Community banking

Community banking

- Virginia

Fauquier Bankshares in Warrenton, Va., has named a North Carolina community banker as its new chief executive.

February 19 -

The decision in Yvanova v. New Century Mortgage Corp. has the potential to radically increase the number of lawsuits brought by borrowers, particularly on loans that were pooled into securitized trusts.

February 18 -

First Sound Bank in Seattle has recruited chief financial and administrative officers from rival banks.

February 18 -

Centrue Financial in Ottawa, Ill., has been released from an enforcement action that had prohibited the company from paying dividends without regulatory approval.

February 18 -

Advia Credit Union in Parchment, Mich., has agreed to buy Mid America Bank in Janesville, Wis. The $1.2 billion-asset Advia did not say what it will pay for the $84 million-asset Mid America.

February 18 -

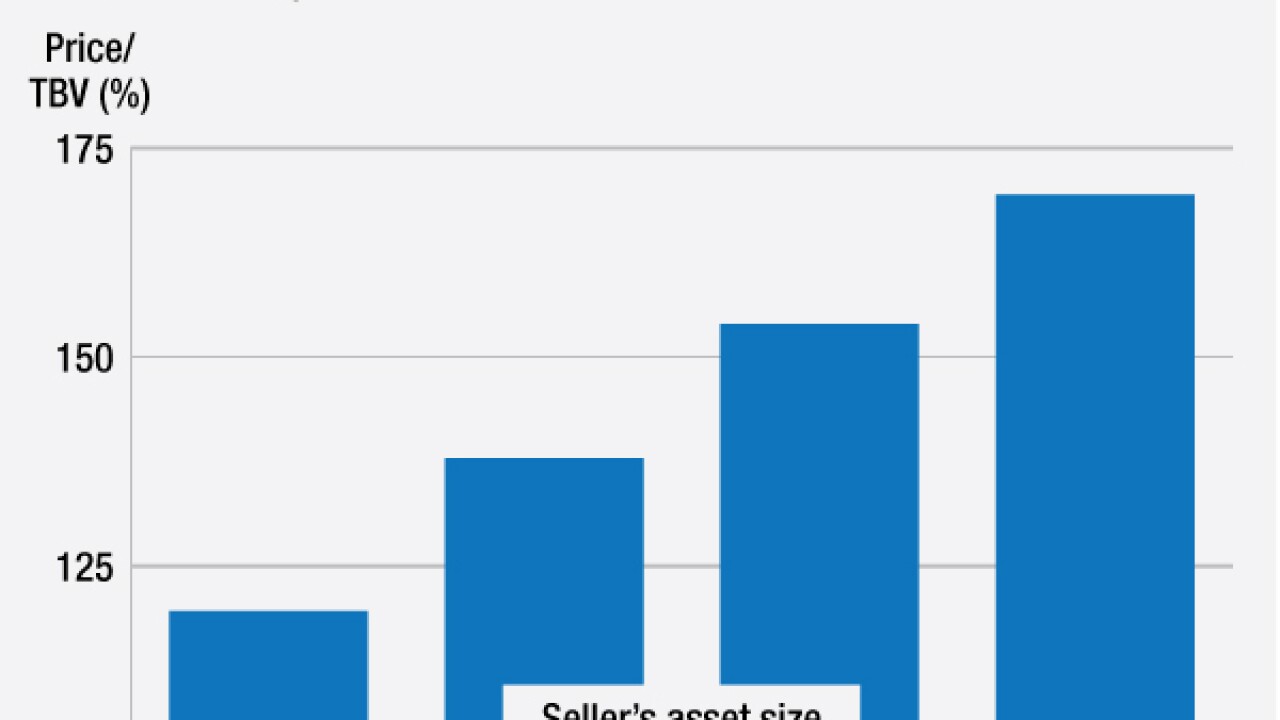

There is a widening gap between the premiums paid for bigger institutions and those of smaller community banks. Economies of scale, scarcity value and earnings potential are more important than ever, and a return of larger acquirers has increased demand for bigger sellers.

February 18 -

Freedom Bank of Virginia in Fairfax has named to its board a consultant to a fund that recently invested in the bank.

February 18 -

Correcting misperceptions about banking, in addition to focusing on recruitment efforts, will help fix an apparent rupture in the talent pipeline.

February 18 -

Josh Hinkel, a partner with Bain & Co., discusses the rise of shareholder activism in financial services and how "aggressive" investors are driving higher returns.

February 18 -

Lakeland Bancorp in Oak Ridge, N.J., has agreed to buy Harmony Bank in Jackson, N.J.

February 18 -

About 10% of midsize businesses say they want to develop a relationship with nonbank providers, such as marketplace lenders or business development companies, and even more are said to be considering switching banks.

February 17 -

Pathfinder Bancorp in Oswego, N.Y., has exited the Small Business Lending Fund program.

February 17 -

Several money managers increased their holdings in banking companies during the fourth quarter and added new investments in other banks.

February 17 -

The NCUA's plan to expand credit unions' business-lending powers generated more than 3,000 comment letters, mostly from bankers urging a "no" vote. But the agency's board is expected to stick by its original proposal.

February 17 -

There are millions of businesses deserving of loans that banks using traditional data resources might overlook due to their thin credit histories.

February 17 -

The mismatch between demand for new homes and the supply threatens to drive up prices and dampen lending.

February 17 -

Banks are generally selling for less than they did before the financial crisis. Yet there have been select instances in which buyers have been willing to pay significant premiums to sellers' tangible book values. Here are the highest premiums since January 2015 for deals valued at $100 million or more.

February 17 - Maryland

Glen Burnie Bancorp in Maryland has appointed a successor to its outgoing president and chief executive.

February 16 -

The $325 million-asset State Bank said in a press release Tuesday that it will pay $29.6 million in cash and stock for the $206 million-asset Country Bank.

February 16 -

Citizens Community Bancorp in Eau Claire, Wis., has agreed to buy Old Murry Bancorp in Rice Lake, Wis.

February 16