-

Susan Ehrlich, the fintech lender's new chief, discusses what she learned working at Amazon and Simple and how her firm is approaching consumer loans differently.

March 22 -

Rising waters in the Cornhusker State have already caused in excess of $1 billion in damages.

March 22 -

Simple math only partly explains why smaller lenders are adding commercial and industrial loans at a faster clip than their larger counterparts.

March 21 -

Direct lenders are gearing up for more business in the U.K. as they see banks shrinking their sterling corporate loan books in the wake of Brexit-linked volatility and slower economic growth.

March 21 -

An executive at the Rhode Island company said the complexity of business lending remains an obstacle to switching to entirely automated, paperless operations.

March 20 -

Mechanics Bank was close to buying Rabobank's U.S. unit last year, but pressed pause when the seller ran into serious legal troubles.

March 20 -

Credit unions in those two states also posted double-digit growth in total loans and recorded lower delinquency rates.

March 19 -

The online lending industry has turned to the courts, Congress and now federal banking agencies in an effort, thus far fruitless, to blunt the impact of a 2015 appeals court ruling.

March 18 -

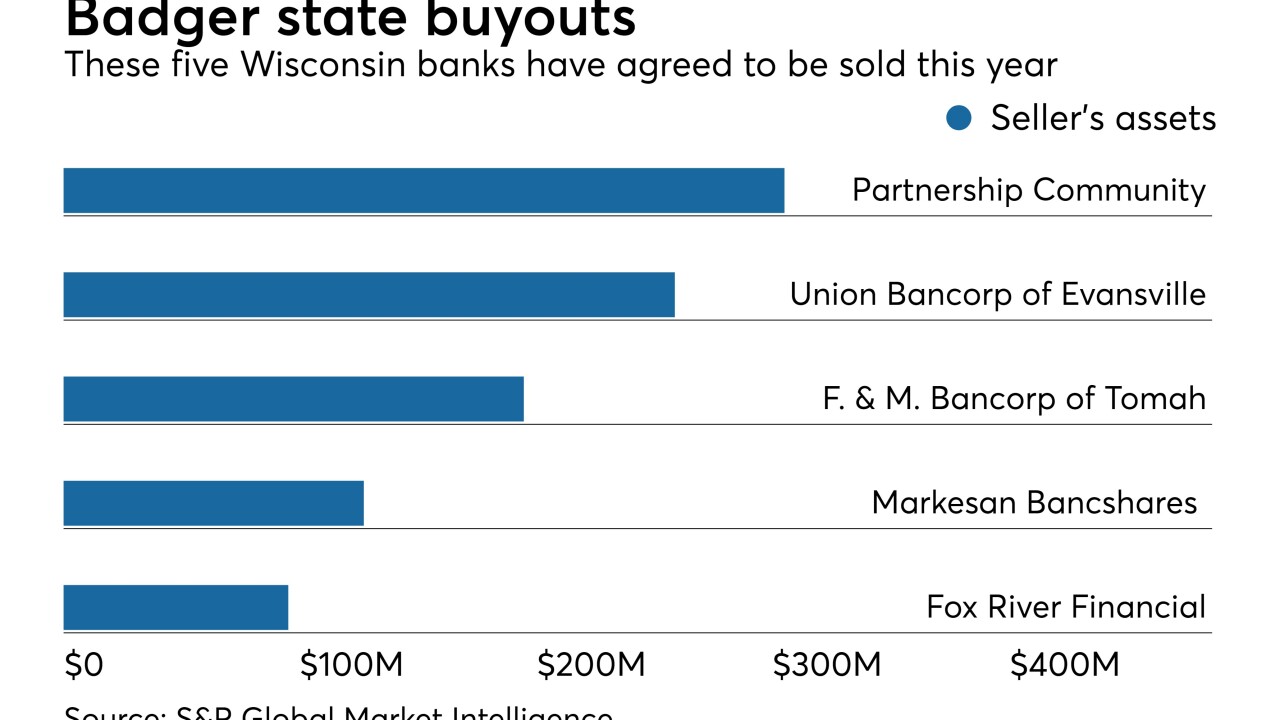

On Dec. 31, 2018. Dollars in thousands.

March 18 -

The small Wisconsin city features a vibrant economy, low employment and a growing population, but banks that want to buy their way into the market have their work cut out.

March 14 -

A new line of inquiry into President Trump's business dealings is thrusting small New Jersey lender Investors Bancorp into a spotlight with Deutsche Bank, which for years has been better known as the real estate mogul's creditor of choice.

March 13 -

The Connecticut bank, which has been unable to complete a pending deal for an SBA platform, has managed to build the business anyway.

March 13 -

The Nusenda Credit Union Foundation, which is being honored with a Wegner Award, works with its partners to find creative solutions to unmet needs, including its mircolending program, Co-op Capital.

March 11 -

The upstart lenders have been chipping away at credit cards’ consumer-lending dominance by offering fixed-rate loans with predictable repayment plans. Now the card giants are fighting back.

March 8 -

Until now, Toyota Financial Services has offered banking services to its dealers. But as it builds its digital bank, that will soon change, according to its newly appointed chief information officer.

March 8 -

Events like the recent government shutdown present opportunities for banks to help customers when they need it most.

March 8 Oliver Wyman

Oliver Wyman -

Recent history shows how dangerous these short-term products can be without appropriate guidelines in place.

March 8 The Center for Responsible Lending

The Center for Responsible Lending -

The bank will fund community development financial institutions that lend to women-owned businesses backed by the fashion designer's foundation.

March 7 -

Pacific Mercantile and P2Bi are collaborating on a program to help businesses that are not ready for traditional bank financing.

March 7 -

Karen Mills, who led the Small Business Administration from 2009 to 2013, is joining the Eastern Bank spinoff Numerated as an adviser and investor as it tries to bring online-lending technology to community banks.

March 6