Community banking

Community banking

-

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

Broadway Financial prefers a small balance sheet and loans to real estate investors that offer affordable housing. Capital Corps and its founder, Steven Sugarman, want the bank to expand by making more loans directly to low- and moderate-income borrowers.

February 13 -

Congress should further expand a tiered regulatory system to help community banks better serve local neighborhoods.

February 13 -

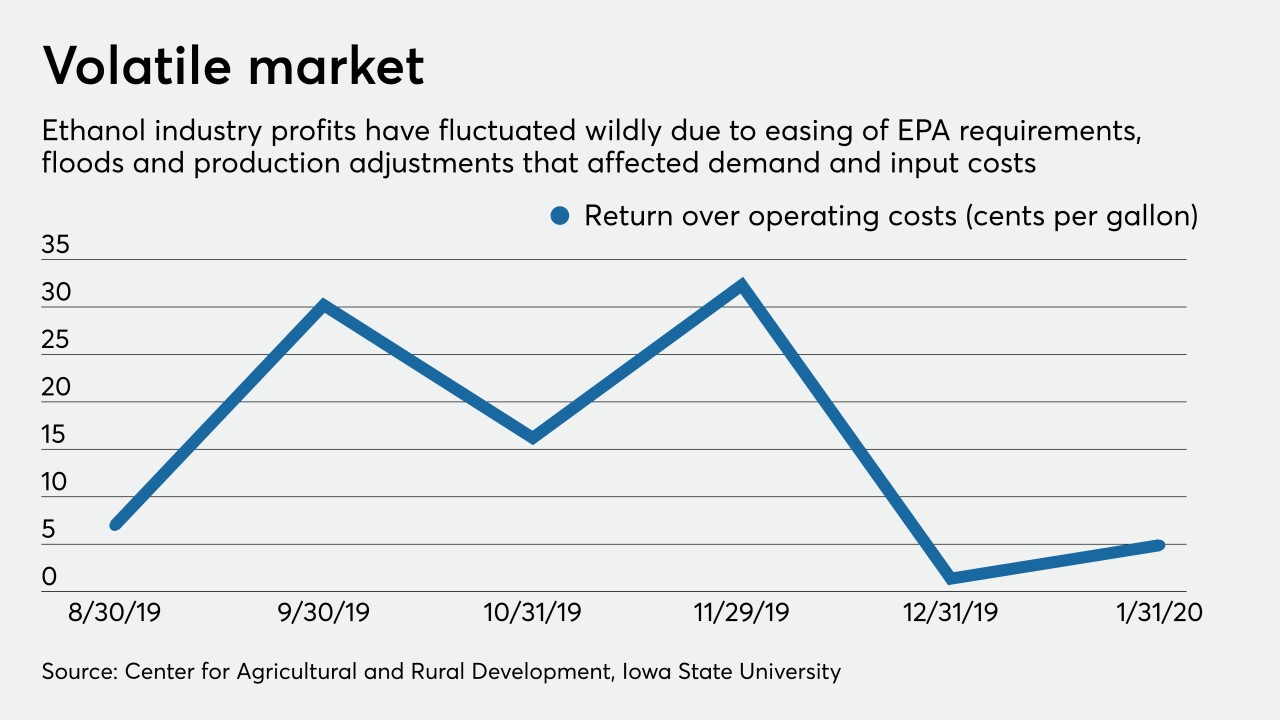

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Capital Corps, founded by former Banc of California CEO Steven Sugarman, wants the minority-run Broadway sold to a buyer that serves low- and moderate-income borrowers.

February 12 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

February 11 -

The Iowa company will pay $280 million to gain 25 branches and $1.2 billion in loans.

February 11 -

Ken Karels will be succeeded by Mark Borrecco, who had been CEO of Rabobank's U.S. bank.

February 11 -

The agency released two new manual supplements and other materials to help nonbanks and its own staff better understand application procedures.

February 10 -

On Sep. 30, 2019. Dollars in thousands.

