-

The mortgage giant’s net worth of $42 billion at the end of the quarter was more than double what it was a year earlier. CEO Hugh Frater said that financial strength puts the company on better footing to support affordable housing goals outlined by the Federal Housing Finance Agency.

October 29 -

The combined refinance and purchase total was nearly double the average quarterly volume logged before the pandemic, the company said in its third-quarter earnings call.

October 29 -

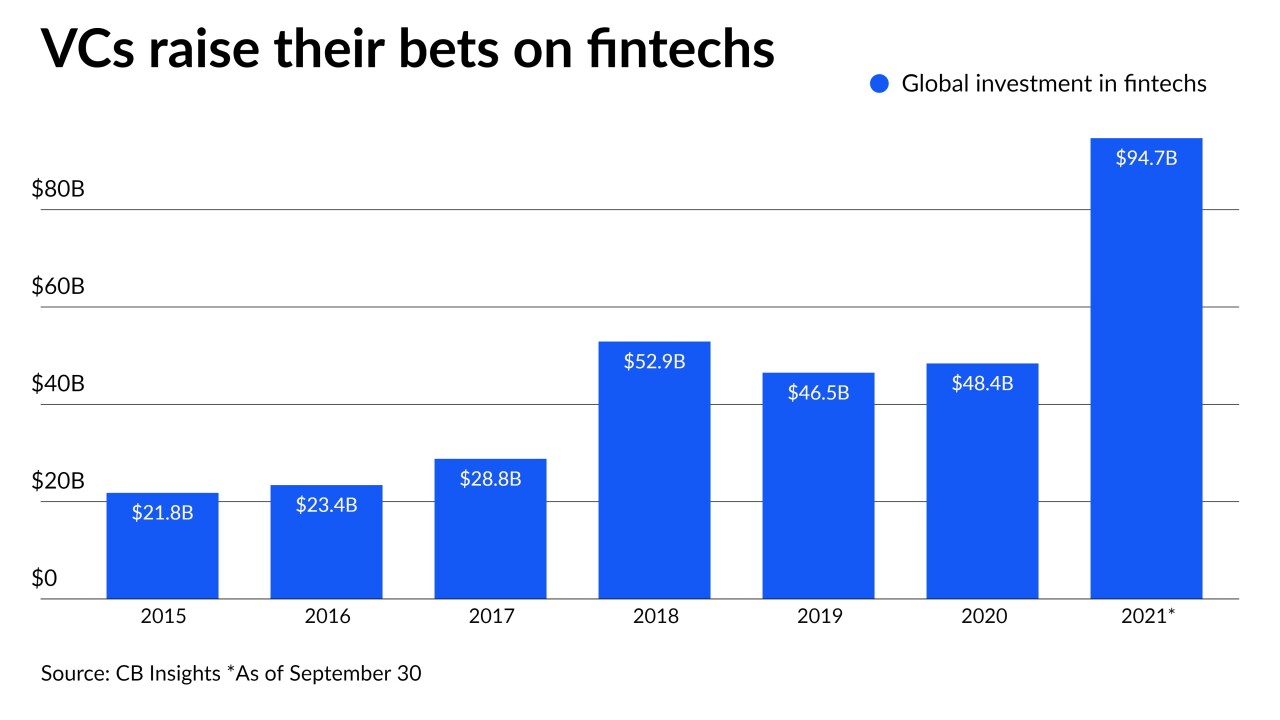

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

Maxwell, a startup that operates an online platform catering to mortgage loan officers and smaller lenders, raised $28.5 million in equity funding from investors led by the venture firm Fin VC and Wells Fargo Strategic Capital.

October 26 -

The country's biggest financial companies are well represented in the ranking. Citigroup leads the way, followed by JPMorgan Chase and Bank of America.

October 6 -

The acquisition of Sabal Capital Partners, which has been growing its footprint in commercial mortgage-backed securities lending, will help the Alabama bank build out its capital markets business.

October 4 -

Neobanks and Fintechs have raised the bar in terms of client experience and expectations, forcing incumbents to break free and innovate. Now they are coming after the next generation, launching next-gen youth-focused offerings. Europe is leading this charge with nearly half of the startups based in the region. With the increased popularity and competition how are these neobanks finding different ways to market and monetize? In this session hear from Taylor Burton, co-founder of Till Financial on why there is a race to capture the next generation and how Fintechs like Till Financial is turning is a popular trend into a profitable business.

-

Companies like Ally are mimicking the approach of fintechs by curbing overdraft charges and instituting other changes. It is a sign that startups’ efforts to improve customer experience were successful and that competition in digital-first banking will intensify.

September 24Flourish -

Bilt Rewards, which offers a loyalty program and credit card that converts rent into reward points, raised $60 million from investors including Mastercard and Wells Fargo, giving the startup a $350 million valuation.

September 21 -

The company will return to selling pieces of its credit exposure to private investors during the last three months of the year, but is still evaluating its strategy for 2022.

September 20