-

Banks have all the experience they need to remain relevant in the world of digital payments, but they must not sit idly by as a slew of disruptors look to snag the business.

December 18 -

JPMorgan Chase investment bank head Daniel Pinto said internal technology projects, including those focused on blockchain, big data and robotics, will be a "major priority" next year.

December 18 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

December 18 -

FIS in Jacksonville, Fla., has partnered with the Venture Center to create an incubation lab to boost innovation in financial technology.

December 17 -

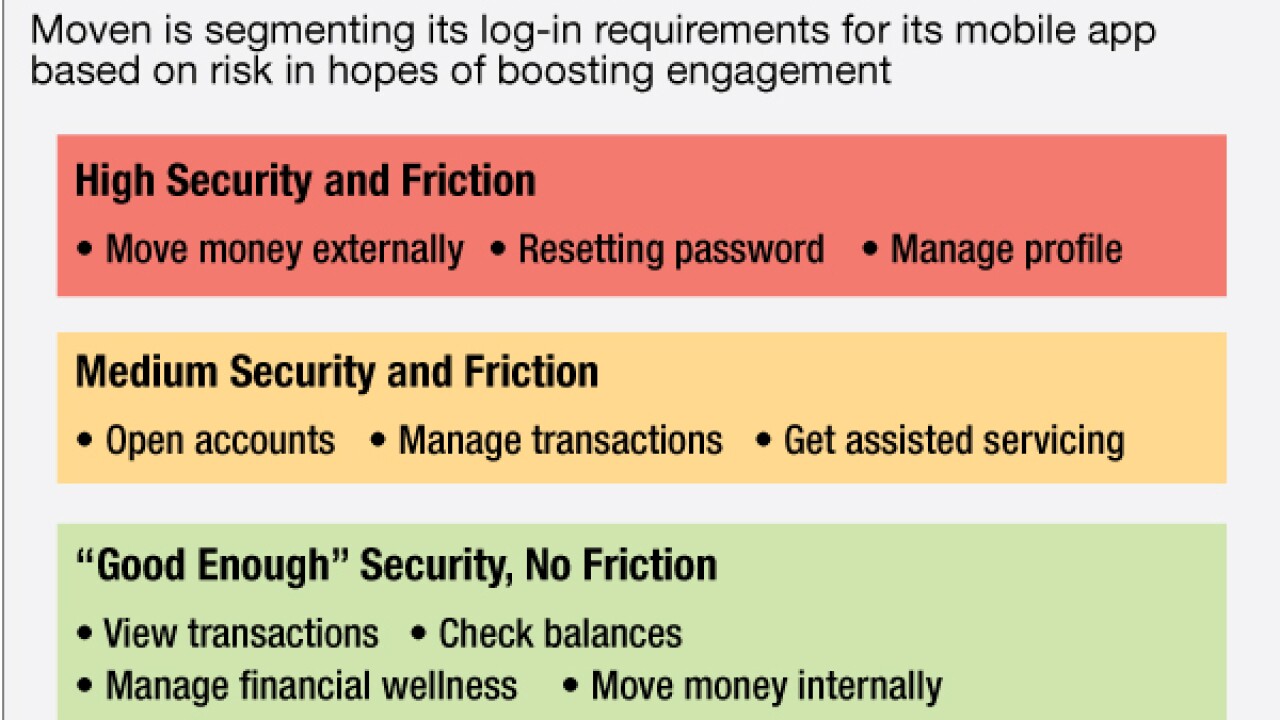

Moven will soon prompt its customers for usernames and passwords only for riskier transactions. By removing the login for most functions, the company aims to drive engagement in an app meant to be used on the go.

December 17 -

Ramamurthi has transformed a 123-year-old institution with one branch serving a dusty Kansas town into a seedbed for disruptive financial technology not to mention a wildly profitable generator of fee income.

December 17 -

Wells Fargo in San Francisco said that its chief information officer will retire at the end of March.

December 17 -

The success of a new blockchain-technology initiative will hinge on the ability of many influential players to work together: IBM, Digital Asset Holdings, R3, other tech companies, banks, Swift, the London Stock Exchange and the Linux Foundation.

December 17 -

Digital Asset Holdings is reportedly seeking a $35 million funding round that would put the blockchain technology startups valuation at $100 million.

December 17 -

The Consumer Financial Protection Bureau's payday loan proposal threatens many money services businesses on the front lines of stopping money-laundering and terrorist financing.

December 17