-

The Swiss banking giant will come under the spotlight Tuesday at a Senate hearing.where the question of whether a 1999 settlement over Holocaust-looted funds should be reopened is expected to be discussed.

February 3 -

The digital bank added two new board members and raised $123.9 million as it continues to manage regulatory costs amid its push for profitability.

February 2 -

In keeping with its policy of outsourcing functions outside its core commercial and retail banking competency, Signature Bank near Chicago teamed with a larger trust company to fill a longstanding gap in its product set.

February 2 -

Instead of fighting to keep the banking industry unchanged, perhaps it's time for banks to accept that change is inevitable and focus on adapting to remain competitive.

February 2

-

As tokenization increasingly brings instant settlement to transactions, the liquidity buffer that batch settlement has provided for decades is going to shrink and then disappear. Banks will need to rethink liquidity management.

February 2

-

The Arkansas-based company pivoted to organic growth a few years ago, after making 14 bank acquisitions in less than a decade.

February 2 -

The combination of the banks is the latest in a trend of deals closing on speedier timelines, and signals the industry's hunt for scale.

February 2 -

When the Swiss banking giant bought rival Credit Suisse in 2023, it inherited an investigation over money the Nazis looted from European Jews. The issue now seems to be coming to a head in Washington.

February 2 -

The Chicago-based, $261 million-asset Metropolitan Capital Bank & Trust was placed in receivership and its assets sold to Detroit-based First Independence Bank, costing the Federal Deposit Insurance Corp.'s Deposit Insurance Fund an estimated $19.7 million.

January 30 -

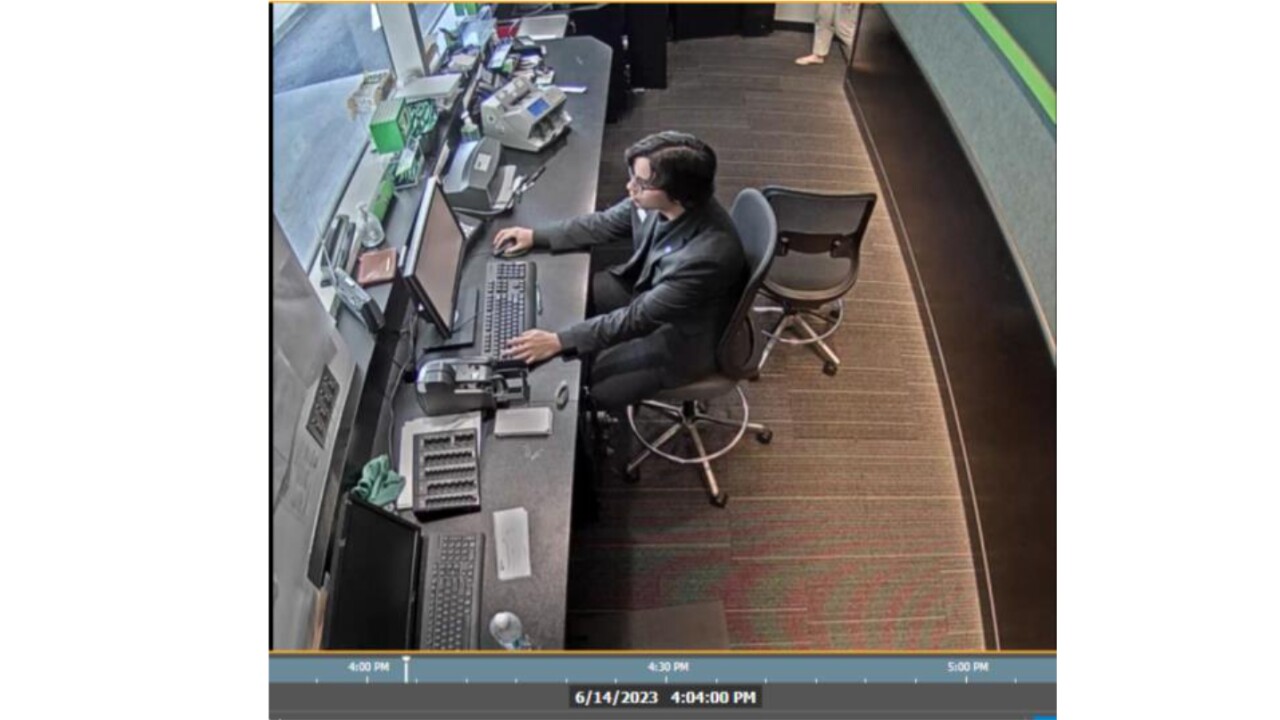

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

January 30 -

U.S. Bancorp shuffles management as COO Souheil Badran announces his retirement; Stock Yards Bancorp agrees to buy Field & Main Bancorp; Citi's wealth business hires Mercer's Olaolu Aganga for a newly created role; and more in this week's banking news roundup.

January 30 -

The Long Island-based bank returned to profitability during the fourth quarter of 2025. The results mark "a significant milestone" in the bank's turnaround plan, CEO Joseph Otting said.

January 30 -

While they may look like a tool for reinforcing customer's connection to their banks, loyalty coalitions present serious risks if they are not constructed properly and monitored continuously.

January 30

-

Fidelity Digital Assets, the national crypto trust bank subsidiary of Fidelity Investments, is set to launch a dollar-backed stablecoin on ethereum.

January 30 -

The Brazil-based fintech got conditional approval from the OCC to bring its digital banking services to U.S. customers.

January 29 -

A one-time accounting change will boost the bank's ability to spend on marketing. Traders flinched at the change; analysts called it a buying opportunity.

January 29 -

The auto lender's earnings mostly surpassed expectations in the fourth quarter, but its financial outlook was dampened by its projection of a weaker labor market in 2026.

January 29 -

A world of hundreds if not thousands of stablecoins sounds chaotic – but that's because we're still thinking of stablecoins as money. Consider their potential for strengthening customer loyalty and engagement.

January 29 -

The fintech, founded by an ex-Coinbase executive, seeks to offer stablecoin-powered global money movement services to businesses.

January 29 -

The Connecticut bank invited rival bankers, lawyers and regulators to share their experiences with and warnings on using AI.

January 28