February 10 -

On Sep. 30, 2019. Dollars in thousands.

February 10 -

M&T hires Aarthi Murali away from JPMorgan Chase as its customer experience chief; when a small town loses its only bank; why more banks are ditching their legacy core vendors; and more from this week’s most-read stories.

February 7 -

Organizers of Triad Business Bank have raised enough capital and have received approval from the FDIC.

February 5 -

The Mississippi company will pay $49 million for Traders & Farmers Bancshares.

February 5 -

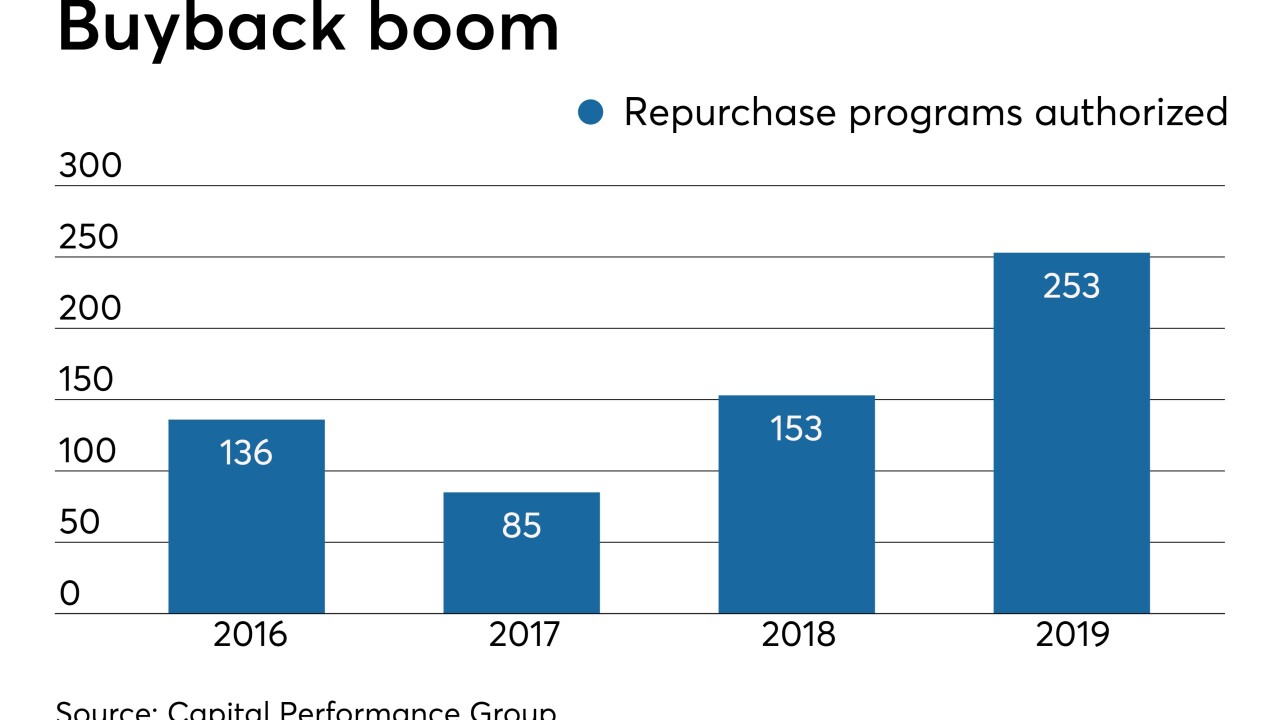

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

The company agreed to acquire Alliance Benefit Group of Illinois, which has more than 600 clients and 40,000 plan participants.

February 4 -

The Michigan company will pay $101 million for the parent of First National Bank in Howell, Mich.

February 4 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

Unlike other regions of the country, the western U.S. has seen very few large bank mergers in recent years. Here's why Pacific Premier's acquisition of Opus Bank could change that.

February 3