Community banking

Community banking

-

Bank consolidation in the city has picked up in recent months despite erratic oil prices and flooding tied to Hurricane Harvey.

February 21 -

The internet giant, SunTrust, Ally and other backers have invested $16 million in a new funding round for Greenlight Financial Technology, further blurring the lines between banks and tech companies.

February 21 -

The Michigan company has been acquisitive lately, buying California branches and a wealth advisory firm.

February 21 -

First Citizens, which wants to buy KS Bancorp, has filed a lawsuit to challenge a so-called poison pill provision that the much smaller bank's board recently passed.

February 21 -

Choice, which has a history of acquisitions, is buying a financial institution that largely focuses on business banking.

February 20 -

Superior Choice Credit Union's deal for Dairyland State Bank in Wisconsin is the second such deal announced this year.

February 20 -

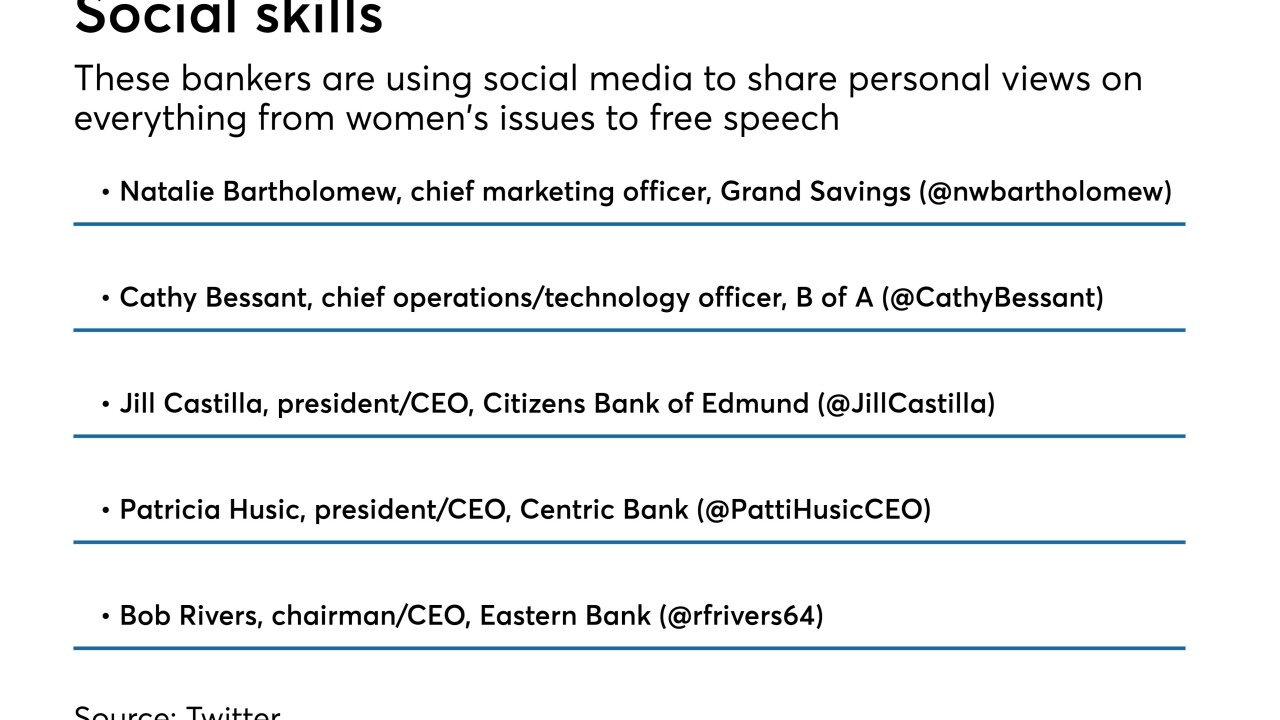

Bob Rivers, CEO of Eastern Bank, was praised and criticized after he called out a Boston sports radio station whose on-air personalities made insensitive remarks. The incident underscores why bankers must be mindful about the positions they take.

February 20 -

The company could use proceeds from the planned offering to add branches and make bigger loans.

February 20 -

Just two months after a capital infusion, First Capital Bancshares added banking veterans including John McCoy and Harvey Glick as directors in a board overhaul, changed CEOs, and decided to move its corporate headquarters to Charleston, S.C.

