-

American Banker predicted these five bankers would make news. Several delivered, mostly with small, strategic deals and finding ways to make money in spite of challenging conditions.

December 23 -

Add Investar Holding in Baton Rouge, La., to the growing list of community banks filing shelf registrations.

December 23 -

Sussex Bancorp in Rockaway, N.J., has raised $15 million by selling fixed- to floating-rate subordinated notes to an institutional investor. It did not name the investor.

December 22 -

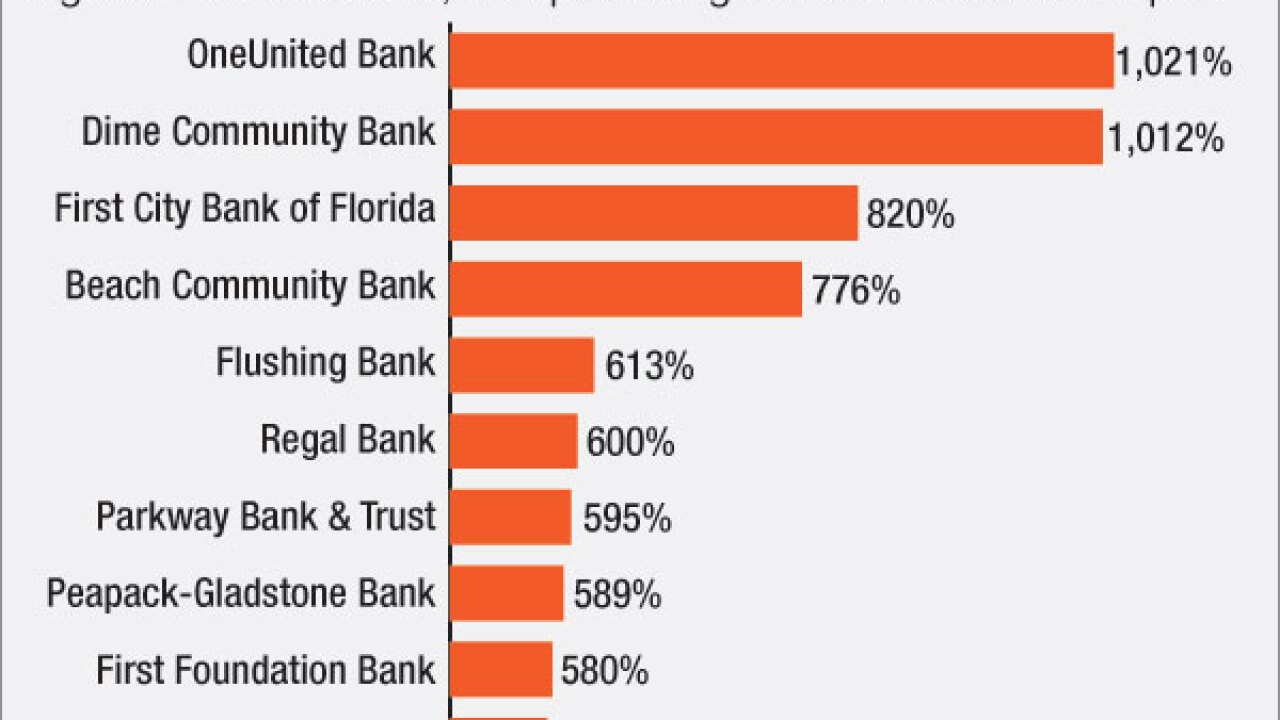

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

Equity Bancshares in Wichita, Kan., has raised $35.4 million in a common stock offering and plans to use the proceeds to pay down a line of credit and support growth.

December 22 -

Prosperity Bancshares in Houston filed a shelf registration to sell a variety of shares.

December 22 -

Peapack-Gladstone Financial in Bedminster, N.J., has filed a shelf registration statement to sell as much as $100 million in securities.

December 20 -

City Holding in Charleston, W.Va., is looking to raise up to $55 million in a stock offering.

December 20 -

Ameris Bancorp in Georgia wanted to buy a premium-finance business but settled for a joint venture, blessed by its regulators, after being flagged for insufficient Bank Secrecy Act compliance.

December 20 -

The banking system ultimately needs a balanced approach to capital, which allows banks to efficiently function while also maintaining financial stability.

December 20 Brookings Institution

Brookings Institution -

Ameris Bancorp in Moultrie, Ga., has entered into a consent order with regulators tied to the Bank Secrecy Act.

December 19 -

Barclays is preparing to tell 7,000 clients to do more trading with the firm or find another bank, the latest move in an industrywide trend of winnowing down customer lists to the ones that produce significant profits.

December 19 -

Pacific Metro Bank would cater to Chinese-Americans around Atlanta. The application process is worth watching since the group is seeking the first Georgia charter in seven years and would be based in a market where more than 90 banks have failed since 2007.

December 16 -

The $14.3 billion-asset company said in a press release Thursday that it will sell about 4.3 million shares of common stock.

December 15 -

Colony Bankcorp in Fitzgerald, Ga., has bought back more of its former Troubled Asset Relief Program shares held by private investors.

December 15 -

Ed Francis, a former executive at Hancock Holding, is seeking to buy an existing bank rather than pursue a new charter. He explains why he is prefers a complex bankruptcy process over applying to form a new bank.

December 15 -

First Internet Bancorp in Fishers, Ind., disclosed in a regulatory filing that it is looking to raise $25 million capital through a stock offering.

December 15 -

Renasant in Tupelo, Miss., is the latest bank in the Deep South to announced a large stock offering.

December 14 -

Flushing Financial in Uniondale, N.Y., has raised $75 million by selling subordinated notes.

December 13 -

ConnectOne Bancorp in Englewood Cliffs, N.J., is looking to raise at least $35 million through a stock offering.

December 13