-

Bank of America, which has had an environmental business goal since 2007, is significantly increasing its current commitment.

April 9 -

It's no longer a matter of if, but when, regulators will require banks to document the impact of global warming on their loan portfolios and other operations.

April 9 Willis Towers Watson

Willis Towers Watson -

Dozens of European and U.S. banks are considering throwing their weight behind the White House’s Earth Day summit under plans being drawn up by former Bank of England Gov. Mark Carney.

April 9 -

President Biden plans to direct his administration to develop a strategy on climate-related risks for public and private financial assets, according to a draft document seen by Bloomberg News.

April 8 -

Policymakers have scrutinized social disparities in the financial system and banks' climate-change risks. That has led to a new line of attack from Republicans who say agencies such as the Federal Reserve should stay in their lane.

April 6 -

Treasury Secretary Janet Yellen conducted her first meeting as chair of the Financial Stability Oversight Council and set the stage for a potential recalibration of the panel's role after it was weakened in the Trump administration.

March 31 -

Climate groups are calling on John Kerry, the special presidential envoy for climate, to shut off the flow of money from Wall Street to the fossil-fuel industry and acknowledge the role of U.S. finance firms in warming the planet.

March 31 -

Activist investors are pressuring big banks to further curtail lending to the fossil-fuel industry, undergo so-called racial-equity audits and disclose more about their lobbying practices and financing of nuclear weapons manufacturers.

March 30 -

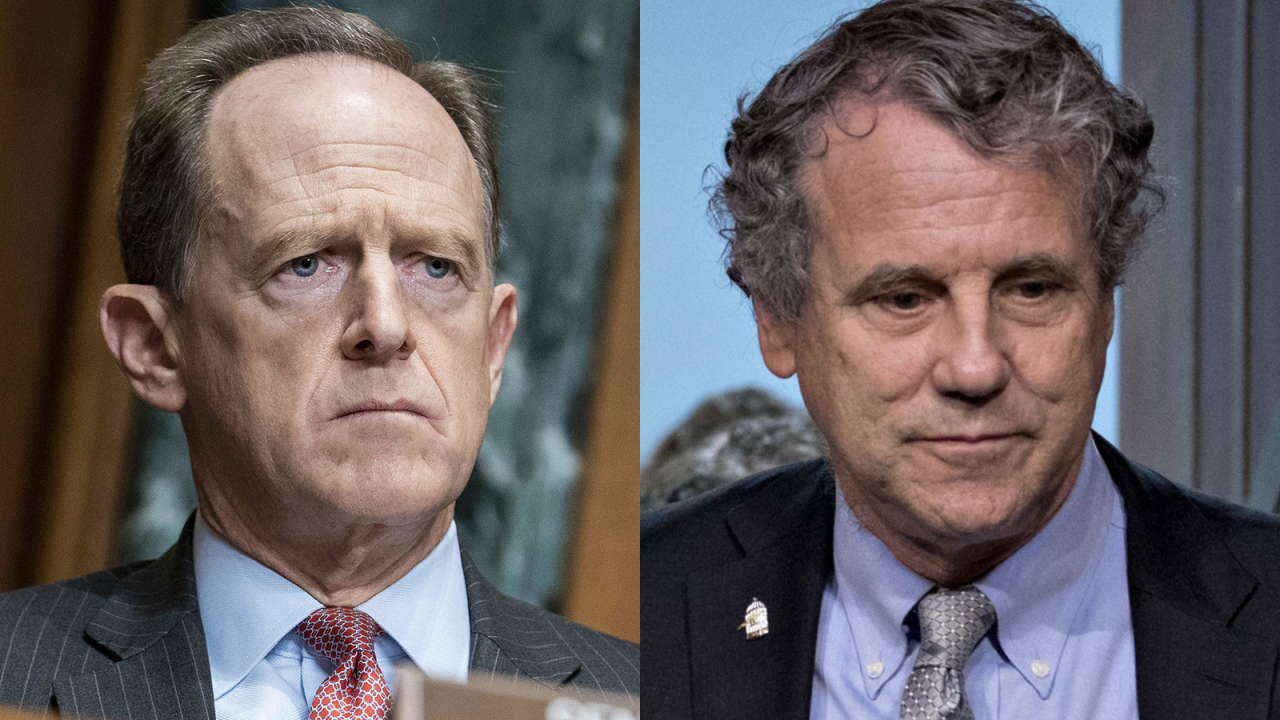

Sen. Pat Toomey, R-Pa., warned the regional Federal Reserve bank that its papers about environmental, social and corporate governance policies hurt its ability to stay neutral on partisan issues.

March 29 -

The move is part of a broader push at Citigroup to reduce carbon emissions. Jane Fraser, who took over as CEO on March 1, vowed on her first day that the bank would achieve net-zero greenhouse gas emissions in its financing activities by 2050.

March 29 -

The Rainforest Action Network says the 2020 decline stemmed more from weak energy demand during the pandemic than banks’ pledge to reduce financing to firms that contribute to climate change.

March 25 -

Top officials at the U.S. central bank and Treasury Secretary Janet Yellen reaffirmed their commitment to understand how extreme weather events affect financial institutions and the economy as a whole. Many Republicans, however, worry the Federal Reserve’s new climate focus strays too far from its traditional function.

March 23 -

The Treasury Department and U.S. regulators aim to boost demand for assets that tackle climate change, while preventing companies from making claims that could be considered “greenwashing,” or overstating the significance of emissions reductions and sustainability efforts.

March 19 -

Democrats want regulators to actively protect the financial system from losses tied to extreme weather events, while Republicans say climate policy is "beyond the scope" of their mission.

March 18 -

The Cleveland company is more than doubling an earlier commitment in order to support racial equity and environmental sustainability.

March 12 -

The bank also committed to finance $500 billion in sustainable businesses and projects by 2030.

March 8 -

MUFG Union Bank is offering a new deposit product to commercial clients who want to see their cash reserves used to help finance sustainable projects, such as renewable energy or green transportation.

March 4 -

Aspiration makes donations to a tree-planting charity based on debit card spending, buys carbon offsets for gas purchases and rates retailers' environmental records.

March 3 -

Citigroup is one of the world's largest lenders to the fossil fuel industry, but CEO Jane Fraser vowed on Monday that the bank would achieve net-zero greenhouse-gas emissions in its financing activities by 2050.

March 1 -

Going green takes time, so lenders need to start revamping entire business relationships now, according to one sustainability-focused nonprofit. That process could include setting environmental goals for fossil-fuels companies and other customers that are conditions for continuing to finance them.

February 26