Community banking

Community banking

-

The $5.9 billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

April 3 -

The proposed Agility Bank would rely heavily on digital offerings. It is pursing a national charter with the Office of the Comptroller of the Currency.

April 3 -

Lenders can offer deferred payments and capitalize on digital banking to help small businesses and consumers get back on their feet.

April 2 -

The pandemic may force the Small Business Administration to rely more on fintechs and digital channels to hasten loan approvals, a shift that could stick.

April 1 -

In supporting the economic recovery from the coronavirus pandemic, lenders have a chance to restore public trust damaged in the last financial crisis. But they face tough decisions on dividend cuts, executive pay, furloughs and deeper changes to their business model in the process.

April 1 -

The Treasury Department and Small Business Administration are responsible for distributing $350 billion in coming months.

March 31 -

While some big banks have pledged to avoid layoffs this year, hiring freezes and delayed projects are becoming the norm during the pandemic.

March 31 -

The regulation established standards for investors who own less than a quarter of an institution. Banks are getting more time for implementation as they focus on effects of the COVID-19 pandemic.

March 31 -

The newly minted Transact Bank will provide payment processing and card issuing services to a wide range of clients.

March 31 -

Motivated by the entrepreneur and TV celebrity, Citizens Bank of Edmond is offering an overdraft line to give customers quick access to cash they will eventually receive from the federal government.

March 30 -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

The acquirer had pursued a de novo strategy in its home state but was unable to raise enough capital.

March 30 -

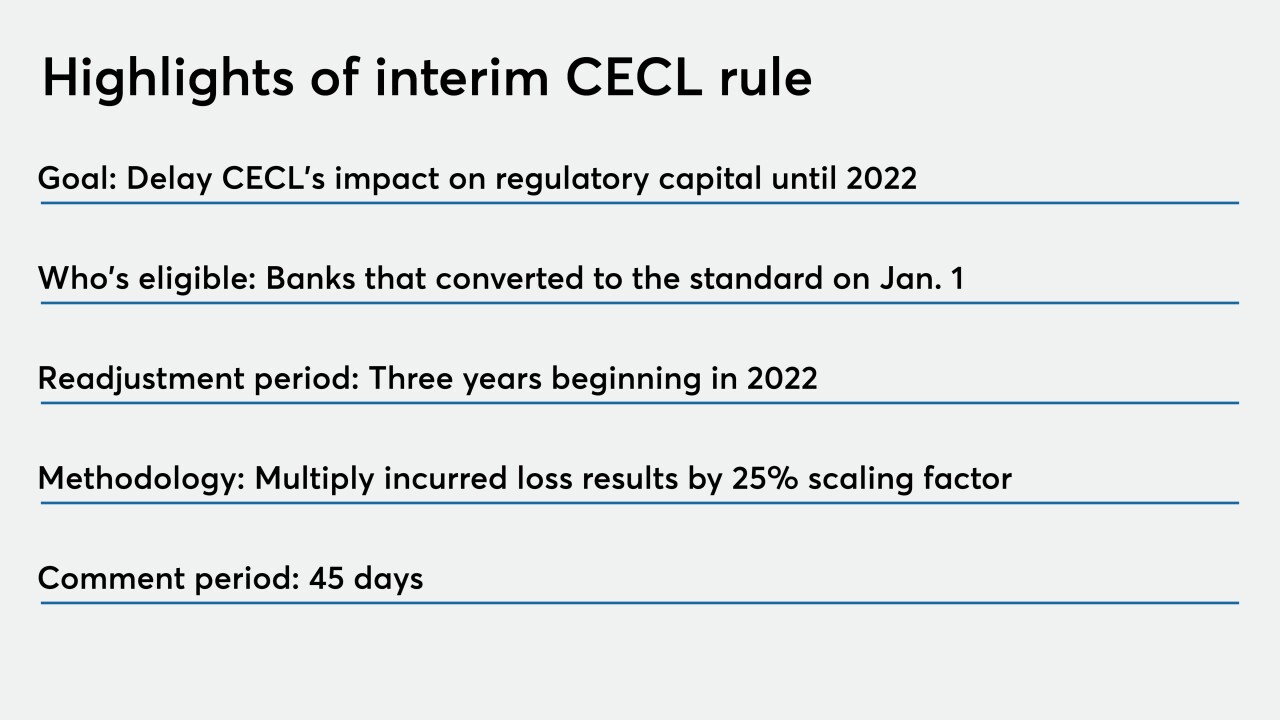

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

Citigroup CEO says it’s a “fine line” between supporting customers and burdening them with debt; Goldman gives away 600,000 N95 masks it had from prior scares.

March 27 -

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

Tom Meyer, CEO of 1st Capital since 2015, decided to step down because shelter-in-place orders are keeping him from family hundreds of miles from the bank.

March 26 -

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

March 26 -

The regulator's extension for first-quarter documents applies to BHCs with less than $5 billion in assets.

March 26 -

A former market president for State Bank Financial would serve as CEO of the proposed Classic City Bank.

March 26