-

The New York State Department of Financial Services on Monday gave a third virtual currency company the green light to begin operations in the state.

October 5 -

Swift CEO Gottfried Leibbrandt talks about how the global messaging network is looking to stay relevant to its bank members; the potential and limitations of blockchain technology; and his views on the startups looking to disrupt banking.

October 5 -

A California company called NEFT wants to provide the online meeting place where debt-laden borrowers get together with lenders and credit bureaus to negotiate repayment plans. Backed by some prominent investors, NEFT says it offers carrots to get all the parties to participate.

October 5 -

Kabbage is one of many nonbank lenders looking to partner with traditional financial institutions. But the firm is facing a tough sell with bankers who worry about the risks associated with ceding control of the loan-underwriting process.

October 5 -

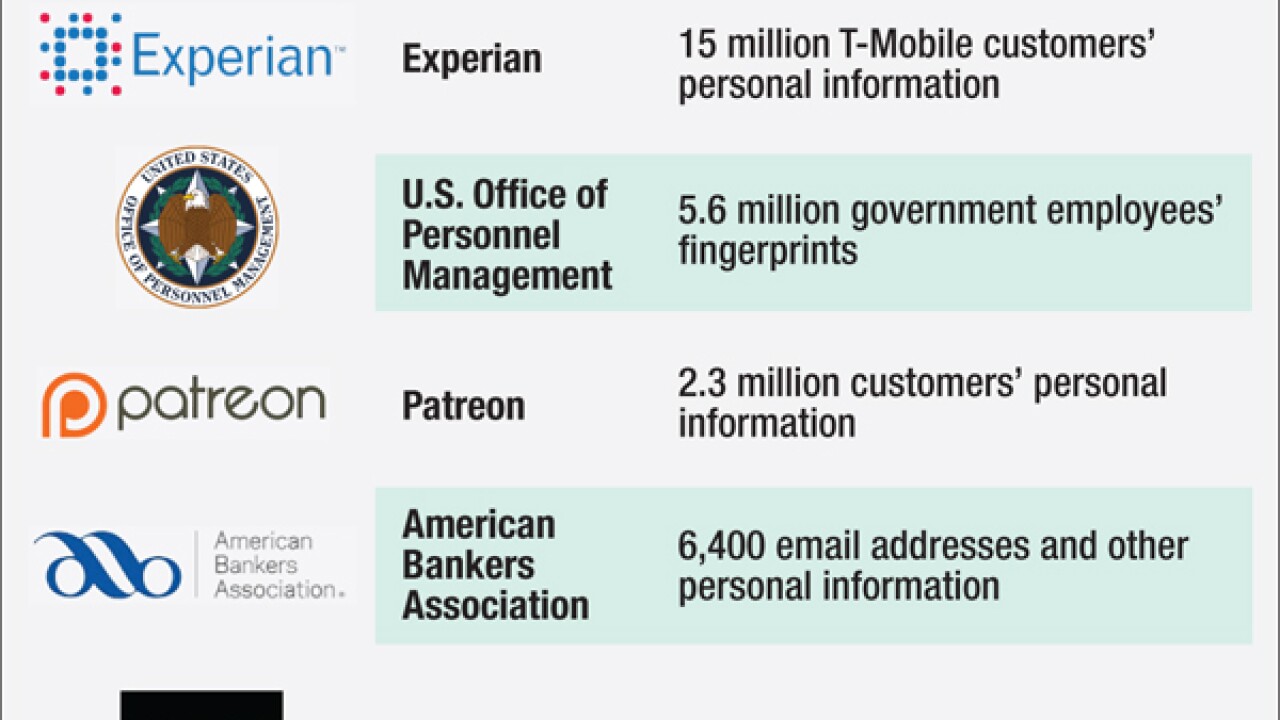

Hackers did not steal banking or payments data from Experian, but they might as well have. Breaches like the one sustained at the company call into question the entire system of identification that banks rely on to open accounts and conduct other everyday business.

October 2 -

Compared with other recent breaches, the theft of 6,400 user email addresses and passwords on the American Bankers Association's website might seem like small potatoes. But experts said the attack the first in the association's history was still significant and could have implications for banks.

October 2 -

"Pricing will have to be changed," American Banker declared in 1977, "to help motivate banks to start such programs with their own customers."

October 2

-

While large banks are risk-averse, conformist and bureaucratic, marketplace lenders are inspiring the best and the brightest with their high-energy cultures.

October 2

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

October 2 -

A server containing sensitive consumer information at Experian has been breached, with the records of as many as 15 million T-Mobile customers stolen, the companies said Thursday.

October 1 -

Banks worldwide are in danger of losing significant profits in several lending areas to nonbank alternative lenders, according to a McKinsey study.

October 1 -

Customers who used a payment card between May 19, 2014 and June 2, 2015, may have had their full set of card data stolen.

October 1 -

PNC Financial Services Group cut the ribbon on its new, environmentally friendly headquarters in Pittsburgh.

October 1 -

Banks have embraced it, but their customers barely use Apple's mobile payment solution.

October 1 -

Outdated and inefficient processes come at the cost of face time with customers and weigh banks down with unnecessary expenses. Here are some of the most common problems faced by the industry and ideas about how to fix them.

October 1

- New York

First Data, the payments processor taken private by KKR & Co. eight years ago, is seeking to raise as much as $3.2 billion in whats poised to be the biggest U.S. initial public offering this year.

October 1 -

In updating cards with EMV technology, Visa and MasterCard have neglected an important element of what makes the security standard so successful elsewhere. The need for PIN verification is clear.

October 1

-

Independence Bancshares in Greenville, S.C., has dismissed Gordon Baird as chief executive and suspended its development of a real-time payments technology.

October 1 -

Many card issuers are well on their way to the migration to chip cards or have a plan to do so. But many merchants are still completely unaware of the shift in fraud liability taking effect Thursday.

October 1

-

Avant, an online lending platform that focuses on borrowers with marred credit, announced an agreement Wednesday to raise $325 million in equity financing from blue-chip investors.

September 30