-

While a majority of business payments are still made by checks, faster payments and increased cash flows will pressure a move to digital options, contends UMB's Brian Hutchin.

April 30 UMB

UMB -

In a unique deal, organizers of Village Financial Cooperative received $500,000 from the Minneapolis City Council as they aim for a June opening.

April 8 -

Paper's costly, and also error prone. Yet most invoices are still paper-based, writes Art Sarno, product marketing manager for Kofax.

March 12 Kofax

Kofax -

As blockchain and other emerging innovation pour into the B2B market, Bottomline Technologies believes bank collaborations with smooth deployment and user experience can lure anxious businesses away from checks.

February 20 -

By adopting faster payments, businesses have more flexibility to make last-minute payments and emergency payrolls, or gain a larger window for early-payment discounts.

January 3 -

Younger consumers today have a very different view of, and utility for, general purpose bank and private label retail credit cards when compared to older generations.

December 26 -

The promotion of “insured” accounts by nonbanks and fintechs is a worrying trend, because it could leave customers falsely believing their accounts are just as safe as FDIC-insured ones.

December 21 Consumer Bankers Association

Consumer Bankers Association -

Robinhood Financial has rebranded its service, deleted tweets about its launch and scrubbed the page from its website.

December 15 -

Robinhood Financial, one of the most valuable private companies in the financial technology space, is rolling out its take on the traditional bank account starting on Thursday.

December 13 -

After incorporating big data, tweaking existing products and reducing barriers for new members, the Mass.-based credit union saw increased checking usage, more deposits and higher PFI levels.

November 16 -

The agency’s flawed methodology for determining interest rate caps on certain accounts poses risks for banks offering free, low-deposit checking and the financial system more broadly.

November 14 Peoples Bank of Magnolia

Peoples Bank of Magnolia -

With fraud rising alongside mobile deposit usage, credit union executives needed a way to solve the problem without making the process burdensome to employees and members.

November 13 -

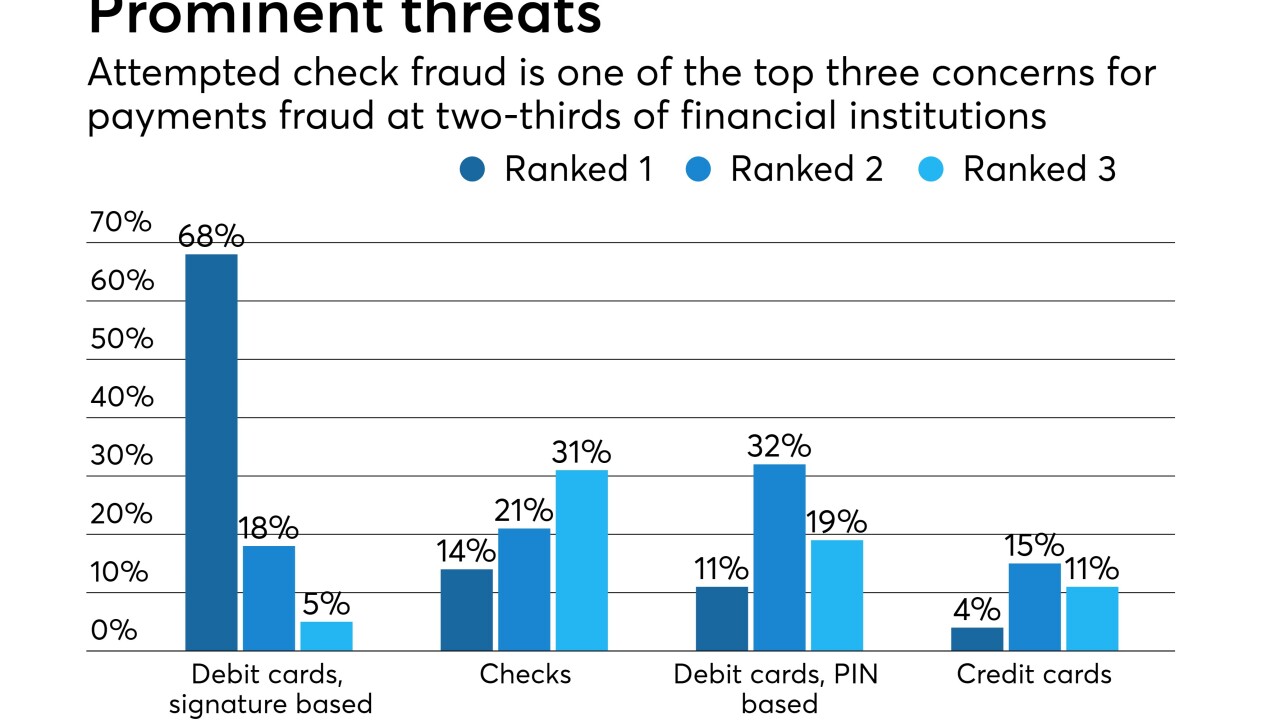

Accounts payables automation is a tough sell for companies that don't want to abandon a process they have clung to for decades. But this old process is a big target for fraudsters — and growing.

