Community banking

Community banking

-

Regulators want to know how banks are planning for the future, particularly in the face of competitive threats such as marketplace lending and added scrutiny over the use of third-party vendors.

March 9 -

Investors have punished most energy lenders since oil prices began sliding more than a year ago. Despite a recent rally, stocks of publicly traded banks with at least 3.5% of loans tied to the energy sector have fallen by 18% since early 2015. The KBW Nasdaq bank index is down 13% over that time. Here is a look at the worst-performing energy lenders in the past year and one exception to the rule.

March 9 - Pennsylvania

Penns Woods Bancorp in Williamsport, Pa., has promoted Michelle Karas to chief operating officer.

March 8 - Tennessee

Mountain Commerce Bancorp in Knoxville, Tenn., has added a former California community bank executive to its board.

March 8 -

Northwest Savings Bank's plan to shutter its branch in Pleasantville, Pa., has run into stiff opposition from the town's mayor.

March 8 -

Green Bancorp Chief Executive Geoff Greenwade, eager to tamp down speculation of a potential sale, stressed during a conference presentation that the Houston company plans to remain independent.

March 8 -

Changes to mortgage disclosures rules implemented in October continue to frustrate community bankers and is just another example of the struggle to stay independent.

March 8 -

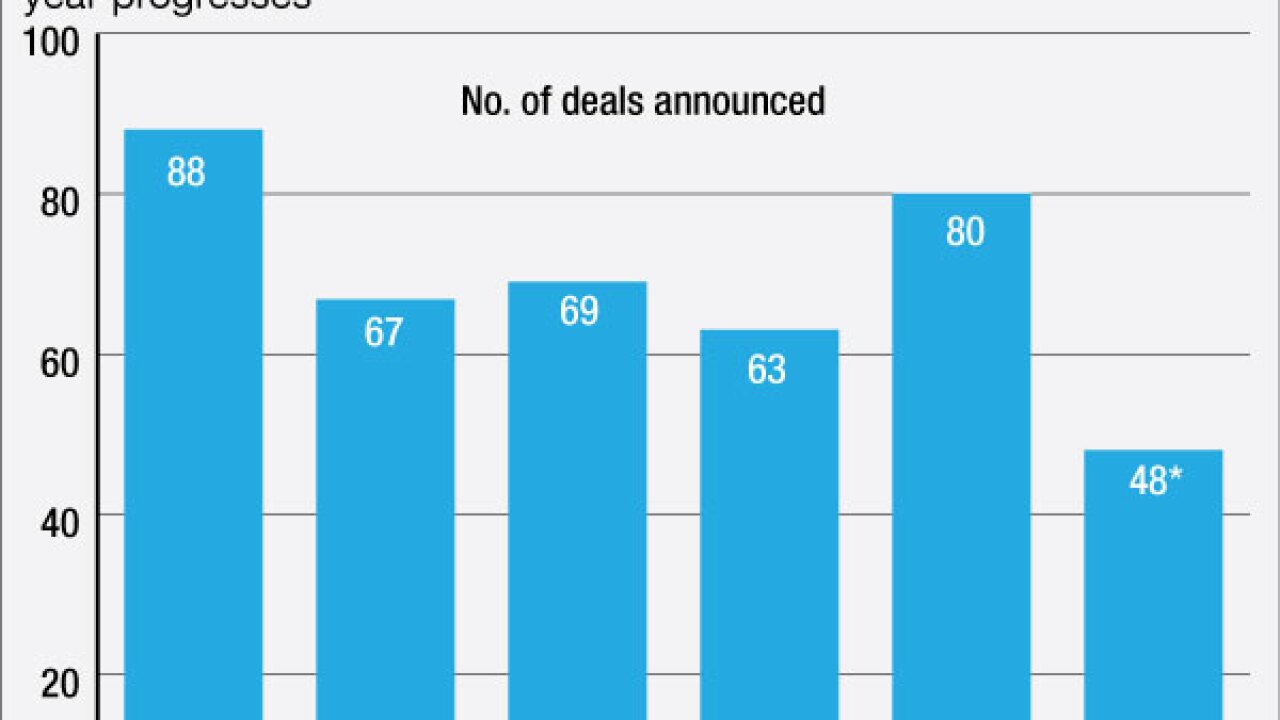

The pace of bank mergers and acquisitions has slowed of late as bank stock values have plummeted, but expect it to pick up as 2016 wears on. Here's why.

March 8 - Texas

Southwest Bancorp in Stillwater, Okla., and LegacyTexas Financial Group in Plano have disclosed exposure to a commercial borrower that faces criminal and civil investigations.

March 8 -

BBCN Bancorp withstood numerous overtures from Hanmi Financial and a revolt by four of its own directors as it negotiated a deal to buy Wilshire Bancorp. A new filing discloses just how intense those pressures were.

March 8 -

Hailed as a space- and cost-saver, interactive video teller machines don't always succeed as a strategy. Many banks offer them without a clear business case to justify the investment.

March 8 -

Alamogordo Financial in Alamogordo, N.M., plans to convert from a mutual to a fully stock-owned bank holding company.

March 7 -

Smaller players are losing ground to deep-pocketed large banks that can both absorb compliance costs and invest in the most up-to-date technology, M&T's longtime CEO said in his annual letter to shareholders. He also worried about banks' shrinking role in the ever-changing lending landscape.

March 7 -

HarborOne Bank, a mutually owned co-operative bank in Brockton, Mass., plans to sell shares to the public.

March 7 -

Are they near New York City? Palm Beach? San Francisco? You are not even warm, according to an analysis of deposit data by IXI Services, a division of Equifax.

March 7 -

Triumph Bancorp in Dallas has agreed to buy ColoEast Bankshares in Lamar, Colo.

March 7 -

Rebeca Romero Rainey, incoming chairman of the ICBA, would like to see the financial services industry add new banks and younger bankers in coming years.

March 7 -

Wonder Bancorp and Harvard Illinois Bancorp have extended the deadline for their merger to May 31, according to a joint news release issued Friday.

March 4 -

American National Bankshares in Danville, Va., said in a press release Friday that Dabney Gilliam, its chief administrative officer, will resign at the end of this month to join Bank of Charlotte County.

March 4 - Illinois

Randy Conte, the $15.6 billion-asset bank's chief operating officer, will become chief financial officer on April 30 and remain operating chief.

March 4