Community banking

Community banking

-

The $128 million acquisition will provide First Financial with its first branches in Kentucky and Tennessee.

January 8 -

Northeast Bancorp also expects the move to make it more efficient.

January 7 -

River Road Financial has agreed to buy Mississippi River Bank in a deal that will bring in a new CEO.

January 7 -

Organizers are planning to raise up to $25 million for Tandem Bank.

January 7 -

On Sep. 30, 2018. Dollars in thousands.

January 7 -

Slumping stock prices may force banks to press pause, but the need for low-cost deposits and scale could provide a spark later this year.

January 4 -

Stephen Raffaele has been the bank's president since 2016.

January 4 -

The Pennsylvania company has agreed to buy Forney Financial Solutions.

January 3 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

Bob Mahoney, CEO of Belmont Savings, called Jack Barnes after People's United agreed to buy a Connecticut bank. The banks announced their own merger agreement five months later.

January 3 -

A partnership between the mobile carrier and BankMobile could help stripped-down banking and deposit transfer services find a footing among U.S. customers.

January 2 -

A smooth integration of Access National could allow John Asbury, CEO of Union Bankshares, to move a step closer to building a regional franchise that stretches from Baltimore to Hampton Roads.

January 2 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

Bank OZK's George Gleason, one of our community bankers to watch in 2019, needs to rein in the Arkansas bank's commercial real estate exposure to placate nervous investors.

December 31 -

Spirit Community Bank is the 15th bank to get the agency's approval this year. That list also includes Community Bank of the Carolinas, which was approved in early December.

December 31 -

James McLemore, one of our community bankers to watch in 2019, has more energy loans to purge and must exit the Small Business Lending fund and a BSA-related enforcement action.

December 30 -

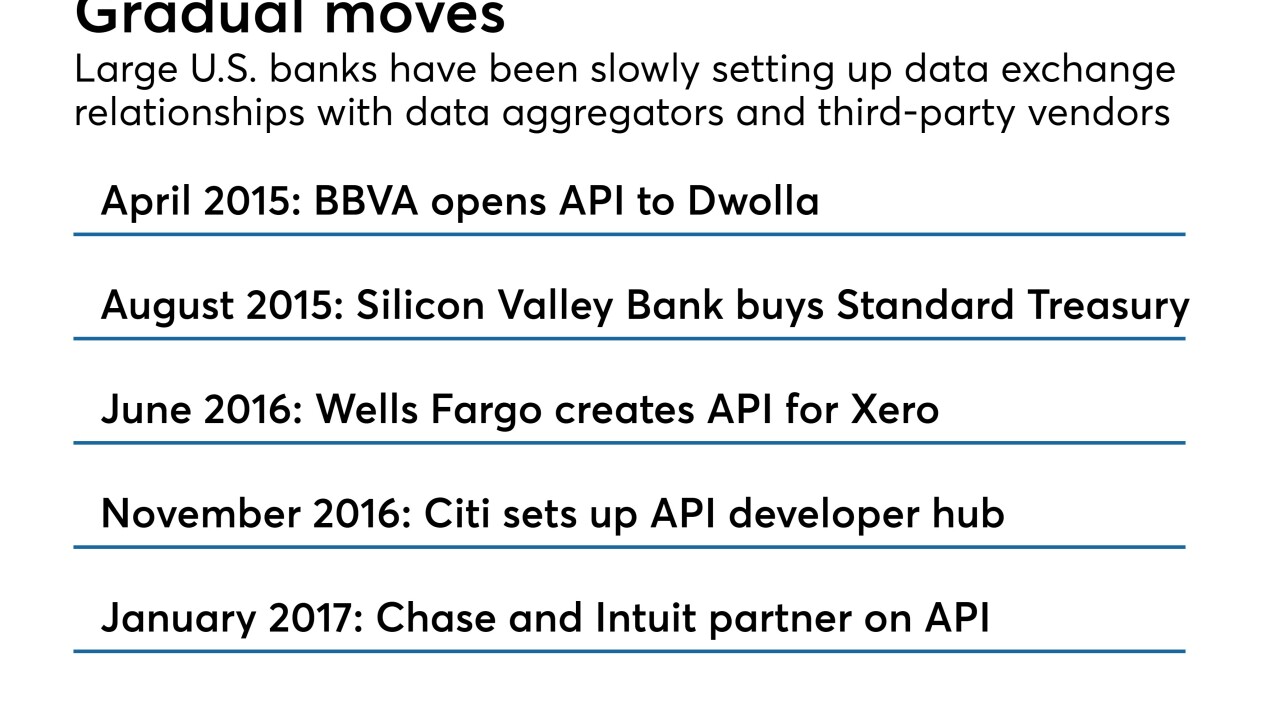

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

The branch closures will reduce overhead by an estimated $1.9 million a year.

December 28 -

HarborOne Bancorp — led by James Blake, one of our five community bankers to watch in 2019 — is a former credit union that recently made its first bank acquisition and has Boston and other markets in its sights.

December 27