-

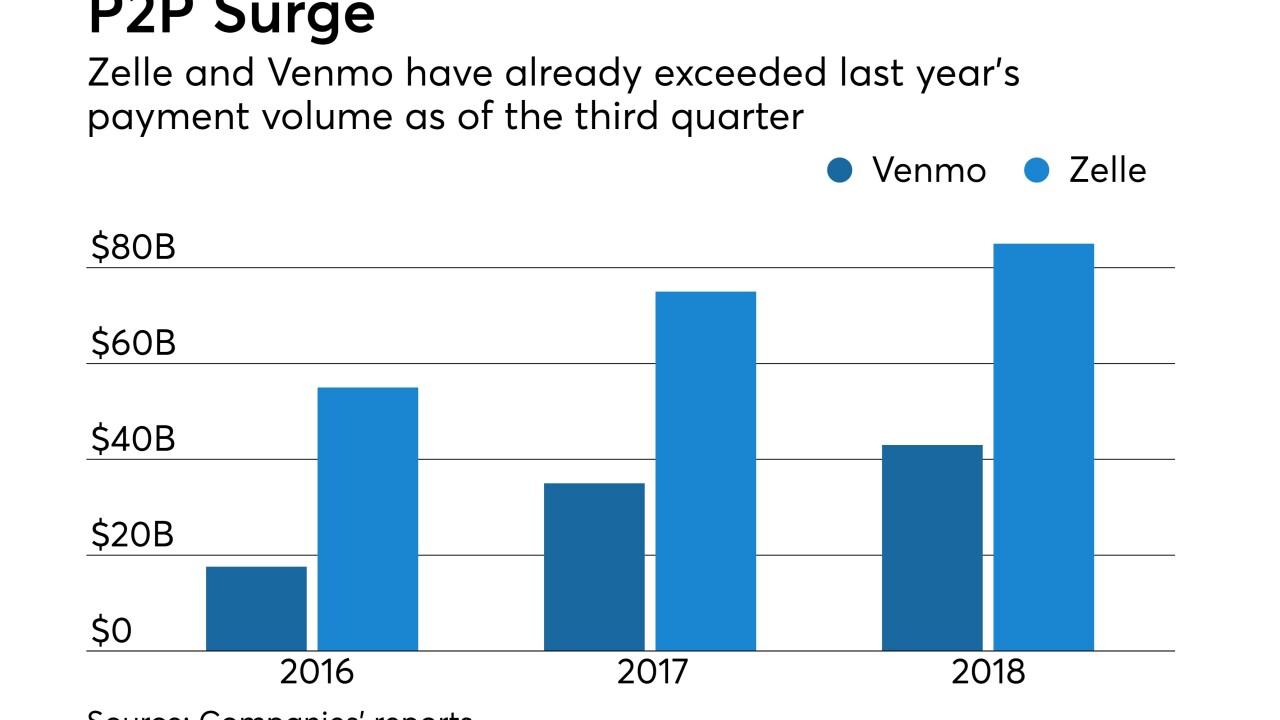

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

Increased third-quarter revenue outweighed higher operating expenses at the Alabama regional.

October 23 -

Though consumer lending and C&I lending improved at the Cincinnati company, its corporate and mortgage banking revenues fell in the third quarter. Last year Fifth Third also posted a one-time gain of $1B associated with its sale of shares in Vantiv, complicating the comparison.

October 23 -

The Columbus, Ga., company ramped up its business and consumer lending even as it scaled back lending on construction and commercial real estate projects.

October 23 -

The personal lending boom continues: HSBC's U.S. arm is teaming up with Avant, a closely held online lender, to offer unsecured loans to new and existing customers.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The Salt Lake City bank said consumer loans rose 7% from a year earlier. That was one of its several quarterly highlights.

October 22 -

The firm is disbanding its consumer and commercial banking division and will make the Marcus brand one of the new business offerings that can be sold to its wealth management unit’s expanding roster of clients.

October 22 -

The $22.9 billion-asset TCF also highlighted improvements in credit quality in the third quarter as it continued to exit the auto finance business.

October 22 -

Brian Johnson, the agency’s second-in-command, wields much power; Fair Isaac is planning changes to credit scoring to boost approvals.

October 22 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

Netspend customers kept from accessing paychecks; Sen. Elizabeth Warren rebukes Comerica over fraud in benefits program; FDIC poised to revamp deposit rules (about time, say banks); and more from this week's most-read stories.

October 19 -

The Providence, R.I., company reported a 27% gain in profits thanks partly to a boost in fee income from its purchase of Franklin American Mortgage in August.

October 19 -

Strong net interest income and other factors made up for a drop in investment banking and other noninterest income at the Atlanta bank, which reported double-digit earnings growth.

October 19 -

A shifting C&I landscape, heated competition for deposits and red flags in consumer lending also took center stage in often testy exchanges between bankers and analysts on quarterly earnings calls.

October 18 -

The Arkansas company, which has faced criticism over its concentration in commercial real estate, charged off nearly $46 million tied to a pair of properties in the Carolinas.

October 18 -

The program will focus on increasing lending to small and medium enterprises in Guatemala, Burkina Faso and Kenya.

October 18 -

Commercial and industrial lending rose 8% in the third quarter at the Cleveland bank, but other factors drove its double-digit gain in profits as overall loan growth was modest.

October 18 -

The $286.4 million deal is an important test for Upgrade, which has raised $142 million of equity over the past two years but has yet to turn a profit.

October 18