-

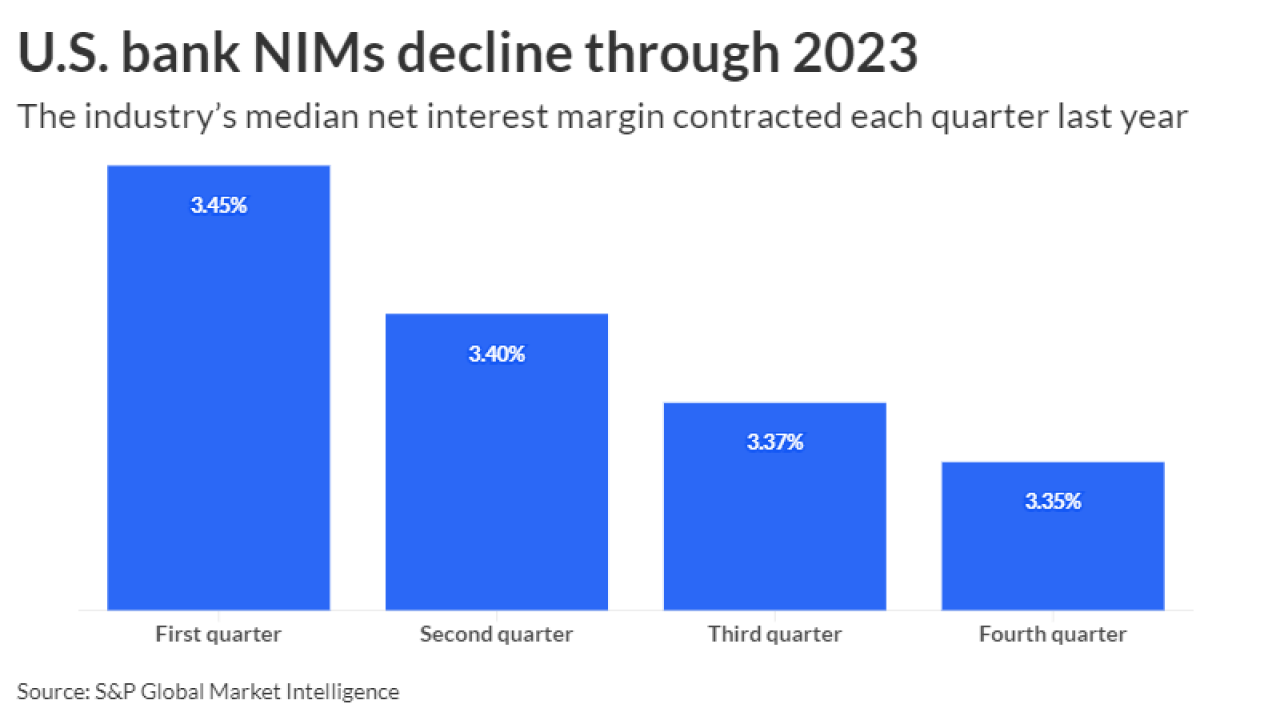

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

The Congressional Budget Office report on the Home Loan banks illustrates the ways the nearly 100-year-old system is integral to the U.S. economy, and its benefits for American consumers.

April 1

-

States reconsidering the opt-out provision of the Depository Institutions and Monetary Control Act should understand that doing so inherently devalues banks chartered within their borders.

March 29

-

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

March 27 -

Lower commodity prices and decreases in government assistance are expected to push farm income lower this year and raise credit risk for banks.

March 25 -

Harborstone Credit Union in suburban Lakewood, Washington, plans to buy Savi Financial. That's seven deals in less than three months this year; the highest full-year total was 16 in 2022.

March 22 -

A key bank stock index ticked up after the Federal Reserve hinted that it could lower rates later this year. But there are still a number of economic uncertainties that are holding shareholders back.

March 20 -

The Cleveland-based regional bank is shedding credit risk in a partnership with the private equity giant Blackstone. It's the latest tie-up between asset managers and regional banks that are looking to free up balance-sheet capacity.

March 20 -

It will take time for the banking industry to work through issues with CRE loans, Brian Moynihan says in discussing the aftermath of last year's banking crisis and New York Community Bancorp's recent warning about its exposure to troubled debt.

March 19