Community banking

Community banking

-

Premier Financial agreed to buy First Bank of Charleston for $33 million.

April 19 -

Online banks have good reason for wanting regulators to update the 41-year-old Community Reinvestment Act.

April 18 -

Organizers of Studio Bank in Nashville have raised more than $40 million, satisfying the minimum amount set by regulators.

April 18 -

Organizers of CommerceOne Bank in Birmingham must raise at least $30 million before opening.

April 18 -

The Illinois company has agreed to buy Springfield Bancshares for $87 million.

April 18 -

An increase in total loans and a lower tax rate helped the Mississippi company offset revenue it lost after selling a consumer finance business.

April 17 -

The company benefited from increases in residential and construction lending.

April 17 -

Though total loans and deposits were down from the end of 2017, management expressed optimism that things will pick up over the rest of this year.

April 17 -

Community banks are increasingly turning to account onboarding technology to help them solve a growing problem — how to win new customers without opening physical branches.

April 17 -

A Virginia bank's decision to pursue a charter in North Carolina puzzles some observers, given the added complexity and costs.

April 17 -

The company, which completed a major acquisition last year, said tax reform will help it generate a higher return on average assets.

April 17 -

The Alabama bank agreed to buy Peoples Bank for $23 million as part of a plan to target new Southeastern markets.

April 17 -

Chris Marshall, a former CFO at Capital Bank Financial, will help Tax Guard recruit bank and nonbank clients. The firm uses technology to let lenders know if potential clients owe money to the IRS.

April 17 -

Michelle Bowman, a former community banker and now the Kansas banking commissioner, was one of two Federal Reserve Board nominees announced by the White House on Monday. President Trump also nominated Columbia University Richard Clarida as vice chair.

April 16 -

New Resource Bank and P2Bi are splitting the risk and revenue associated with asset-based loans.

April 16 -

Gary Shook, who led Middleburg Financial before its sale to Access National, has become president of Blue Ridge's bank.

April 16 -

The bank, which already offers mortgages through seven offices across North Carolina, is the fourth group to announce plans for a de novo in the state.

April 13 -

Amber Baldet is exiting JPMorgan Chase to start her own venture, and another female executive is taking charge of the blockchain effort. BofA makes major progress on digital mortgages and gets gun-shy after Parkland. Plus, GM’s one-sentence dress code.

April 13 -

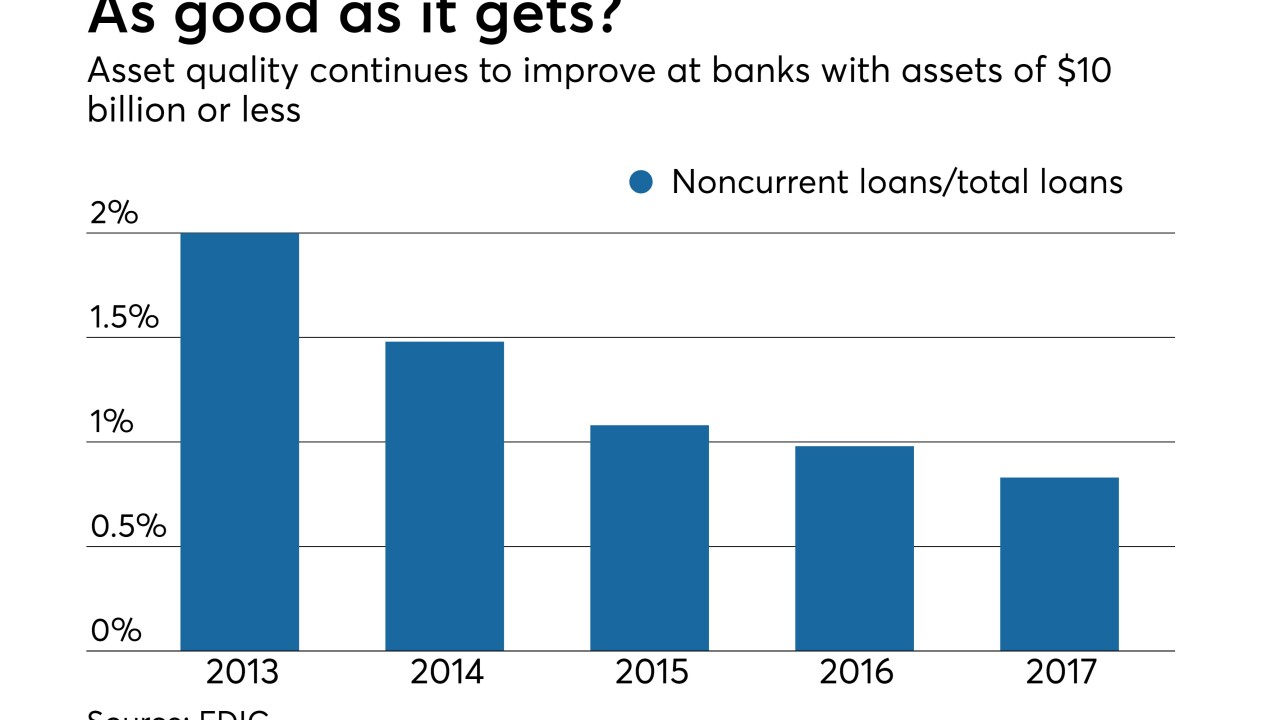

Banks have been hanging on to problem loans for various reasons, but that could create headaches when credit inevitably worsens.

April 13 -

The bill, which also exempts community banks from the trading ban named for former Fed Chairman Paul Volcker, would go a step further than the regulatory relief bill that passed the Senate.

April 13