-

The Main Street Lending Program, announced on April 9 as an option to help U.S. businesses weather the coronavirus outbreak, will be available to a wider array of companies than previously planned.

April 30 -

Submissions total about $17.8 billion in requested funding for the second round of the Paycheck Protection Program, with an average loan size of $81,000.

April 30 -

A former economist says high-ranking officials engaged in “legally risky” behavior to downplay consumer harm; online payments and contactless transactions jumped in the first quarter, and some think the new habits will stick.

April 30 -

The lenders are bracing for spikes in delinquencies or defaults on loans to a sector heavily punished by social distancing measures.

April 29 -

The Small Business Administration's last-minute plan to temporarily block larger banks from the relief loan program is another example of the agency changing the rules midstream, critics said.

April 29 -

The Small Business Administration has processed more than 476,000 applications from struggling small-business owners, but lenders say access to the second round of the Paycheck Protection Program has been spotty.

April 29 -

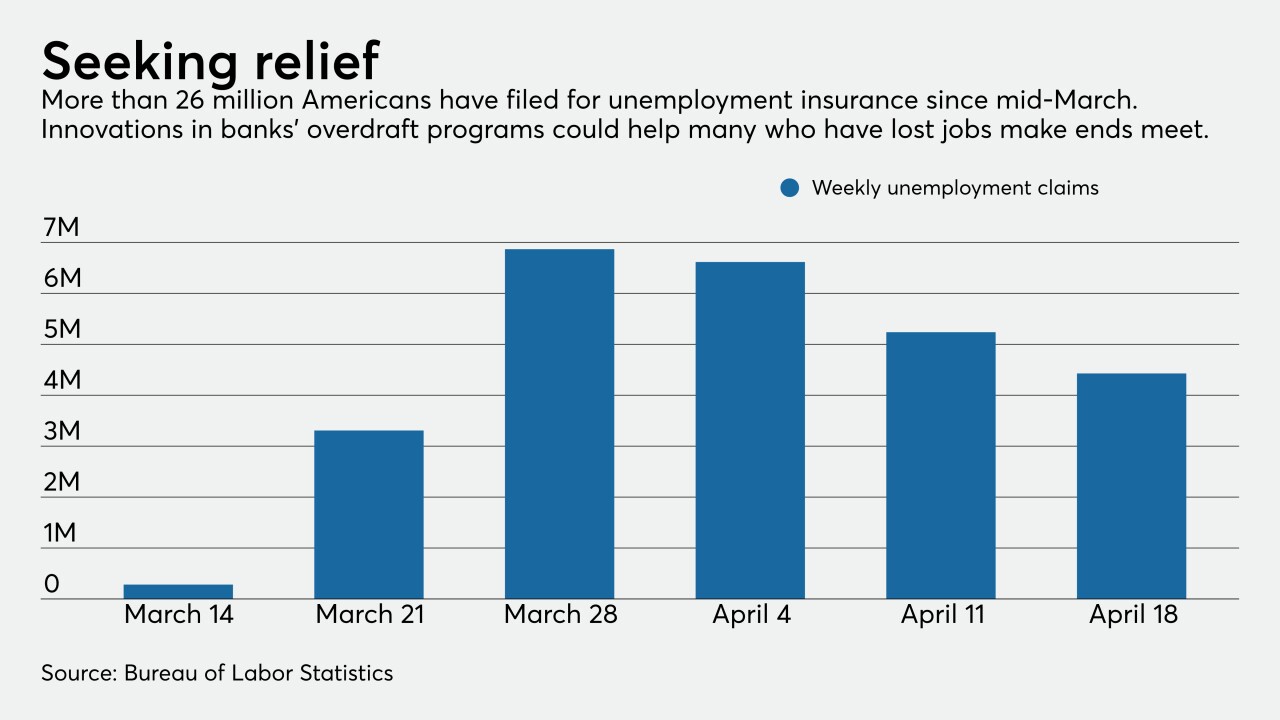

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

April 28

-

Fintechs in the payments industry saw problems coming when the CARES Act’s SBA Paycheck Protection Program opened the floodgates for millions of coronavirus-stricken small businesses to apply for loans.

April 28 -

Lawmakers should approve a program to distribute stimulus funds using a government-sanctioned coin, which would be speedier than the current system.

April 28 Polyient Labs

Polyient Labs