-

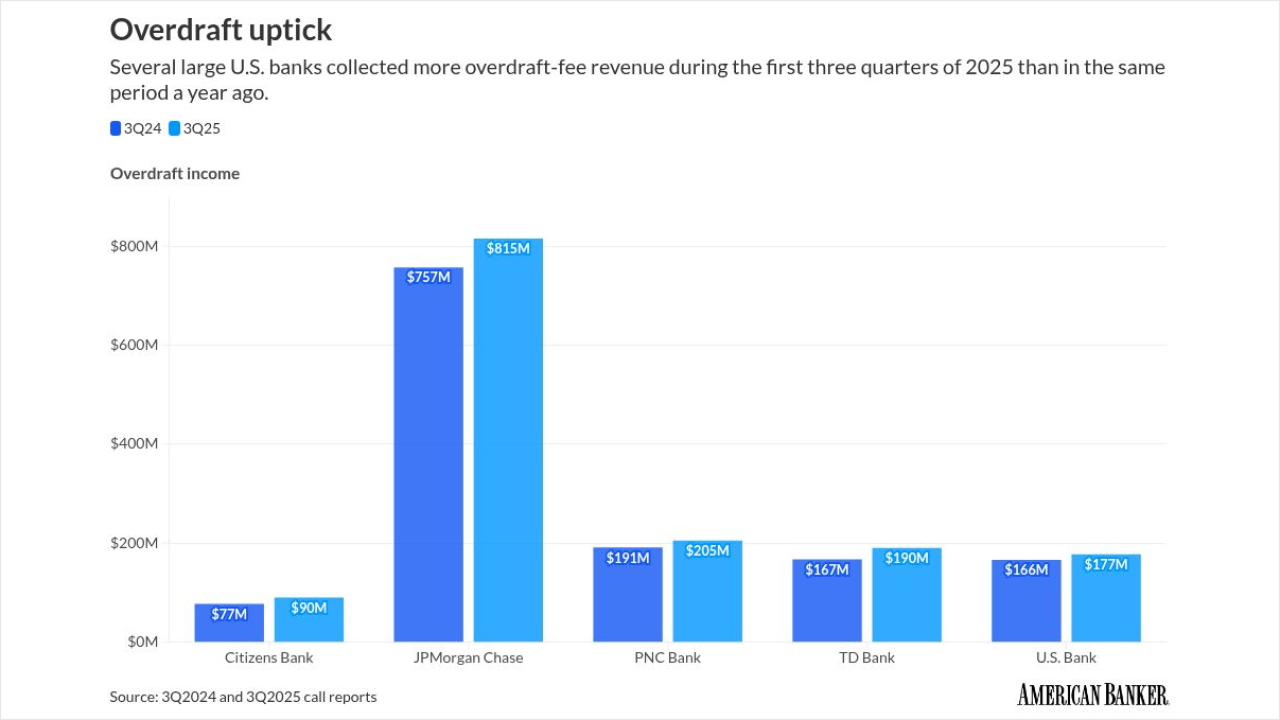

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Federal Reserve will resume accepting pennies from banks and credit unions at all commercial coin distribution locations beginning Jan. 14. The central bank had ceased accepting pennies at some distribution centers late last year, but bankers praised Thursday's reversal.

January 8 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8 -

Investors in alternative assets like private equity, private capital and venture capital often lock their money in for years, but Pluto's founders say its marketplace matches these wealthy investors who need cash with banks and investment firms willing to lend against those illiquid assets.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

House Financial Services Committee Chairman French Hill's community-banking package includes reciprocal deposits, tailoring and many other items on community bankers' wish lists.

January 7 -

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined several priorities affecting community banks, including potential changes to asset thresholds for smaller institutions.

January 7 -

The 81-year-old Metamora State Bank renamed itself Bank419 to better align its brand with its business after years of regional expansion.

January 7 -

The Kansas City, Missouri-based bank completed its first bank acquisition in 12 years on New Year's Day. Now it's focused on retaining and growing FineMark Holdings' high-net-worth clients in markets such as Southwest Florida, South Carolina and Arizona.

January 7 -

PicPay is making a second attempt at entering the U.S. market as a profitable digital bank and a competitor to fellow Brazilian fintech Nubank.

January 6 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

Just a handful of de novo banks opened in 2025. But there are signs of renewed activity, with eight banks currently actively in formation and more than 10 charter applications on file with the FDIC.

January 5 -

Mike Dargan, former chief operations and technology officer for UBS, stepped down at the end of 2025 and will become the CEO of neobank N26 this spring.

January 2 -

Bank First in Manitowoc, Wisconsin, has completed its acquisition of Centre 1 Bancorp in Beloit; Citi plans to shed its remaining Russian operations; Heritage Financial in Olympia, Washington, has received regulatory approvals to acquire Olympic Bancorp; and more in this week's banking news roundup.

January 2 -

As artificial intelligence is integrated into more and more core banking operations, bank boards of directors need to make sure business continuity plans account for the possibility of AI system failures.

January 2

-

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

Community banks are always looking for ways to expand local engagement. But for some banks, sponsoring disc golf courses, clubs and events offers a relatively inexpensive way to boost their profile among a very loyal customer base.

January 1 -

Conditional approval of a national bank charter used to be a virtual guarantee that an institution would open its doors. But the OCC's recent treatment of Erebor Bank suggests that banks with conditional approvals still have work to do.

December 31

-

When Congress returns from its recess in 2026, a number of financial legislative issues will be teed up, including crypto market structure, deposit insurance and supervisory disputes.

December 31