-

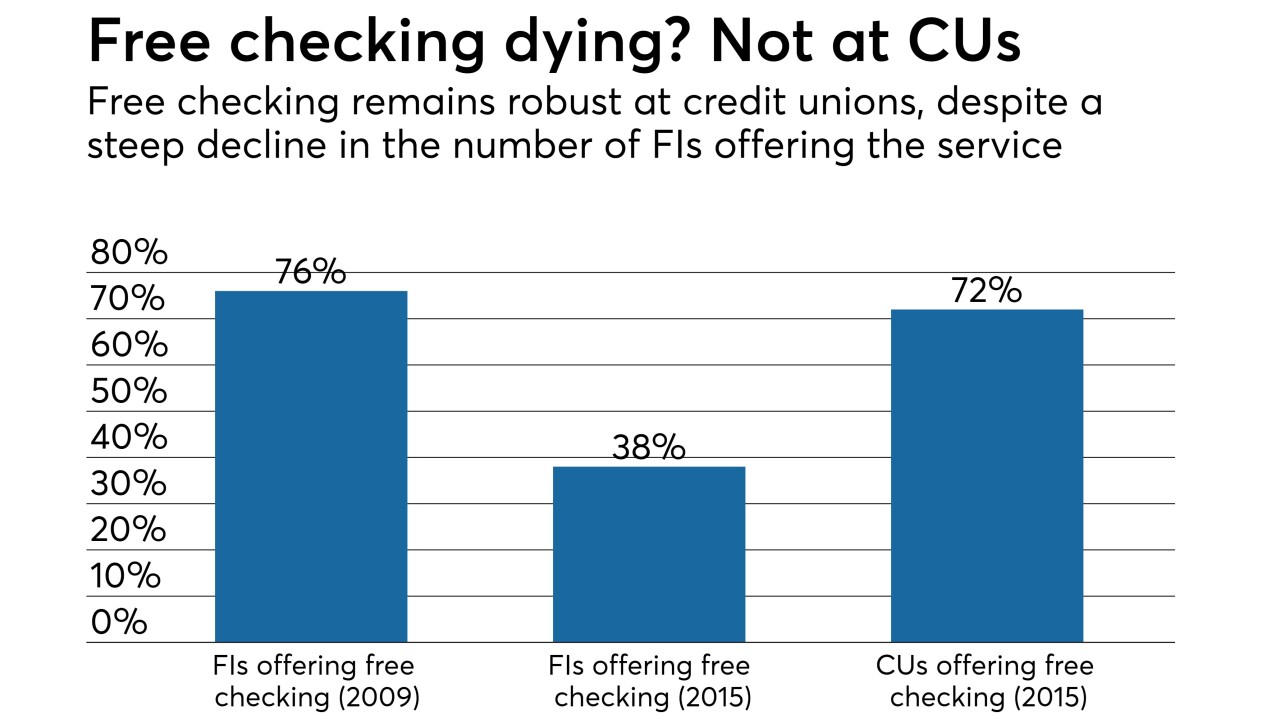

The agency’s flawed methodology for determining interest rate caps on certain accounts poses risks for banks offering free, low-deposit checking and the financial system more broadly.

