-

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

Passage of a resolution blocking guidance on auto loan pricing could set a precedent that allows Congress to nullify other long-past regulatory issuances.

April 18 -

An SBA watchdog's investigation into chicken farms may ensnare other small businesses.

April 18 -

Quarterly earnings at the Minneapolis company were boosted instead by a wider net interest margin and a lower tax rate.

April 18 -

Banks may need to do more to help small businesses after a hurricane, flood or other calamity as those firms tend to favor nonbank lenders after an emergency for a number of reasons, according to research by four regional Federal Reserve banks.

April 17 -

The Wall Street giant's acquisition of the app maker Clarity Money is only one part of a long-term strategy to build a digital retail bank from the ground up.

April 17 -

The Los Angeles bank also benefited from a reduced reliance on costlier certificates of deposit.

April 17 -

The company, which completed a major acquisition last year, said tax reform will help it generate a higher return on average assets.

April 17 -

Joe Petitti and Jack Knight formerly held leadership posts at First Republic.

April 17 -

The Rosemont, Ill., bank rode loan growth, interest rate trends and noninterest-income gains to a double-digit increase in profits in the first quarter.

April 17 -

Profits soared at the Dallas bank as recent interest rate hikes and ongoing expense cuts outweighed weakness in the company’s loan book and in its fee income.

April 17 -

Fed vice chair wants to put stress test scenarios out for comment by banks; C&Is outstanding at record level in March.

April 17 -

Lending, especially in some consumer segments, increased at Bank of America in the first quarter, and CEO Brian Moynihan expects that to continue this year. However, for market watchers skeptical about the industry's growth prospects, BofA's numbers may do little to change their minds.

April 16 -

New Resource Bank and P2Bi are splitting the risk and revenue associated with asset-based loans.

April 16 -

The addition of a personal finance app rounds out the loan and deposit-account offerings at the online lender Marcus.

April 16 -

Expanding SBA funding and providing additional Community Reinvestment Act credit could help boost female entrepreneurs.

April 16 Invest in Women Entrepreneurs Initiative

Invest in Women Entrepreneurs Initiative -

Bankers hoped the tax overhaul would stimulate a boom in business borrowing, but several said this week that hasn’t happened yet. PNC’s Bill Demchak warned that the tax cuts could be encouraging lenders to underprice loans.

April 13 -

The bank, which already offers mortgages through seven offices across North Carolina, is the fourth group to announce plans for a de novo in the state.

April 13 -

A 28% increase in lease assets helped offset stagnant growth in traditional auto lending.

April 13 -

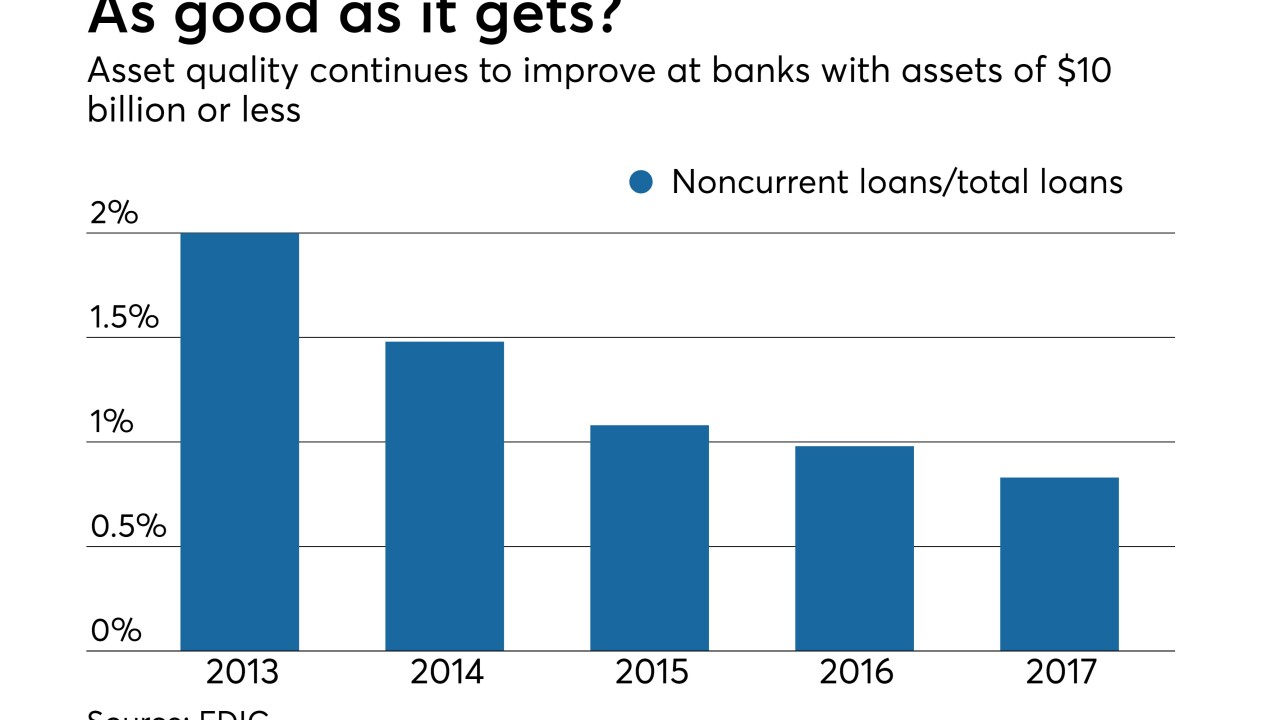

Banks have been hanging on to problem loans for various reasons, but that could create headaches when credit inevitably worsens.

April 13