-

Strong demand for business and multifamily loans, combined with double-digit growth in wealth management revenues, more than offset rising expenses.

July 13 -

The Senate bill, designed to close a loophole in the state's interest rate cap and was closley monitored by the Ohio Credit Union League, must still be reconciled with a similar measure that was passed by the Ohio House of Representatives.

July 11 -

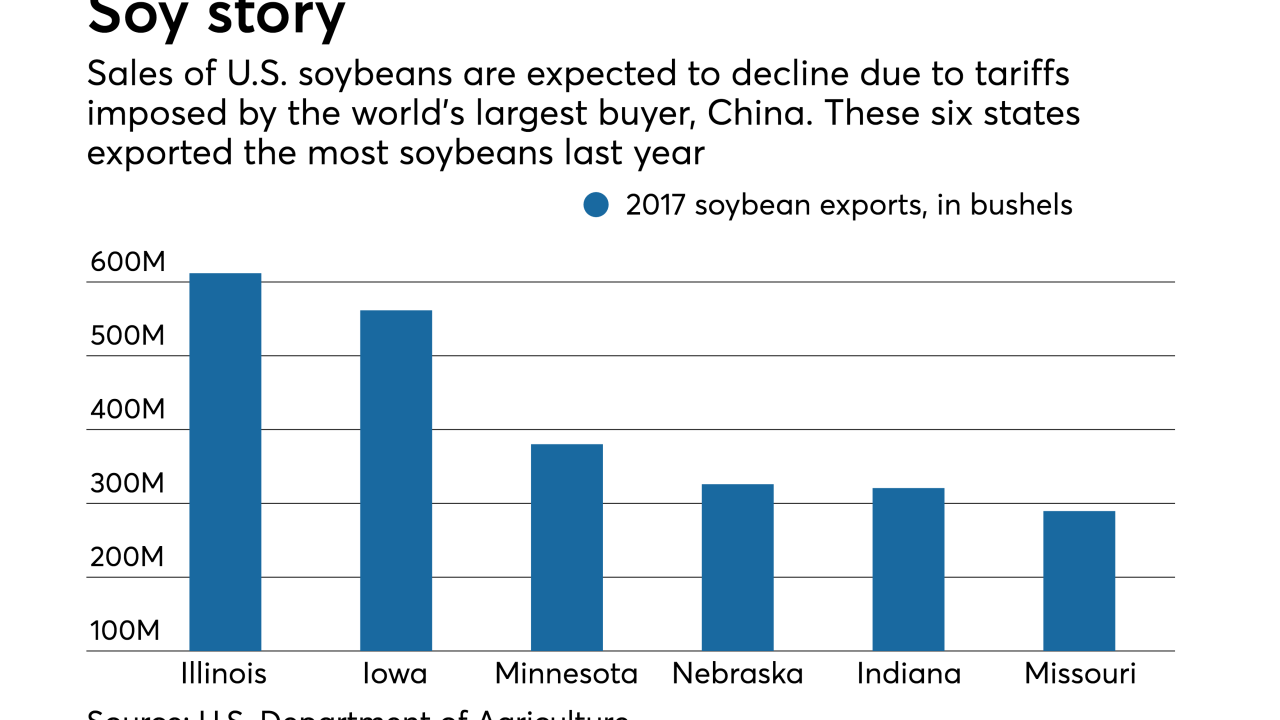

Banks are adjusting loan terms, making use of federal loan guarantees and working with farmers to find new markets, all in an effort to mitigate the damage from a likely drop in soybean exports.

July 11 -

The New York State Department of Financial Services report recommended putting online lenders on a more equal playing field with traditional firms.

July 11 -

Member Business Lending is a Utah-based provider of commercial, small business lending origination for credit unions.

July 11 -

Financial institutions are beginning to get on board with the global fight against climate change, but they are still trailing pension funds and insurance companies in putting these concerns into action.

July 11 -

The Orlando, Fla., bank has bought Allied Affiliated Funding in Dallas in an effort to branch out beyond traditional commercial and consumer lending.

July 10 -

The Senate bill, designed to close a loophole in the state's interest rate cap, must still be reconciled with a similar measure that was passed by the Ohio House of Representatives.

July 10 -

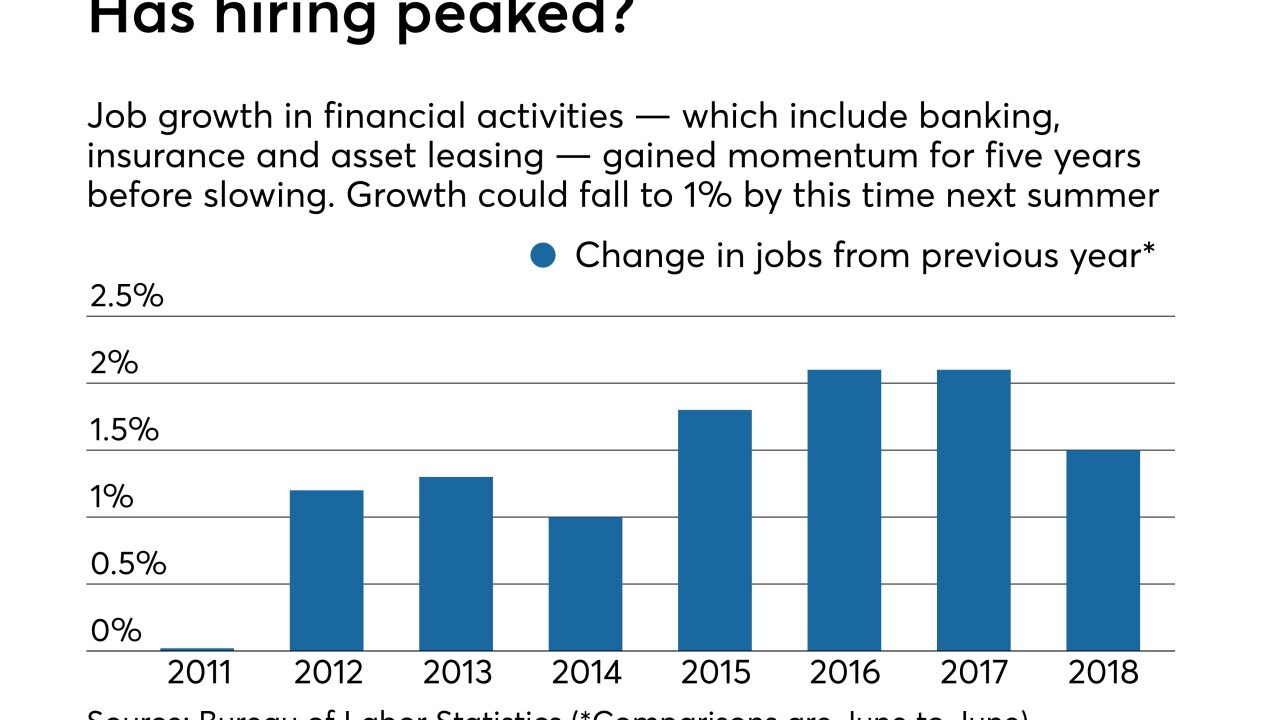

A tighter labor market and declining demand for compliance employees are expected to slow down hiring at banks in the coming year.

July 9 -

Woodforest National in Texas has relied heavily on hundreds of in-store branches and overdraft fees to boost revenue. That is starting to change.

July 9