-

Small-business owners heard "no" more often in July when seeking loans from big banks after six months of improving prospects.

August 9 -

The embattled firm is offering financial incentives in an effort to kick-start lending, but compliance-focused banks have been slow to respond.

August 9 -

The marketplace lender OnDeck Capital is sticking with its lend-and-hold strategy even though the practice contributed to a second consecutive quarterly loss.

August 8 -

Lending Club announced the resignation of its chief financial officer while reporting an $81.4 million quarterly loss due largely to fallout from the scandal that rocked the firm in May.

August 8 -

By buying EverBank Financial, the insurance and retirement savings behemoth will gain billions of dollars in low-cost deposits and access to many new lending products that it can offer to millions of clients.

August 8 -

Community banks are often burdened with manual data entry for processing commercial loans. Union State Bank has turned to digitization software to make it easier. It may sound modest in the age of APIs, but it made a quantifiable difference.

August 8 -

The biggest change in banking in the last 60 years is the shift in balance sheets from business lending to real estate finance and therefore more risk tied to volatile real estate prices.

August 8

-

The scandal-plagued marketplace lender is set to report earnings Monday, and the results aren't likely to be pretty. The big question going forward is how quickly can it reverse the damage and win back the trust of investors.

August 5 -

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4

-

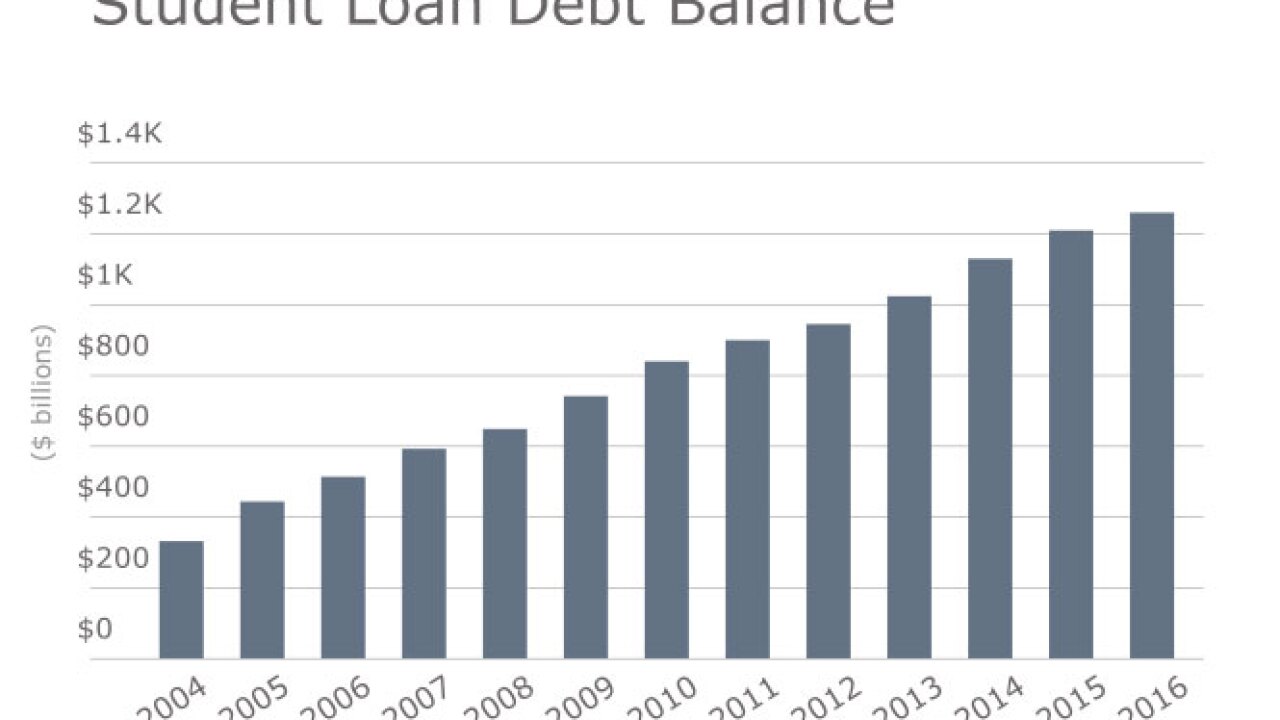

Fintech firms and millennial-focused advisers are providing advice on student loan refinancing, with the expectation that over time it will eventually lead to new business, in the form of brokerage and retirement accounts.

August 4