-

Seeking to expand financial services access, tribal officials and some firms want regulators to award Community Reinvestment Act credit to any bank that funds projects in Native American communities.

September 2 -

CDCUs provide essential financial services in underserved communities but these institutions can struggle to keep up with compliance and technology demands.

August 20 -

The number of minority depository institution charters is declining even as their financial performance is going up, according to a new study by the FDIC.

June 25 -

It's admirable that the National Credit Union Administration wants to make opening a de novo easier but organizers will still face challenges in raising the necessary funds to launch a new credit union.

May 24 Archer+Rosenthal

Archer+Rosenthal -

Montgomery County Employees Federal Credit Union is now operating as SkyPoint Federal Credit Union.

April 16 -

About 100 financial institutions are owned by or work with Native Americans, yet traditional banking services remain out of reach for many in this demographic.

April 15 -

A new outreach effort will target parts of New York City to help boost membership at several African-American credit unions.

March 28 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

Robust public discussion from a diverse array of stakeholders has informed regulators working to reform the Community Reinvestment Act, but it has also included some misleading claims, writes a top OCC official.

March 25 Office of the Comptroller of the Currency

Office of the Comptroller of the Currency -

The bank will fund community development financial institutions that lend to women-owned businesses backed by the fashion designer's foundation.

March 7 -

Now the third-longest shutdown in history, there are few signs the government will reopen anytime soon, and that's causing problems for lenders.

January 7 -

As Congress moves closer to its Dec. 21 deadline to keep the government funded, the outlook for more financial services regulatory relief continues to worsen.

December 14 -

Recent comments from the chairman of the National Credit Union Administration signal the agency may soon take a lighter touch with small institution

November 1 Inclusiv

Inclusiv -

Inclusiv's annual conference in Florida focused on the rocky road ahead for small credit unions – and how to ease the way forward.

October 26 -

From branch networks to technology and cybersecurity concerns, there's plenty to keep leaders of CDFIs and small CUs awake at night.

October 24 -

Now known as Inclusiv, the name change also brings several high-profile programs under one umbrella.

October 23 -

Credit unions based on the island made history receiving CDFI grants for the first time ever, but larger issues tied to population decline remain.

October 17 -

In addition to CUs across the continental United States receiving grants, Puerto Rico's cooperativas de ahorro y credito were included for the first time.

September 20 -

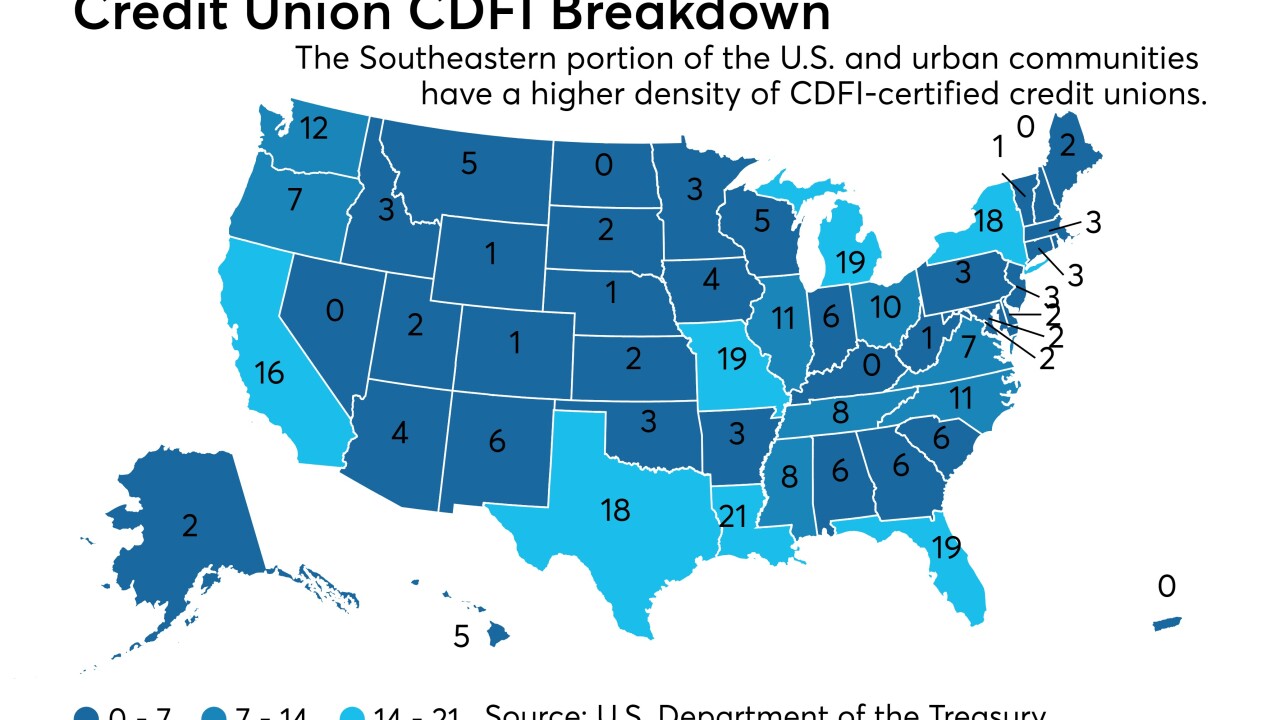

Some of these states may surprise you.

September 10 -

There are more credit unions in the Community Development Financial Institution Fund program than banks, but advocates are pressing for even greater involvement.

September 6