February 16 -

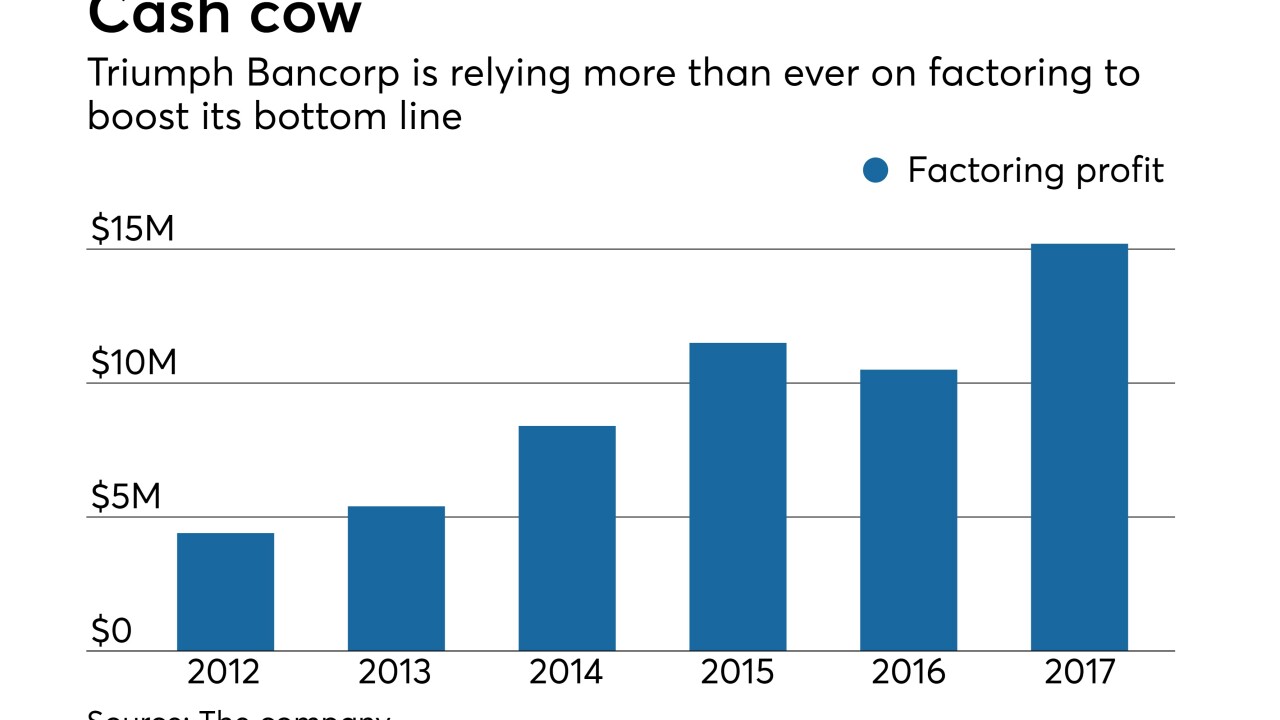

Triumph Bancorp has developed technology to help freight brokers make faster payments to truckers, charging a fee for the service.

February 16 -

Their partnership aims to make it easier for community banks and other institutional investors to vet loans that they could buy from online lenders.

February 16 -

The Chicago institution, formed in 2010 to buy the failed ShoreBank, has hired Sandler O'Neill to gauge interest from potential buyers, according to a published report.

February 15 -

Having solid relationships with those who cover the banking industry can lend credibility to management teams, especially when times are tough.

February 15 -

The as-yet-unnamed bank, which would be based near Charlotte, N.C., would be led by Randy Helton, a former CEO at American Community Bancshares.

February 14 -

The company, which recently shared a three-year plan to bring in more lower-cost deposits and commercial loans, seems ready to play offense a year after the ouster of its CEO.

February 14 -

Nonbank mortgage firms are seeking formal assurance from the Consumer Financial Protection Bureau that they will not become subject to surprise audits or enforcement without involvement of a state regulator.

February 14 -

Achieva Credit Union, which recently formed a business to advise other acquisition-minded credit unions, has agreed to buy Preferred Community Bank.

February 14 -

A strategic payments plan could shine a light on critical gaps in a community bank’s offerings; one frequently missed opportunity is credit cards, writes Deborah Matthews Phillips, managing director of payment strategy for Jack Henry & Associates.

February 14 -

The company agreed to buy Bank of River Oaks for $85 million in cash.

February 13 -

The Justice Department required the sales before signing off on MainSource's pending sale to First Financial in Cincinnati.

February 13