-

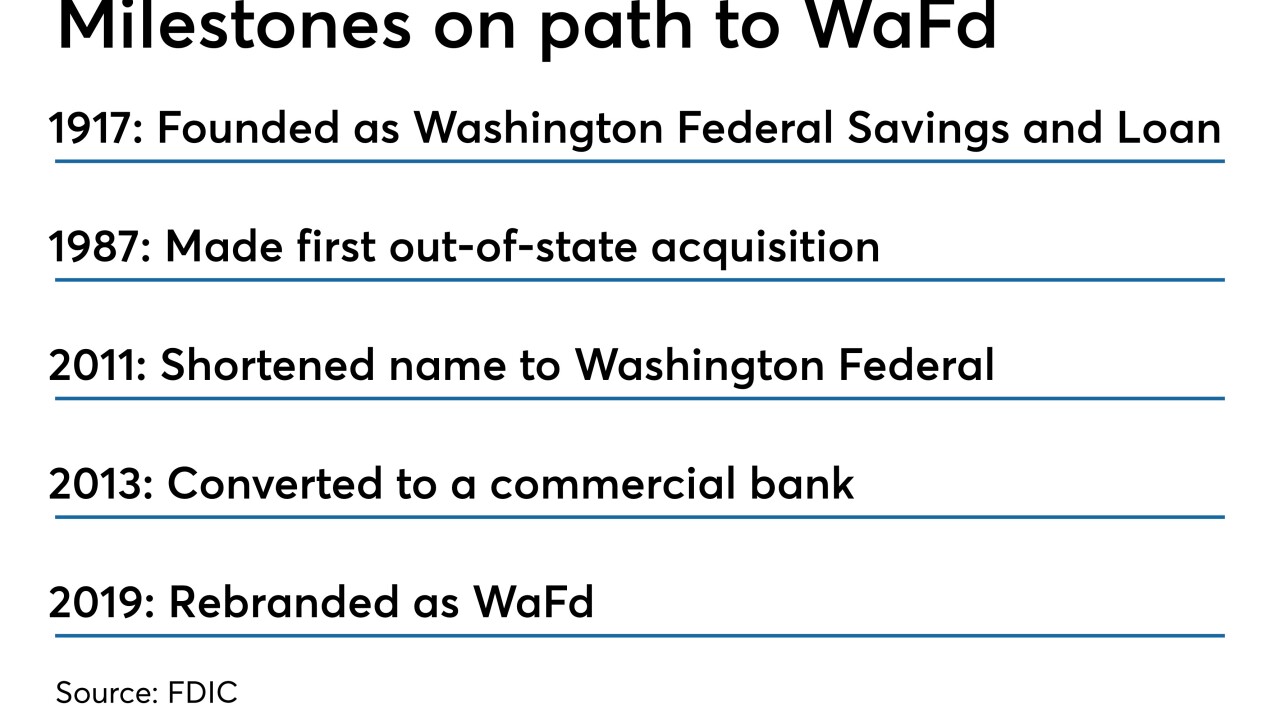

When Washington Federal last rebranded, it was to signal its shift from a savings and loan association to a commercial bank. This time around, it's to reflect geographic diversity and its desire to be viewed as a bank.

October 3 -

The Pittsburgh company is not interested in bank acquisitions, CEO Demchak says; why Citi, Wells, JPMorgan are seeing a spike in API calls; FHFA's Mark Calabria details next steps on GSE reform; and more from this week's most-read stories.

September 13 -

The Cincinnati bank applied in May to convert its Ohio state charter amid an expansion into Texas and Colorado and the completion of its merger with MB Financial.

September 10 -

The Poughkeepsie, N.Y.-based institution will be able to serve a dozen counties after the change takes effect on Oct. 1.

September 4 -

Joseph Campanelli, CEO of Needham Bank, wants to be ready to scoop up mutuals struggling with rising costs and yield curve challenges.

August 30 -

The New York-based institution will double the number of counties it can serve as part of the effort to grow.

July 22 -

The Cincinnati bank wants to convert from a state charter as it expands in the Southeast and beefs up digital banking operations.

May 31 -

Hudson Valley Federal Credit Union wants to eventually add eight counties to the four it currently serves.

May 2 -

Montgomery County Employees Federal Credit Union is now operating as SkyPoint Federal Credit Union.

April 16 -

Credit unions clinging to an outdated name that no longer reflects the institution's current field of membership could be doing themselves more harm than good, experts say. But it's a fine line between honoring the past and preparing for tomorrow.

March 21 -

The Saginaw, Mich.-based institution has yet to reveal the new name, though management indicated that it won't include a religious reference.

March 19 -

The combined bank would be chartered in North Carolina, with the FDIC serving as its lead federal regulator, N.C. Banking Commissioner Ray Grace says. The merger partners had other options, including the Fed and the OCC.

March 12 -

The Lake Mary, Fla.-based shop will also convert to a state charter and plans to drop the phase "credit union" from its name.

February 7 -

In a speech in Japan, the comptroller of the currency urged overseas institutions to consider a “single regulatory framework” instead of applying to multiple states.

November 14 -

The Mass.-based credit union is the latest to drop its federal charter in favor of state oversight.

September 26 -

A proposal to let certain thrifts operate like national banks blurs the line even further between the two institution types.

September 24 -

Northern Credit Union in New York has shed its federal charter, while Gale CU in Illinois has converted to a community charter.

August 13 -

Cobalt Credit Union serves 14 counties across Nebraska and Iowa, but hopes to change to a state charter to help fuel further expansion.

August 2 -

The Hudson, N.Y.-based credit union hopes a community charter will better enable it to serve the high population of unbanked consumers in the region.

May 31 -

The bank sought to evade the consequences of compliance failures including weak scrutiny of transactions that could be tied to North Korea, the N.Y. banking superintendent said in demanding access to communications between the bank and its new supervisor, the OCC.

May 29