-

The proposed Chicago de novo would focus on serving female entrepreneurs.

July 16 -

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

July 15 Financial Services Forum

Financial Services Forum -

The Fed’s recent action capping dividend payments might prove inadequate once the coronavirus crisis really hits banks’ capital.

July 14 -

The credit union regulator has not yet announced an agenda, but the meeting could potentially include mattes related to field of membership and risk-based net worth.

July 1 -

Six of the eight regional banks that announced their stress capital buffers on Tuesday said they will need just a 2.5% cushion to weather an economic downturn. All eight said they’ll keep their dividends steady.

June 30 -

In response to the Federal Reserve's stress tests, Wells said it will lower its third-quarter distribution to shareholders. Meanwhile, JPMorgan Chase, Goldman Sachs and five other companies announced stress test capital buffers that exceed the minimum requirement.

June 29 -

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

As they prepare to exit government conservatorship, Fannie Mae and Freddie Mac have enlisted the investment banks to help them boost capital and evaluate market opportunities.

June 15 -

The last bank where he was CEO, Opus Bank, ran into trouble largely because it made too many acquisitions in too short a time span. This time around, Gordon will take a more methodical approach.

June 15 -

The industry was well positioned in terms of net worth before the pandemic and recession, but some institutions could run into issues with sluggish earnings and a surge in deposits.

June 12 -

Organizers of Coastal Community Bank withdrew their application after the pandemic disrupted efforts to raise capital.

June 11 -

The group behind NewBank is pursuing a charter with the Office of the Comptroller of the Currency to offer banking services nationwide.

June 10 -

Stephen Gordon would become chairman and CEO of Genesis Bank, which is looking to raise $53 million in initial capital.

June 9 -

In an effort to help the industry manage the economic downturn, some credit unions won't be required to submit plans to lower their retained earnings for the rest of this year.

June 9 -

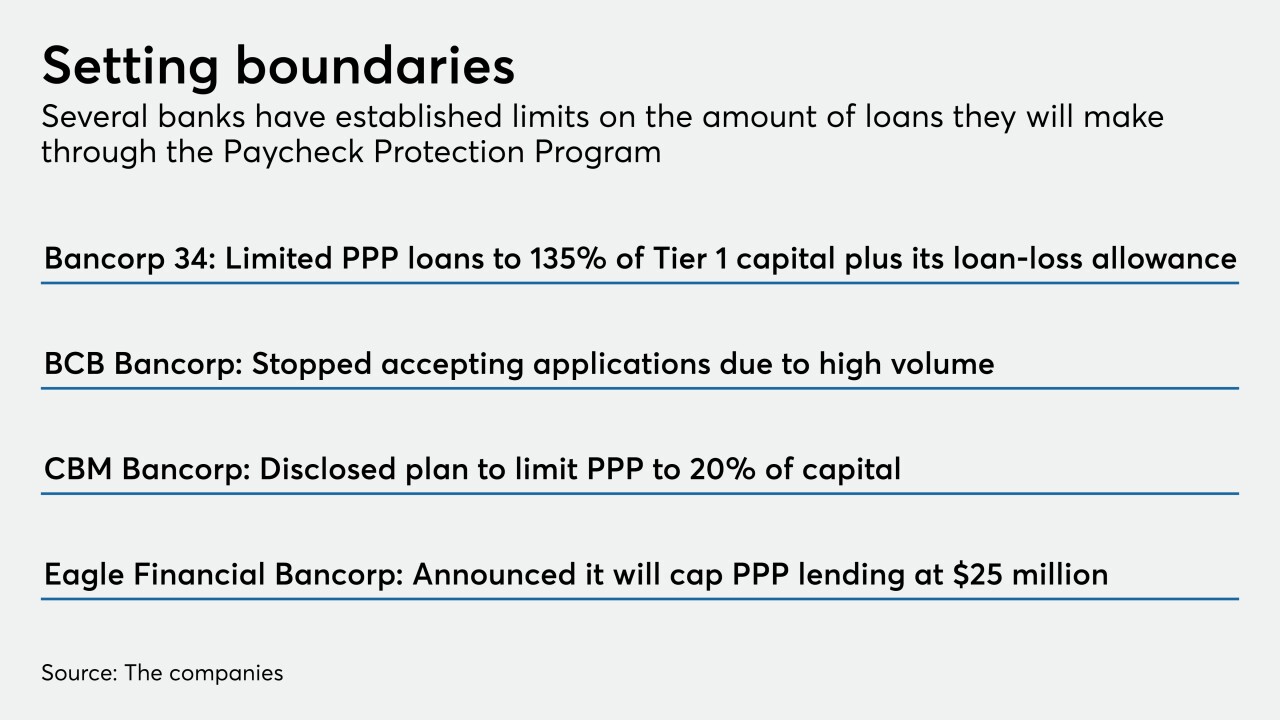

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

May 28 -

Some lenders are issuing debt and preferred stock to provide an extra buffer for credit losses. Others are preparing for growth opportunities.

May 22 -

Craft Bank, which plans to open this summer, is in the final stage of raising $30 million in initial capital.

May 20 -

The central bank's Financial Stability Report said companies may face difficulties repaying debt given lower earnings, “which could trigger a sizable increase in firm defaults."

May 15 -

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

May 12