-

After dragging its feet, the agency has agreed to a court-supervised process for writing a Dodd-Frank-mandated rule aimed at stamping out discrimination.

February 26 -

Executives outlined changes in energy lending policies, said that the largest U.S. bank has only scratched the surface in middle-market credits and discussed their preparations in case of an economic slowdown.

February 25 -

A spike in loan-loss provisions dragged down first-quarter profits at the Toronto company’s U.S. unit.

February 25 - Finance and investment-related court cases

Tech firm accuses PNC of stealing trade secrets; online lender LendingClub agrees to acquire Radius Bank; questions arise whether regulators are turning more partisan; and more from this week's most-read stories.

February 21 -

Lawmakers have also criticized the agency's decision to create qualifying standards for farmers and other small businesses.

February 20 -

When established card networks such as Visa, American Express and Mastercard start investing in fintech lending platforms such as Divido and ChargeAfter — as well as in the fintech lenders themselves such as Klarna and Vyze — it’s a clear signal that the future of unsecured personal loans may not be delivered by banks.

February 19 -

Wells Fargo appears to be outpacing its rivals in the API race; CFPB's unexpected showdown with Citizens; Varo gets vital FDIC OK for bank charter; and more from this week's most-read stories.

February 14 -

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

The startup spawned in Eastern Bank's innovation lab says its bank customers asked for client-friendly software for account opening, credit cards and more types of commercial lending.

February 13 -

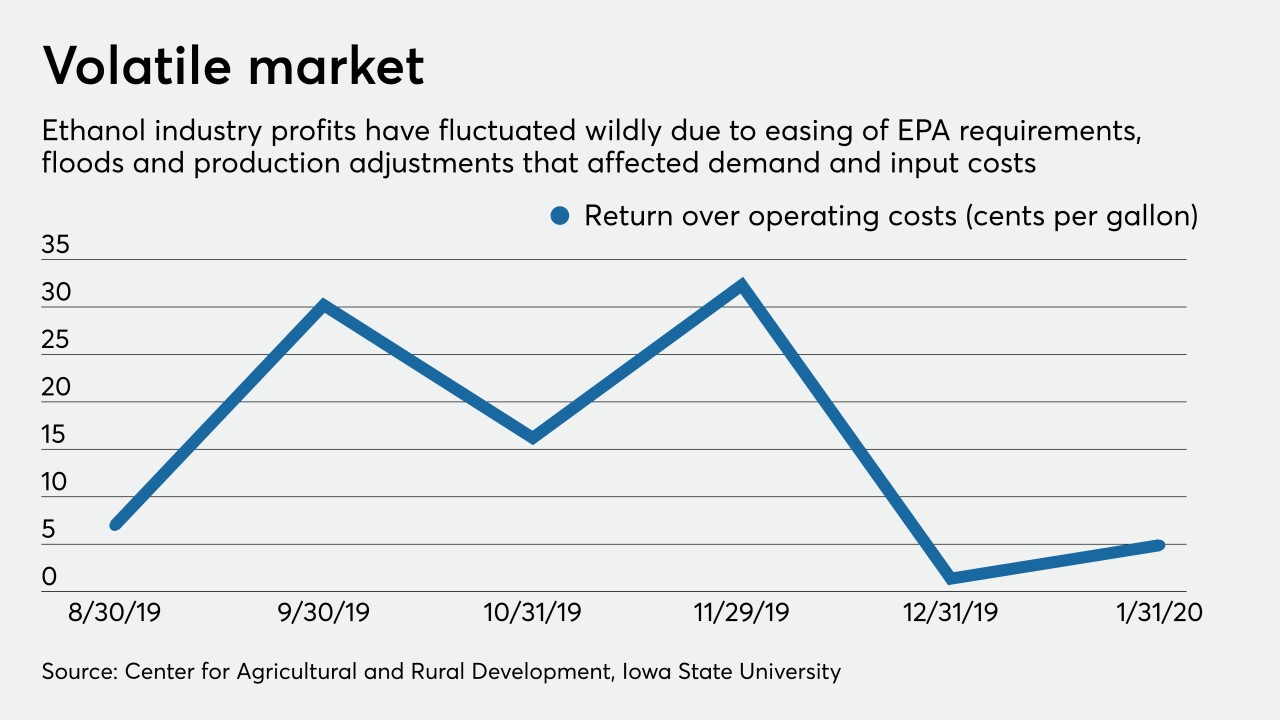

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12