-

The timing couldn’t be worse for ag and energy lenders as well as global banks, which were all counting on the Chinese market to help bolster commercial lending and fee income.

February 4 -

Reduced dine-in traffic is eating away at bottom lines, forcing eateries to rethink how they borrow money.

February 4 -

Kaustav Das was part of Kabbage’s effort to transform small-business lending by using new data analytics, and the CEO of Petal wants him to help it do the same in consumer credit cards.

February 4 -

Customers of the online lender's payments service can select their own loan terms.

February 4 -

The bank would make small-business loans on the online retailer’s platform; Fed survey says banks worry about increasing delinquencies, especially in subprime.

February 4 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

The people of tiny Duncan, Ariz., have found creative ways to adapt to life in a banking desert, but their experience augurs a worrisome future for many other rural communities.

February 2 -

Nonbanks hold a disproportionate percentage of the worst-rated loans, but banks hold a majority of the market, and risk management safeguards are largely untested, according to an interagency report on shared national credit.

January 31 -

Slowing sales, decreasing market share and other factors could make it harder for credit unions to grow one of the industry's biggest products in the year ahead.

January 31 -

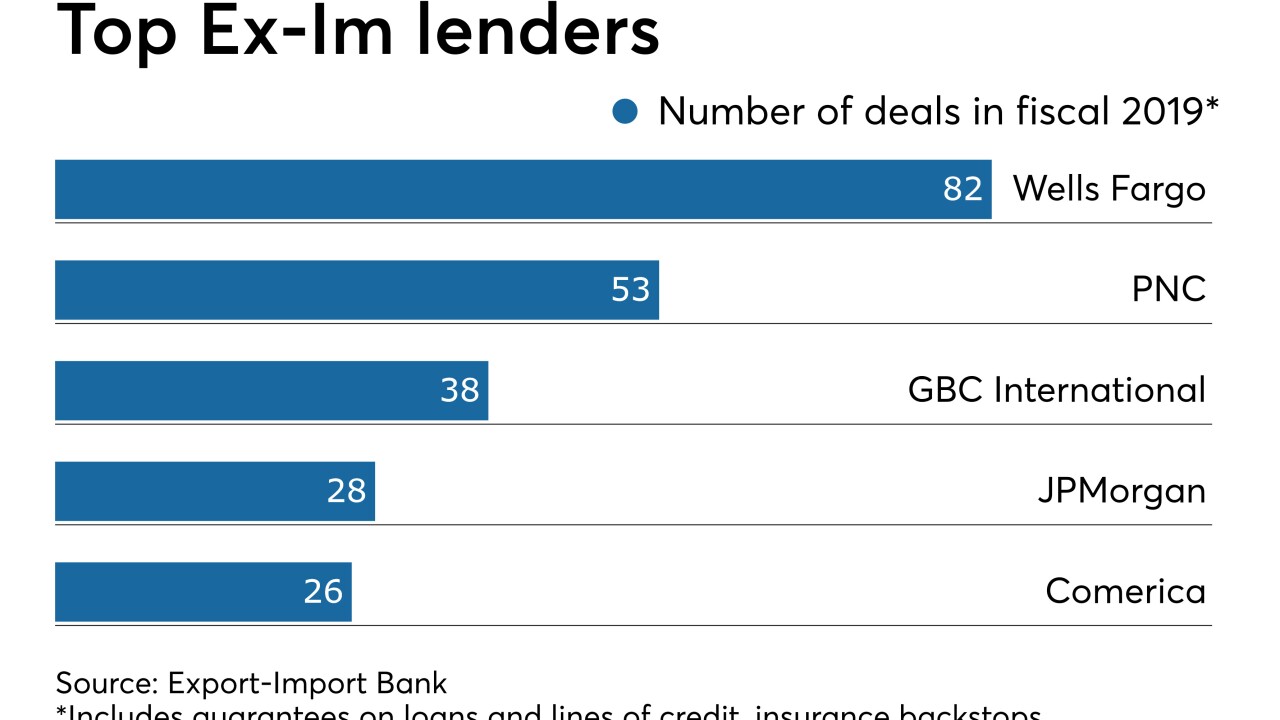

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30