-

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

Just a handful of de novo banks opened in 2025. But there are signs of renewed activity, with eight banks currently actively in formation and more than 10 charter applications on file with the FDIC.

January 5 -

Mike Dargan, former chief operations and technology officer for UBS, stepped down at the end of 2025 and will become the CEO of neobank N26 this spring.

January 2 -

Bank First in Manitowoc, Wisconsin, has completed its acquisition of Centre 1 Bancorp in Beloit; Citi plans to shed its remaining Russian operations; Heritage Financial in Olympia, Washington, has received regulatory approvals to acquire Olympic Bancorp; and more in this week's banking news roundup.

January 2 -

As artificial intelligence is integrated into more and more core banking operations, bank boards of directors need to make sure business continuity plans account for the possibility of AI system failures.

January 2

-

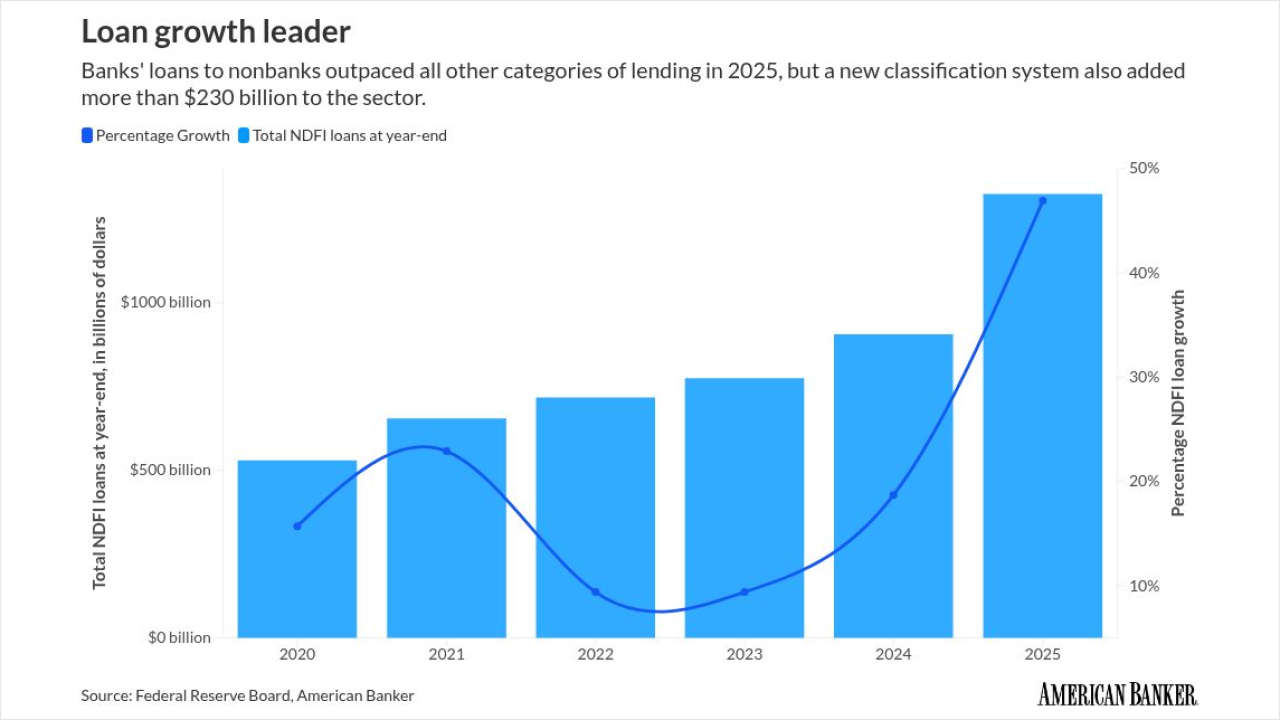

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

Community banks are always looking for ways to expand local engagement. But for some banks, sponsoring disc golf courses, clubs and events offers a relatively inexpensive way to boost their profile among a very loyal customer base.

January 1 -

Conditional approval of a national bank charter used to be a virtual guarantee that an institution would open its doors. But the OCC's recent treatment of Erebor Bank suggests that banks with conditional approvals still have work to do.

December 31

-

When Congress returns from its recess in 2026, a number of financial legislative issues will be teed up, including crypto market structure, deposit insurance and supervisory disputes.

December 31 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

Credit unions hit new highs in membership, deposits and loans in 2025. But it was also a chaotic year for the industry's governing body, and the sector faced renewed attacks by banks.

December 30 -

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

December 30 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

It's not just Capital One Cafés; banks all over the country are repurposing branches and offices. Marketing experts call it innovative, but critics say some lenders are crossing a legal boundary between banking and commerce.

December 30 -

National ad campaigns are impressive. But few things create more goodwill or lasting impact than visible, hands-on support of a community's youth, no matter the size of the bank.

December 29

-

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

-

The former chief national bank examiner for the Office of the Comptroller of the Currency sees welcome changes in the structure of federal banking supervision, but warns against the dangers of complacency.

December 24