branch sales, using technological advancements to keep customers despite the lack of a physical location.

March 31