Community banking

Community banking

-

After essentially failing its 2013 CRA exam, BBVA Compass embarked on an ambitious plan to achieve the highest possible CRA grade. Here’s how it succeeded.

February 6 -

Hometown Financial will merge Abington Bank into Pilgrim Bank. The combined bank will be run by Andrew Raczka, Abington's CEO.

February 6 -

The company will gain four branches in Athens, Ga., with the $52 million acquisition.

February 6 -

Volume was steady, but deal values would've been the lowest in years if not for one big, and very intriguing, transaction.

February 5 -

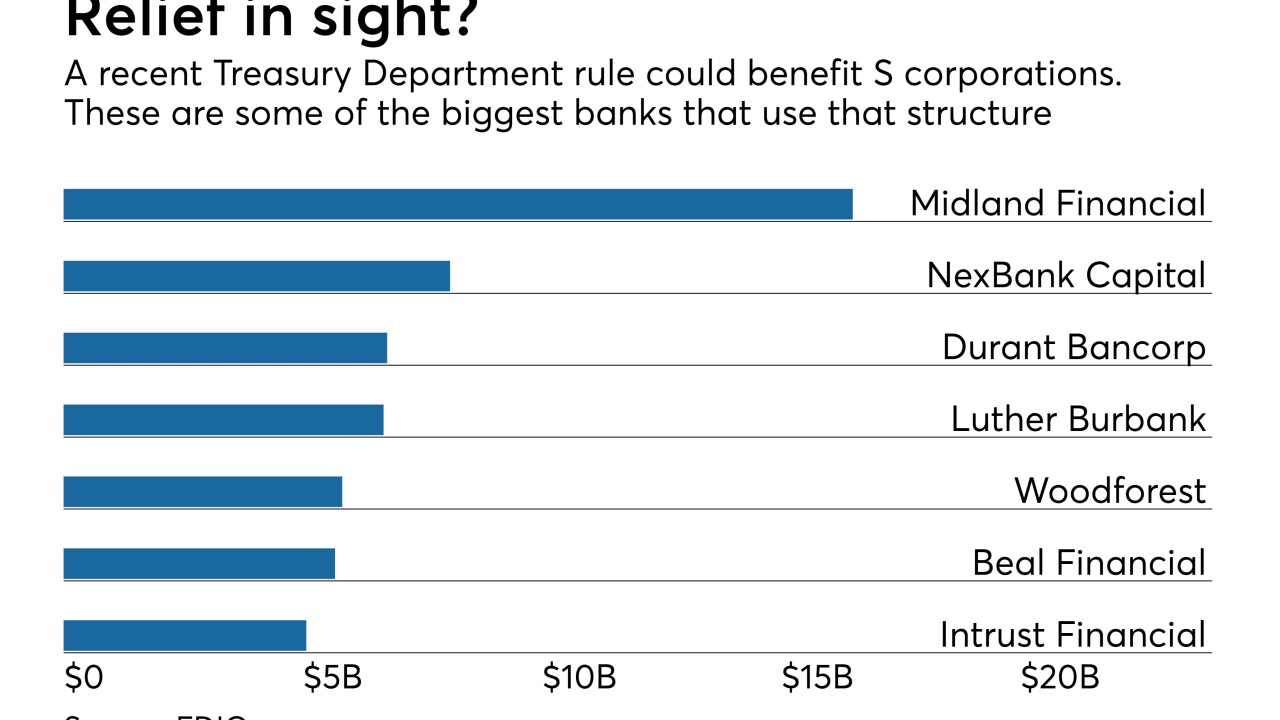

Shareholders in Subchapter S corporations will get some tax relief of their own under a new Treasury Department rule that will let them take a 20% deduction on qualified business income, which includes loan originations and sales.

February 5 -

Superior is the latest credit union to announce an acquisition involving a bank.

February 5 -

The company said the move reflects intense competition and a "significant decline" in origination volume.

February 5 -

Bank of Princeton will also buy $190 million in deposits as part of the deal.

February 4 -

Superior is the latest credit union to announce an acquisition involving a bank.

February 4 -

Bankers weigh their options in mortgage and CRE lending as implementation of a new accounting standard nears.

February 4 -

Community banks generally make digital a consumer play, but TransPecos Bank, with its BankMD brand, is focusing on doctor practices, which tend to weather economic downturns well.

February 1 -

The Virginia company, which recently bought Access National, will become Atlantic Union Bank later this year.

February 1 -

Lenders are glad the agency worked swiftly through a backlog of paperwork, but they're worried funds will get cut off if the government closes again.

February 1 -

Gatsby, which has built an app to let novice investors buy puts or calls, has received funding from Barclays, Radius Bank and others. Radius is considering offering the service to its customers.

January 31 -

The Louisiana company got more aggressive with credit issues and recorded its final charge tied to addressing a regulatory order.

January 31 -

The deal between the U.S. bank and the U.K. software firm adds another potential payments rival for Swift, and the two companies will offer banking APIs to U.S. fintechs.

January 30 -

The French banking giant has spent months winding down its holdings in the $20 billion-asset bank.

January 30 -

Reliance Bancshares was in a position to reject five buyout offers over the course of a year before it got one it liked.

January 30 -

Shaza Andersen, a well-known banker around the nation's capital, would serve as Trustar Bank's CEO.

January 29 -

At banks of all sizes — from the $7.2 billion-asset WSFS Financial to the $373 billion-asset Capital One — marketing budgets ballooned in the fourth quarter.

January 29