Community banking

Community banking

-

Doug Bowers contends that last year’s leadership shake-up, job cuts and corporate governance overhaul will make the company more competitive in its home state.

January 2 -

The assessment from the central bank means MidSouth faces restrictions on board appointments and executive duties. Last year the OCC called the Louisiana company a "troubled institution."

January 2 -

Acquirers announced deals in California, Missouri and Pennsylvania on the last business day of 2017, raising the year's final tally to 245 transactions.

January 2 -

Oriental Bank in San Juan was ordered to pay just over $153,000 for failing to notify borrowers that they were required to purchase flood insurance. The fine was one of several November enforcement actions made public Friday by the FDIC.

December 29 -

From hosting important visitors to being recognized for a variety of good deeds, here's how credit unions are giving back to their communities.

December 29 -

Carter Bank & Trust’s founder shunned internet banking and handled most executive duties himself. He died in April and his successor, Litz Van Dyke, is now working at breakneck speed to modernize this once-hidebound Virginia bank.

December 29 -

From the identity of bankers in the 21st century to the regulatory turmoil in Washington to the huge impact of technology on the industry, readers expressed an array of strong opinions about what happened in 2017.

December 28 -

After visiting with dozens of banks, tech firms and retailers, the CEO of the Delaware bank concluded that he needed to create a customer experience department but could leave blockchain development to his larger rivals. He also gained valuable insights about succession planning during his time away and discovered new ways to connect with employees.

December 28 -

State and federal regulators finally approved the Mississippi bank’s acquisitions of Ouachita Bancshares and Central Community after anti-laundering and CRA matters were resolved. BancorpSouth’s CEO says he may pursue more deals.

December 28 -

The energy crisis, hurricane damage and merger costs have hampered earnings per share at the Louisiana bank. Its CEO has to clear those hurdles and convince investors steady growth is ahead.

December 28 -

Legislation advanced by the Senate banking panel has a good shot at passage, as long as lawmakers remain focused on helping community banks — not Wall Street.

December 28 -

Here's another look at how credit unions across the country are giving back to the communities they serve.

December 27 -

The veteran banker wants to turn his Pennsylvania bank into a major business lender. But first he has to spin off the buzzy digital-only bank he helped build.

December 27 -

Scott Page, CEO of CoBiz Bank, will retire in a few days. He will be succeeded by Steven Bangert, the company's chairman and CEO. The company's chief financial officer will also become its chief operating officer.

December 27 -

The company will gain four Chicago-area branches as part of the $41 million all-cash acquisition for the parent of ABC Bank.

December 27 -

Rita Lowman recently joined the bank from C1 Financial, where she had been chief operating officer.

December 26 -

David Becker is trying to prove to investors that his Indiana bank can succeed over the long term. With the rise of online banking and fintech firms, Becker is a community banker worth watching in the new year.

December 26 -

Bank M&A started off with a bang this year, with eight of the 10 biggest deals taking place in the first six months. North Carolina and Florida accounted for six deals on the list.

December 26 -

Davis, who stepped down as CEO a year ago, will retire as the company's chairman and as an employee at the end of 2017. Umpqua will then become one of the few publicly traded banking companies with a female chair.

December 22 -

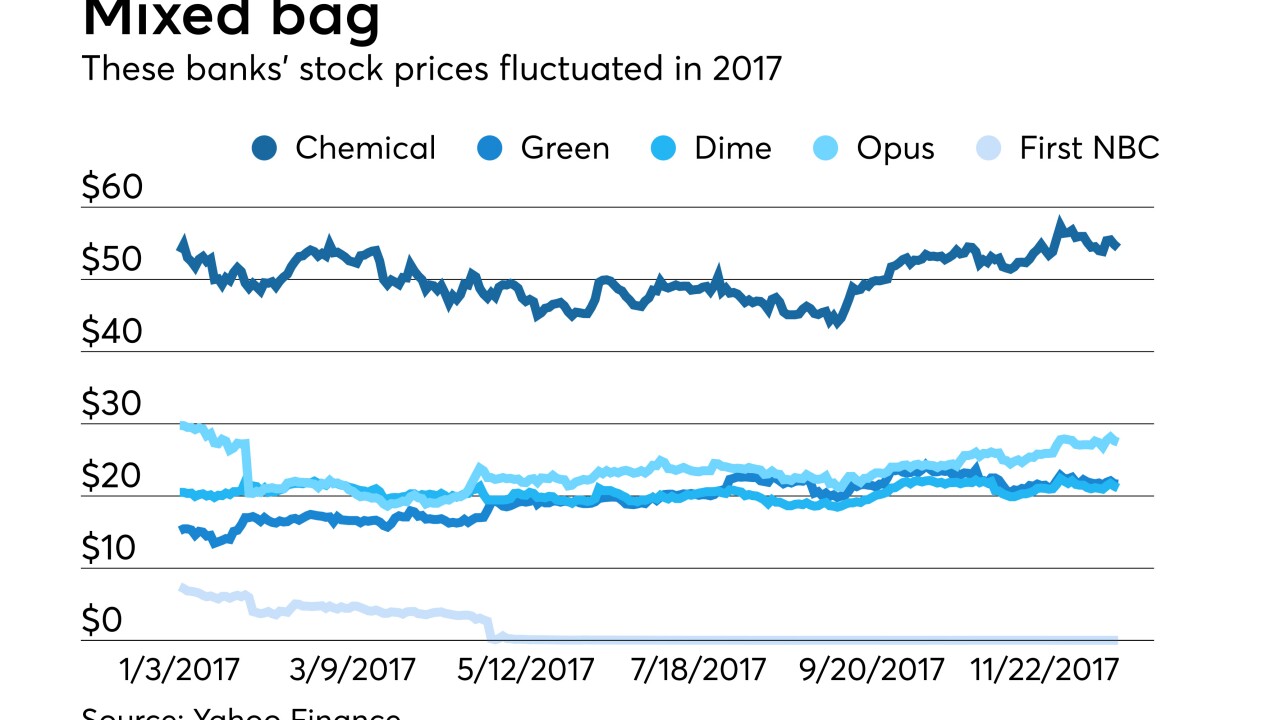

We never promised the news would be good for all these community bankers, and it wasn’t. One couldn’t stop a failure, and another quit soon after an acquisition. The rest have their banks at different points on the comeback trail.

December 22