-

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

April 14 -

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

April 14 -

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

April 14 -

The results preview a tough first year for new CEO Charlie Scharf as the coronavirus pandemic brings the U.S. economy to a standstill.

April 14 -

The nation's largest bank set aside nearly $8.3 billion for bad loans, more than double what some analysts had expected.

April 14 -

Bank’s earnings fall 69% in the first quarter; this week’s earnings reports could determine whether banks will need to suspend dividends.

April 14 -

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

April 13 -

PayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

April 13 -

Just days after the Fed lifted Wells Fargo's asset cap so it could make more Paycheck Protection Program loans, it warned customers its queue is long and they may want to go elsewhere before program funds are exhausted.

April 13 -

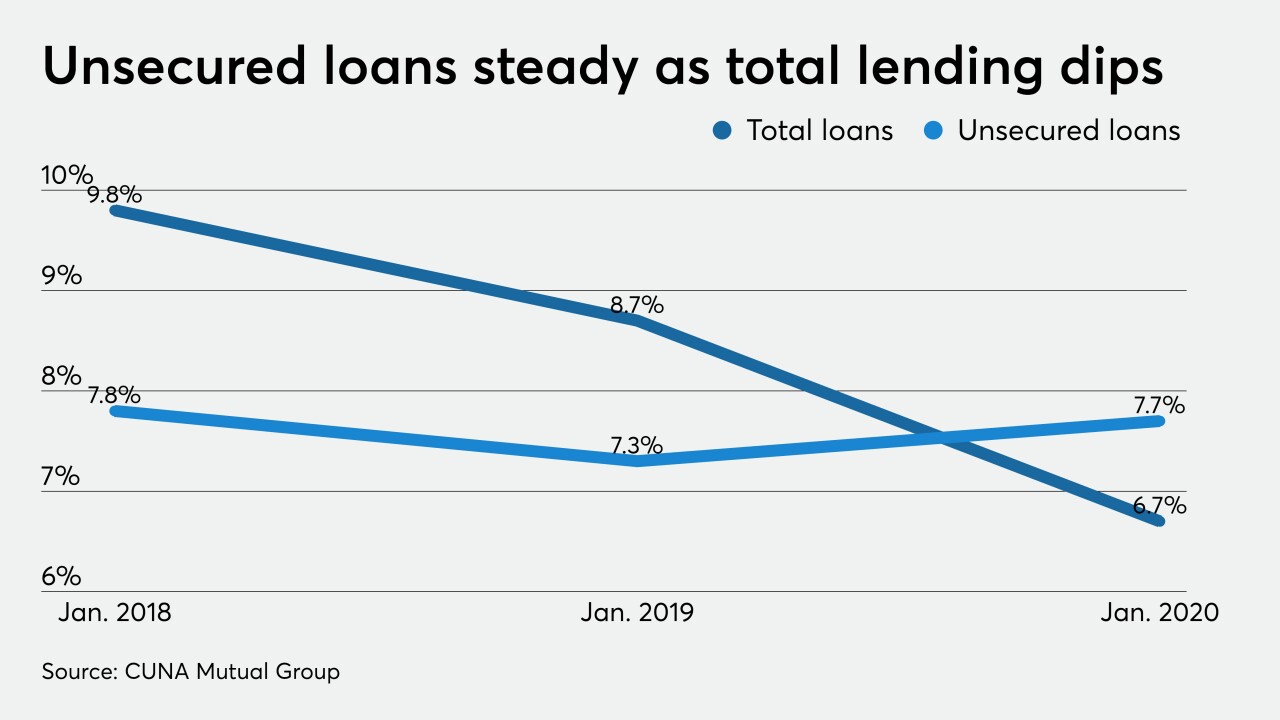

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13