November 14 Peoples Bank of Magnolia

Peoples Bank of Magnolia -

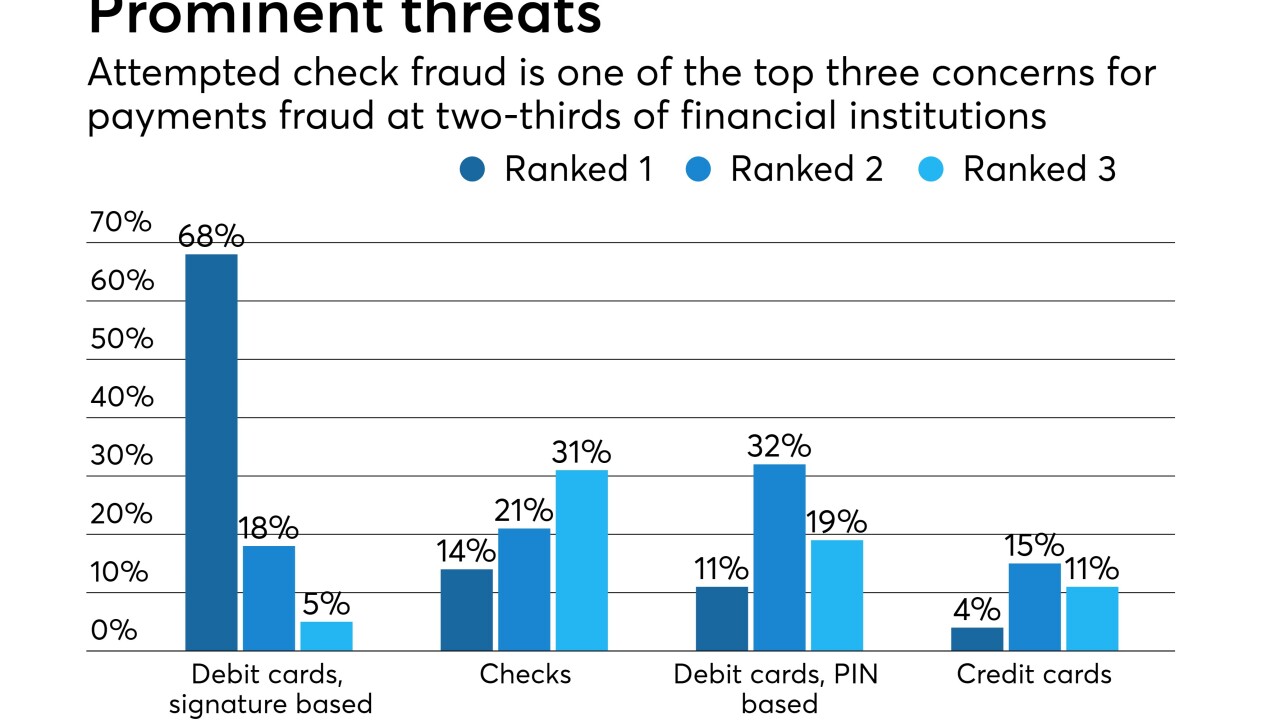

With fraud rising alongside mobile deposit usage, credit union executives needed a way to solve the problem without making the process burdensome to employees and members.

November 13 -

Accounts payables automation is a tough sell for companies that don't want to abandon a process they have clung to for decades. But this old process is a big target for fraudsters — and growing.

October 29 -

Capgemini's 2018 World Payments Report is out, and it has some alarming predictions. Are its findings a threat to traditional payment systems, or just the first sign of a transformation that will affect all economies?

October 16 -

Free checking peaked nearly a decade ago, but more than half of all credit unions continue to offer it, despite new players fighting for that business.

August 28 -

As part of the modernization of the U.K.’s payments systems, the new Image Clearing System is now being phased in. All banks and building societies across the U.K. are connecting their deposit channels into the central infrastructure, a process that will be completed by the end of 2018.

August 14 -

Small and midsize businesses (SMBs) are adapting to digital payments technology at slower speeds and for different reasons than larger enterprises. Cash and checks still account for almost half of all SMB payments, and SMBs have lagged behind other merchants in the U.S. shift to EMV technology.

May 23 -

Buyers who rely on paper-based payments often struggle to onboard new suppliers. This "process overhead" can be so cumbersome that many buyers become resistant to change, opting instead to limit their supplier choices to a small number of partners, writes Patrick Bermingham, the CEO of Adlex.

May 15 Adflex

Adflex -

Regulatory initiatives have erupted across the globe that call for the implementation of immediate payment systems, writes John Mitchell, CEO of EpisodeSix.

May 7 Episode Six

Episode Six -

Three corporate credit unions now fund the check-processing services LLC.

May 2 -

The $219 million deal will expand RealPage's geographic and digital footprint in a market that still relies on paper-based payments.

April 20 -

Artificial intelligence may help rescue donations from paper's retreat, and give a fintech startup an icebreaker with small banks that haven't embraced automated payments.

April 17 -

By reducing, or completely removing, paper-based billing through automation, your company can drastically reduce its environmental impact, writes Colleen Ciak, head of eAdoption at Billtrust.

April 12 Billtrust

Billtrust -

For $29 a month, MoneyLion customers will receive a checking account with no minimum balance requirement and will have access to a large a network of ATMs, as well as low-interest personal loans and financial advice.

April 10 -

Implementing an electronic payments solution isn’t about replacing one payment method (checks) for an electronic one—as in abandoning checks for ACH, writes Ralph Perdomo, a research analyst at Nvoicepay.

April 5 Nvoicepay

Nvoicepay -

Venmo is for consumer payments, but that same simplicity can benefit corporate payments, writes Jay Dearborn, president of corporate payments at Wex.

March 29 Wex

Wex -

The e-commerce giant is muscling its way into a number of businesses that banks have long dominated.

March 18 -

The tech giant is reportedly in talks with JP Morgan Chase and Capital One about creating a checking account product, and two analysts say that could create major challenges for credit unions.

March 9 -

The online retailer wants to offer customers checking accounts but won’t become a bank; Quarles says the rule is too complex and “not working well.”

March 6 -

The negotiations between Amazon and big banks like JPMorgan Chase and Capital One to offer a checking-account-like product pose significant questions for regulators about the e-commerce giant pushing further into the banking space.

March 5