-

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

Virtual reality and agetech devices were among the consumer electronics devices that caught the attention of U.S. Bank Chief Innovation Officer Don Relyea and Head of Research and Development, Innovation Todder Moning.

January 13 -

Coastal Financial in Washington State has acquired GreenFi, one of its fintech partners. The move is designed to buy time in order to figure out the best long-term strategy for the struggling neobank.

January 12 -

The 6-2 vote represents a win for the megabank, which has been fighting a nationwide push to organize its workers. Some 28 branches have voted in favor of unionization, while three have rejected unionization.

January 12 -

Despite attracting $2 billion in deposits, the cloud-native unit proved too expensive to maintain, prompting a strategic retreat by parent company SMBC.

January 12 -

-

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

San Diego County Credit Union and California Coast Credit Union, which last year announced plans to merge, are now duking it out in court. SDCCU alleges there are widespread compliance problems at Cal Coast, which Cal Coast denies.

January 12 -

Prosperity Bancshares is fast-tracking bank acquisitions; PNC closed its acquisition of FirstBank Holding Company; BrightBridge Credit Union finalized its merger with Arrha Credit Union; and more in this week's banking news roundup.

January 9 -

Significant regulatory, legislative and business developments could shape the industry this year, putting pressure on banks to respond.

January 9 -

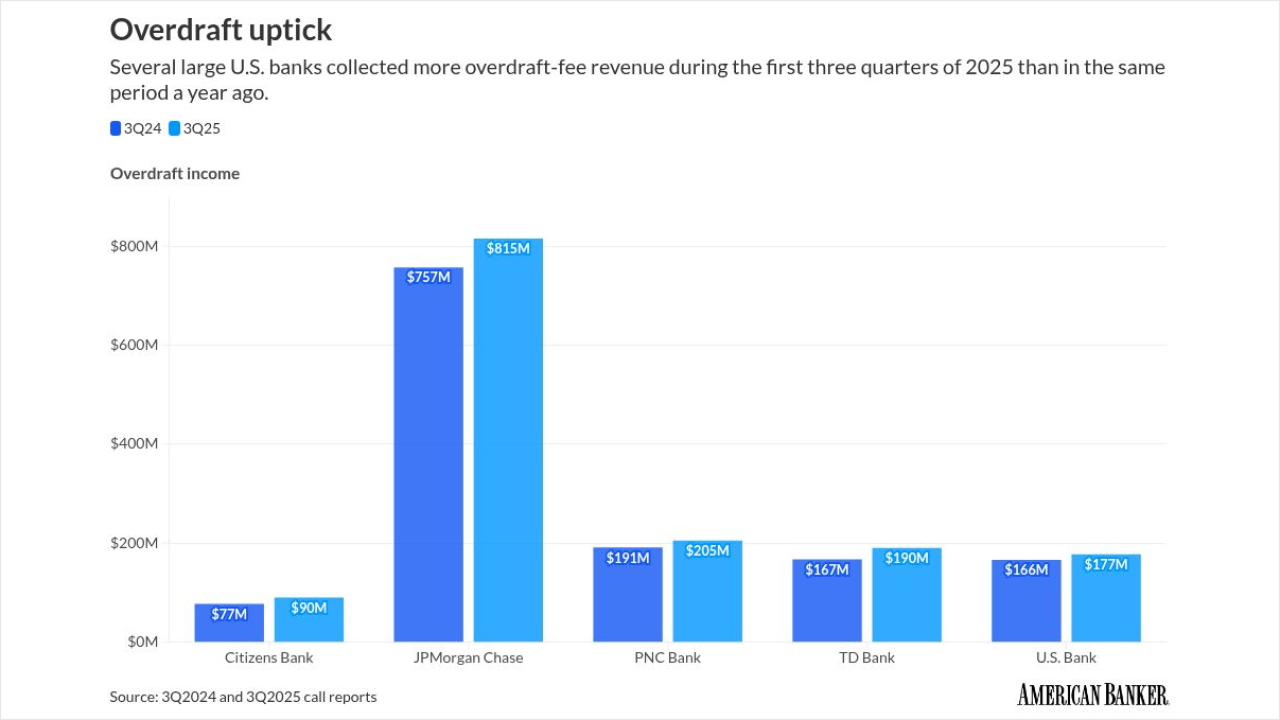

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Federal Reserve will resume accepting pennies from banks and credit unions at all commercial coin distribution locations beginning Jan. 14. The central bank had ceased accepting pennies at some distribution centers late last year, but bankers praised Thursday's reversal.

January 8 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8 -

Investors in alternative assets like private equity, private capital and venture capital often lock their money in for years, but Pluto's founders say its marketplace matches these wealthy investors who need cash with banks and investment firms willing to lend against those illiquid assets.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

House Financial Services Committee Chairman French Hill's community-banking package includes reciprocal deposits, tailoring and many other items on community bankers' wish lists.

January 7 -

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined several priorities affecting community banks, including potential changes to asset thresholds for smaller institutions.

January 7 -

The 81-year-old Metamora State Bank renamed itself Bank419 to better align its brand with its business after years of regional expansion.

January 7 -

The Kansas City, Missouri-based bank completed its first bank acquisition in 12 years on New Year's Day. Now it's focused on retaining and growing FineMark Holdings' high-net-worth clients in markets such as Southwest Florida, South Carolina and Arizona.

January 7 -

PicPay is making a second attempt at entering the U.S. market as a profitable digital bank and a competitor to fellow Brazilian fintech Nubank.

January 6