-

Organizers of Coastal Community Bank withdrew their application after the pandemic disrupted efforts to raise capital.

June 11 -

The group behind NewBank is pursuing a charter with the Office of the Comptroller of the Currency to offer banking services nationwide.

June 10 -

Stephen Gordon would become chairman and CEO of Genesis Bank, which is looking to raise $53 million in initial capital.

June 9 -

In an effort to help the industry manage the economic downturn, some credit unions won't be required to submit plans to lower their retained earnings for the rest of this year.

June 9 -

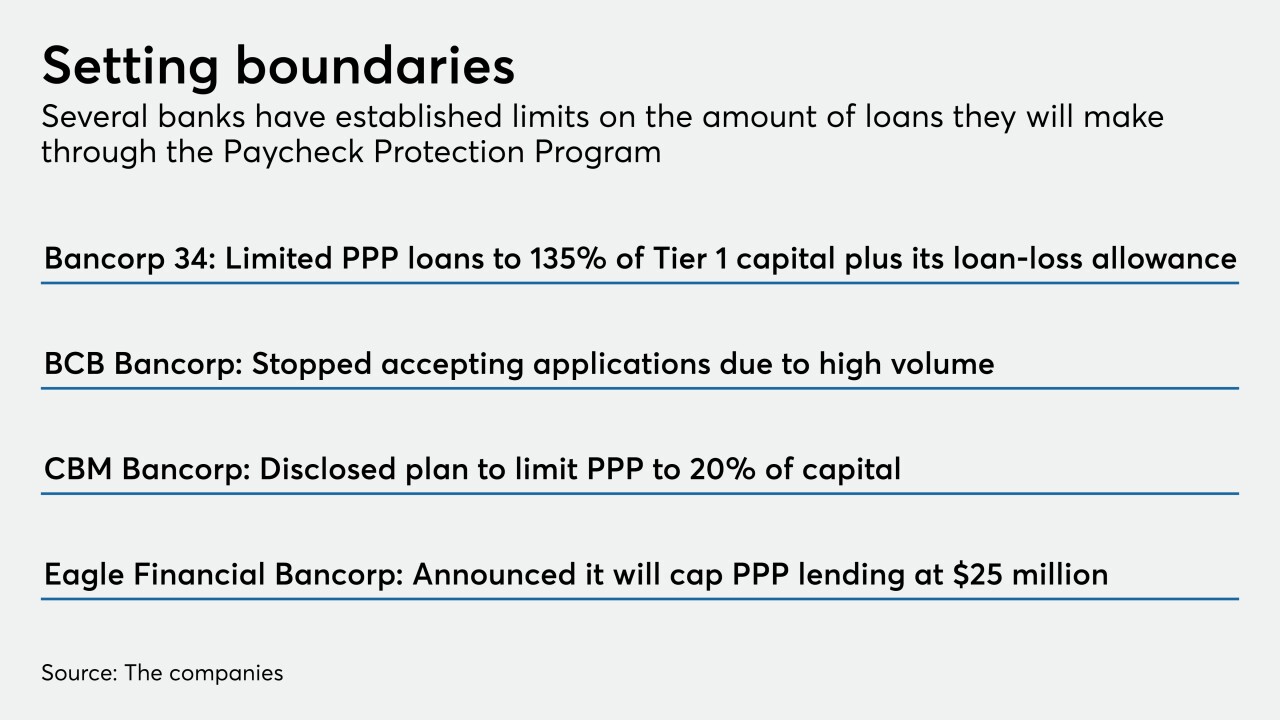

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

May 28 -

Some lenders are issuing debt and preferred stock to provide an extra buffer for credit losses. Others are preparing for growth opportunities.

May 22 -

Craft Bank, which plans to open this summer, is in the final stage of raising $30 million in initial capital.

May 20 -

The central bank's Financial Stability Report said companies may face difficulties repaying debt given lower earnings, “which could trigger a sizable increase in firm defaults."

May 15 -

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

May 12 -

The regional bank’s $240 million investment from 1995 is now worth $17 billion, which it could use to fund acquisitions; the debt deal will count towards the German bank’s capital buffers.

May 12 -

The Pittsburgh company has owned a 22% position in the money manager since 1995.

May 11 -

The Federal Reserve also said in a supervisory report released Friday that it would conduct stress tests this quarter as planned, taking into account sudden deterioration in the economy brought on by the coronavirus pandemic.

May 8 -

Organizers representing five tribes aim to create a financial institution to serve their members.

May 8 -

Seneca-Cayuga Bancorp's capital levels have fallen steadily since peaking in 2013.

May 6 -

The Wisconsin regional said the funds will support loan growth and its dividend policy as well as create an added capital buffer.

May 4 -

Organizers of Rockpoint Bank still need to raise $30 million before opening.

May 1 -

Rodney Hood, chairman of the National Credit Union Administration, says the agency's Central Liquidity Facility can be a vital backstop if a crisis occurs, but it will be stronger if more credit unions chip in to make it a success.

April 29

-

The agency's top supervisory official said the Comprehensive Capital Analysis and Review will proceed on schedule, and signaled that the Fed will look at how institutions are responding to fallout from the coronavirus.

April 13 -

The regulator must speed up its capital reform efforts while taking immediate steps to reduce the examination burden.

April 7 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions