The community banking team at American Banker huddles up this time each year to name five executives we think will emerge as newsmakers.

As 2017 draws to a close, we take a look at how our previous selections fared. Most years our bankers to watch deliver, and 2017 was no exception. Sometimes the news is good, and sometimes not so much.

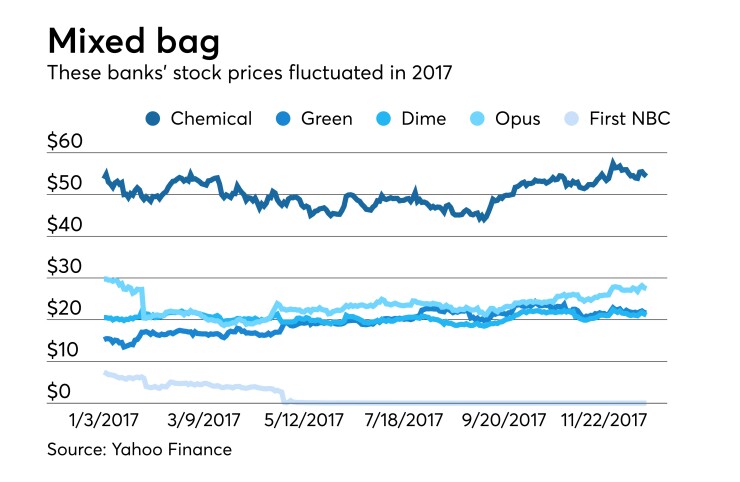

Shivan Govindan’s efforts to keep First NBC Bank afloat ended with the New Orleans company’s failure, while David Ramaker at Chemical Financial began the process of integrating a large acquisition before he made a surprising announcement.

Steven Gordon at Opus Bank, Kenneth Mahon at Dime Community Bancshares, and the duo of Geoff Greenwade and Manny Mehos at Green Bancorp all made progress in reducing or eliminating exposure to certain types of risky loans.

What follows is a detailed recap of each of their stories. Stay tuned for the 2018 list, and profiles of each banker on it, over the coming week.

Coming up short

It was going to take a miracle to save First NBC after it was stung by problems in its tax-credit business and rising delinquencies in its commercial loan book.

Govindan, the company’s chairman and biggest investor, certainly gave it shot.

First there were management changes.

Ashton Ryan, who had relinquished his title as CEO in late 2016,

Next came the challenging task of raising capital to address regulators’ concerns. First NBC, which was the subject of a consent order late last year, was hit with a prompt corrective action from the Federal Deposit Insurance Corp. in March after determining that the bank was

The company shrank to $3.8 billion in assets when it sold

Those efforts proved inadequate.

Regulators stepped in to

Cheney, who told American Banker soon after joining First NBC that he was determined to rescue the bank, reflected on the experience in October.

“I came in to find out how deep the hole was,” he said while moderating a panel at the University of Mississippi. “After six weeks I found the hole to be six times deeper than I thought.”

Combining, then departing

Chemical’s Ramaker entered 2017 on a high note.

The Midland, Mich., bank, where Ramaker was CEO, had just completed its

It also meant that the $17.6 billion-asset Chemical and its leadership would have a

Then Ramaker in June abruptly

While some analysts speculated about a potential disagreement between Ramaker and others at the bank, Chemical gave no indication that a rift existed. Three months later, the company announced plans to close 25 branches, or 11% of its network, and fire 7% of its employees, or roughly 235 people.

Chemical’s third quarter was noisy, taking into account upfront costs tied to the cost-cutting effort, but loan growth was strong.

Reinventing the business

Gordon, the chairman and CEO of Opus, struggled in early 2017.

His Irvine, Calif., bank reported its second consecutive quarterly loss in January. Though it returned to the

While total loans in the third quarter fell 20% from a year earlier, Opus remained profitable. And its nonperforming assets fell 32% from the beginning of the year.

The moves delivered on a promise Gordon made in late 2016.

“We don't want to end up getting whipsawed in the next” downturn, he

Gordon also brought on a number of new executives, including Kevin Thompson, who became the $7.3 billion-asset bank’s

Management has given indications in recent weeks that legacy issues have largely been addressed and that the company is again in growth mode. The bank, for instance, has hired at least eight commercial lenders in recent months.

Though Opus shed many higher-yielding loans, it should also benefit from rising interest rates, industry observers said.

“It sounds like the company is poised to get back on the field on offense following last year’s credit blowup,” Tim O'Brien, an analyst at Sandler O’Neill, said after attending an investor meeting in late November.

Heading in right direction

Mahon had one clear job in 2017: reduce Dime’s outsize reliance on commercial real estate.

Mahon, who became the Brooklyn, N.Y., company’s CEO a year ago,

"I just don't think we can run [the Dime model] forever because of the regulatory regime, and investors like diverse lines of business," Mahon said. "I don't expect this model to change after a year or two. We see this as a long-term solution."

At this time last year, CRE loans exceeded 1,000% of total risk-based capital, the second-highest percentage in the country for banks with assets of less than $10 billion, according to BankRegData.com.

Dime recently announced plans to

The securitization move will also lower the company’s loan-to-deposit ratio to 130.4% from 136.8% and boost its Tier 1 common ratio to 10.93% from 10.65%.

The size of Dime’s C&I book spiked to $111 million at Sept. 30; it only had $2 million of such loans at the end of 2016. Total real estate loans fell by 4% of that time to $5.6 billion.

The company also filed an application with the Federal Deposit Insurance Corp. to form Dime Municipal Bank in New York. The precise purpose of the proposed bank is unclear; a copy of the application was not available.

Exiting gracefully

Green Bancorp in Houston made it clear that it would overhaul its loan portfolio in 2017.

The company has been determined to

The company’s president, Greenwade, and its chairman, Mehos, spent much of the year methodically tackling those objectives. They also had to react quickly this summer when Texas was slammed by Hurricane Harvey. Relatively limited damage from Harvey prompted a $1 million loan-loss provision in the quarter, and Green managed a 1.1% return on assets and a 13% return on equity.

Total energy exposure at Sept. 30 was $71 million, or just 2.3% of total loans. It was a significant decrease from early 2016, when such credit made up nearly 9% of total loans.

Management was also able to lower Green’s ratio of CRE to total capital below 300%.