October 29 -

Capgemini's 2018 World Payments Report is out, and it has some alarming predictions. Are its findings a threat to traditional payment systems, or just the first sign of a transformation that will affect all economies?

October 16 -

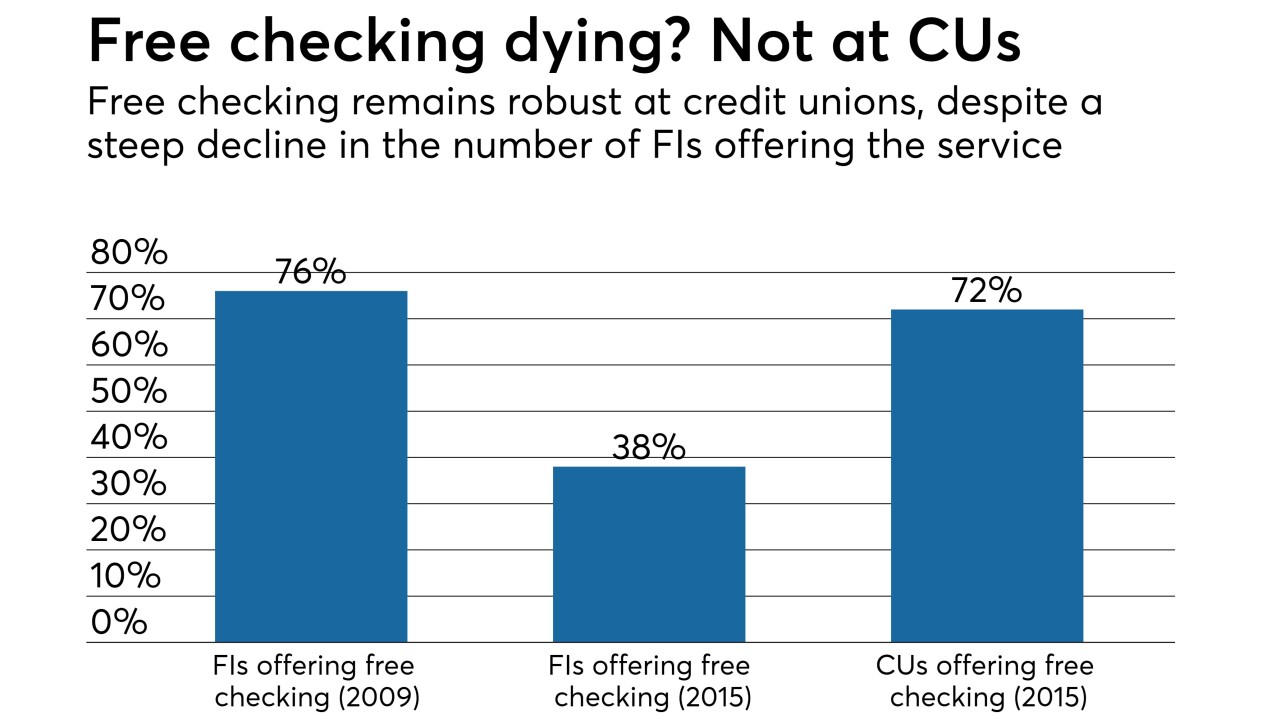

Free checking peaked nearly a decade ago, but more than half of all credit unions continue to offer it, despite new players fighting for that business.

August 28 -

As part of the modernization of the U.K.’s payments systems, the new Image Clearing System is now being phased in. All banks and building societies across the U.K. are connecting their deposit channels into the central infrastructure, a process that will be completed by the end of 2018.

August 14 -

Small and midsize businesses (SMBs) are adapting to digital payments technology at slower speeds and for different reasons than larger enterprises. Cash and checks still account for almost half of all SMB payments, and SMBs have lagged behind other merchants in the U.S. shift to EMV technology.

May 23 -

Buyers who rely on paper-based payments often struggle to onboard new suppliers. This "process overhead" can be so cumbersome that many buyers become resistant to change, opting instead to limit their supplier choices to a small number of partners, writes Patrick Bermingham, the CEO of Adlex.

May 15 Adflex

Adflex -

Regulatory initiatives have erupted across the globe that call for the implementation of immediate payment systems, writes John Mitchell, CEO of EpisodeSix.

May 7 Episode Six

Episode Six -

Three corporate credit unions now fund the check-processing services LLC.

May 2