Community banking

Community banking

-

Peapack-Gladstone Financial in Bedminster, N.J., has filed a shelf registration statement to sell as much as $100 million in securities.

December 20 -

Liberty Financial Services in New Orleans said it will redeem more than 11,000 shares of preferred stock it issued as part of the Troubled Asset Relief Program after receiving an investment from BancorpSouth in Tupelo, Miss.

December 20 -

Flagstar Bancorp in Troy, Mich., said that the Office of the Comptroller of the Currency has terminated its 2012 consent order with its Flagstar Bank on Monday.

December 20 - West Virginia

City Holding in Charleston, W.Va., is looking to raise up to $55 million in a stock offering.

December 20 -

Ameris Bancorp in Georgia wanted to buy a premium-finance business but settled for a joint venture, blessed by its regulators, after being flagged for insufficient Bank Secrecy Act compliance.

December 20 -

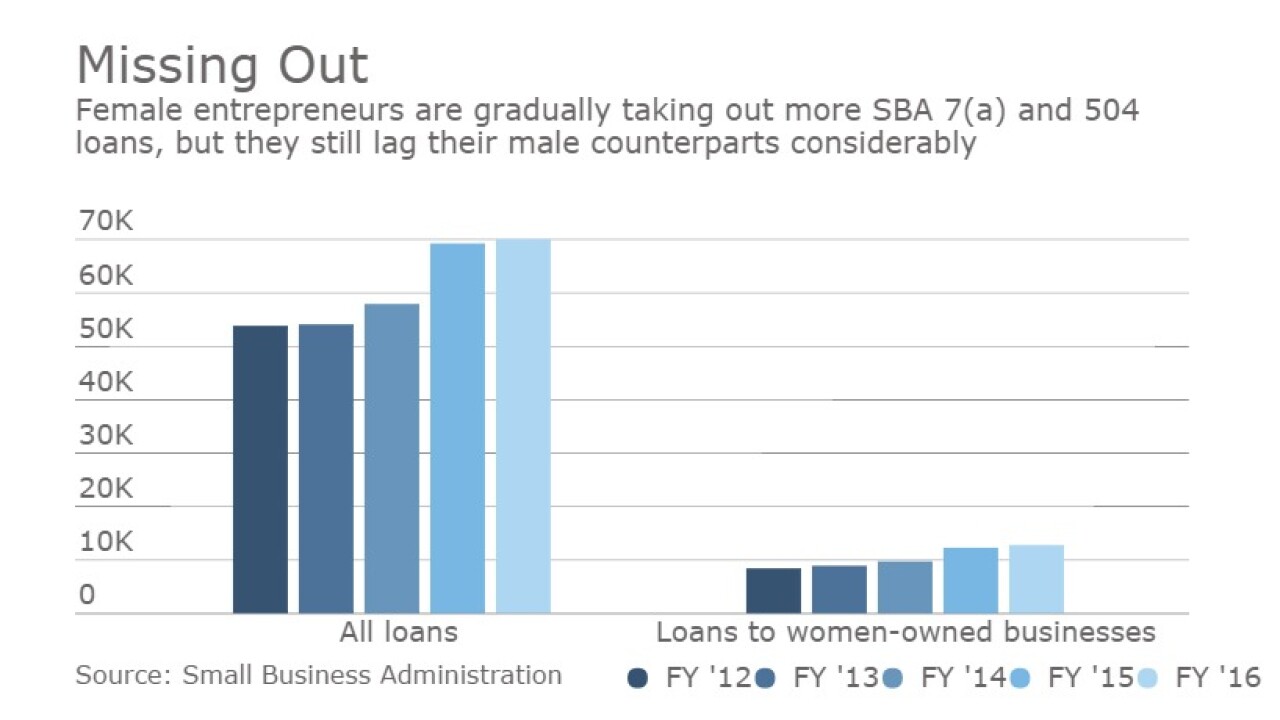

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

United Community Banks in Blairsville, Ga., is searching for a new financial chief officer.

December 20 -

Following the passage of the November ballot initiative, it is hugely important that cannabis businesses in the nation's largest state be able to secure bank accounts, at a minimum.

December 20 -

Wayne Savings Bancshares in Wooster, Ohio, is looking for a new CEO.

December 20 -

CVB Financial in Ontario, Calif., and Valley Commerce Bancorp in Visalia, Calif., have amended the terms of their planned merger.

December 20 -

MainSource Financial Group in Greensburg, Ind., has agreed to buy FCB Bancorp in Louisville, Ky., for about $56.9 million. The cash-and-stock transaction is expected to close in the second quarter.

December 19 -

Two former executives of the failed GulfSouth Private Bank in Destin, Fla., and another man have been indicted on federal charges of defrauding the Troubled Asset Relief Program of $7.5 million.

December 19 -

Smaller institutions have increased the size of their auto books in the last year, with the 25 most-active lenders reporting a nearly 7% increase. More borrower demand and a pullback by some bigger lenders are contributing to the rise.

December 19 -

Banc of California in Irvine and PL Capital have reached an apparent truce, as the bank agreed to consider letting the activist investor group submit two nominees to next year's board election.

December 19 -

Dickinson Financial in Kansas City, Mo., has agreed to buy Community Bancshares of Kansas in Overland Park.

December 19 -

Ameris Bancorp in Moultrie, Ga., has entered into a consent order with regulators tied to the Bank Secrecy Act.

December 19 - California

Pinnacle Bank in Gilroy, Calif., has appointed a new CEO and its current leaders will move into a newly created role.

December 16 - New York

Carver Bancorp once turned to Citigroup during a time of need for financial assistance. Now Citigroup has recruited Carver's former CEO to join its board.

December 16 -

Credit One Bank in Las Vegas, Nev., a credit card specialist, plans to almost double its workforce over several years to support business growth.

December 16 -

To act like a startup as many banks say they want to do institutions must employ a nontechnical strategy: build services based on customers say they want.

December 16