Community banking

Community banking

-

HCSB Financial in Loris, S.C., said Jan Hollar would become its chief executive after a $45 million recapitalization led by Castle Creek Capital Partners.

March 3 -

United Federal Credit Union's deal to merge with Lake Michigan Credit Union fell through, but it has acquired an executive from its larger rival.

March 2 -

The House Financial Services Committee approved a bill 34-22 Wednesday that would require financial regulators to tailor rules to ensure they are appropriate for small banks but the measure continues to face significant Democratic opposition.

March 2 -

Mergers of equals are hard to complete due to cultural issues, but a spike in consolidation paired with weary leaders and a lack of young talent could make such combinations more appealing.

March 2 -

As in-person transactions continue to decline, bankers should focus on engaging with customers in settings outside the physical branch.

March 2 -

Hancock Holding in Gulfport, Miss., has nominated the chief financial officer for the city of Tampa, Fla., to join its board.

March 2 -

Green Bancorp, the Houston lender that went public in 2014, is exploring a sale, according to people with knowledge of the matter, as weakness in its energy loan book pressures its share price.

March 2 -

In almost any other election cycle, bankers would be celebrating the fact that a Republican candidate has emerged so far in front of the pack and would quickly fall in line behind him. But this has been anything but a normal election cycle, and there are a whole host of reasons that bankers will be at least as reluctant to embrace the outspoken businessman Donald Trump as the Republican establishment has been.

March 1 -

Cordia said in a press release Tuesday that it sold its CordiaGrad platform to its Jack Zoeller, the $348 million-asset company's chief executive.

March 1 -

WASHINGTON The House Financial Services Committee will hold a vote Wednesday on a bill that would provide regulatory relief for financial institutions that are not considered systemically important.

March 1 -

More than 200 small banks across the country will be able to offer online loans to their small-business customers as part of a new partnership announced Tuesday.

March 1 - Oregon

Cascade Bancorp in Bend, Ore., has named a new bank president and chief operating officer, as its chief executive hands over some of his leadership responsibilities.

March 1 -

Sunstate Bank in Miami has been released from an enforcement action that had required it to strengthen its anti-money-laundering controls.

March 1 -

Estimates of nonbank mortgage providers that will close or change hands should worry consumers and policymakers about access to credit.

March 1 -

Establishing an active dialogue with major shareholders can help banks get ahead of activist campaigns, according to Josh Hinkel, a partner with Bain & Co.

March 1 -

Summit Financial Group in Moorefield, W.Va., has agreed to buy Highland County Bankshares in Monterey, Va., for $21.8 million in cash. The deal is expected to close early in the third quarter.

March 1 -

Focusing on customer experience and building the best products will mean nothing to your company's bottom line if your bank fails to cultivate a positive culture.

March 1 - Pennsylvania

A Malvern Bancorp director has resigned following a disagreement over one of the Paoli, Pa., company's clients.

March 1 -

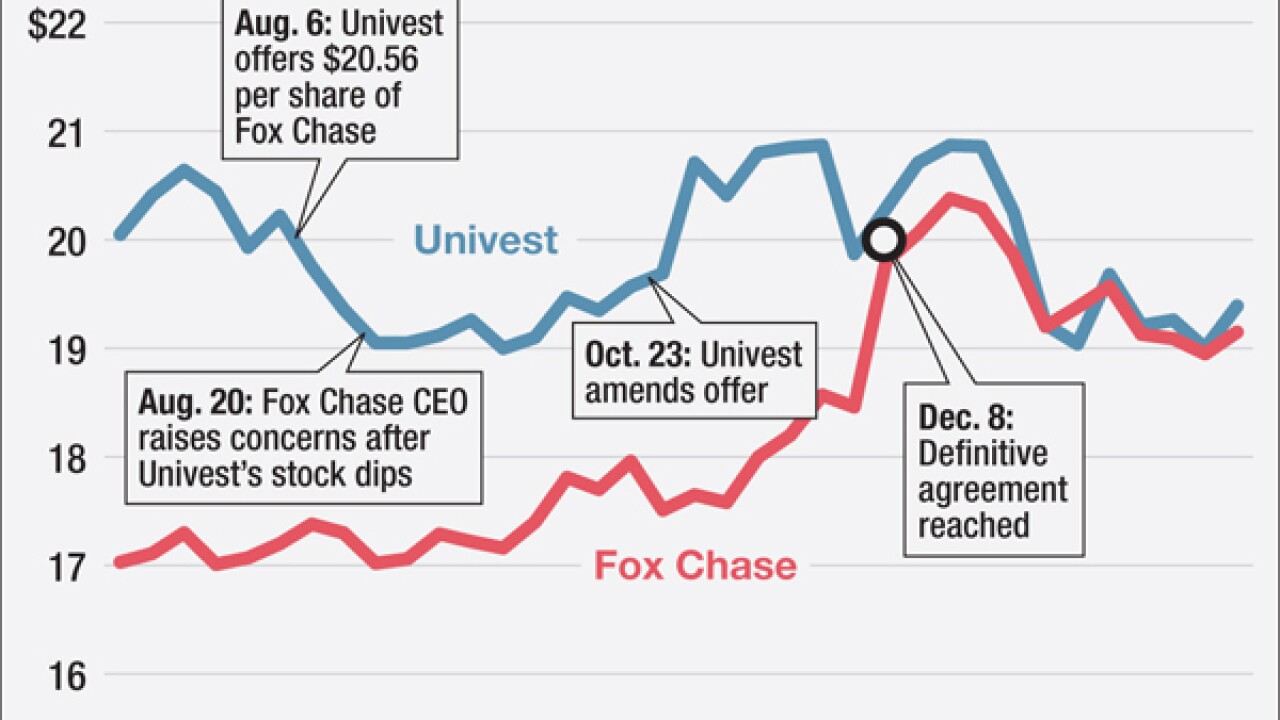

Univest Corp. of Pennsylvania was negotiating to buy Fox Chase Bancorp when its stock plummeted in August. The decline prompted Fox Chase to seek other offers, while forcing Univest to adjust its proposal to prop up the deal value.

February 29