-

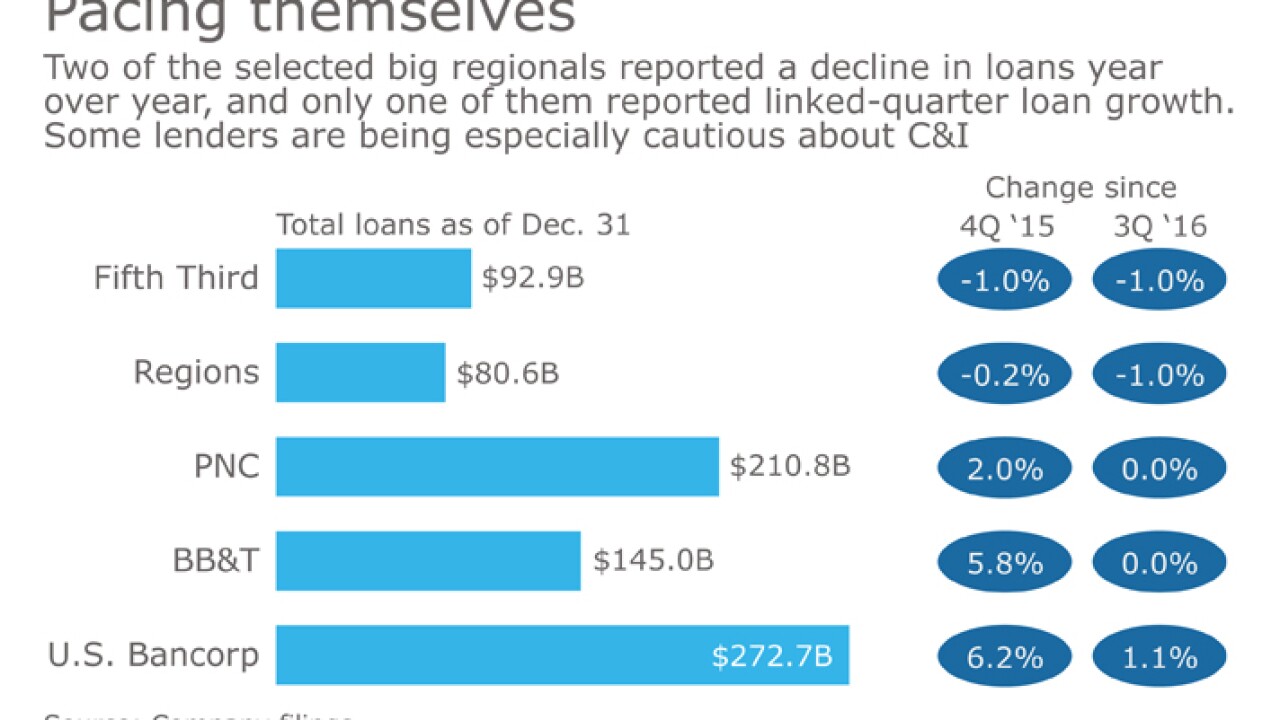

Fifth Third and other regionals have ditched what they deem to be high-risk commercial loans in hopes of strengthening credit quality over the long term.

January 24 -

Mortgage lending was "challenging" in the fourth quarter, but the Troy, Mich., company showed strong growth in commercial loans

January 24 -

To succeed, the Tennessee company must build on momentum created by BNC, the bank it just agreed to buy.

January 23 -

Expanded lending across a broad range of categories and extremely low unemployment in Hawaii pushed up the Honolulu bank's quarterly profit.

January 23 -

Guest host Sam Maule chats with American Banker reporter Lalita Clozel and others about the OCC fintech charter, smart home devices, virtual assistants, the security and compliance issues posed by Alexa, and more.

January 22 -

Donald Trump was sworn in Friday, but banking industry executives have spent the last two months envisioning a vastly different political, economic and regulatory climate. The dominant question in coming months will be how realistic those expectations are.

January 20 -

On earnings calls this week CEOs expressed optimism for increased loan demand, a softer tone from regulators, a higher SIFI threshold and, potentially, a surge of interest in health savings accounts.

January 20 -

Quarterly profit fell at SunTrust Banks in Atlanta as noninterest expense rose 8.4% and its loan-loss provision increased.

January 20 -

Two lending specialists from the Small Business Administration will join NCUA representatives for the webinar.

January 20 -

The Connecticut bank said a spike in business lending and residential mortgages gave its fourth-quarter earnings a boost.

January 19