Keeping pace with technology demands has been a long-simmering concern among community banks, regionals and credit unions.

But it appears ready to come to a boil in 2019 as many grow increasingly frustrated with major core providers, arguing they aren’t moving fast enough to allow institutions to meet consumers' heightened expectations.

It’s an issue the core processors say they understand and are trying to address, even as industry representatives grow more publicly restless.

“I’m very sympathetic to the fact that everyone feels like we have to move faster,” Byron Vielehr, Fiserv’s chief administrative officer, said in an interview. “We hear that message. We’ve been accelerating the rate of advancing our products that last few years.”

For many financial institutions, though, change isn’t coming fast enough. Small institutions contend core processors haven’t met their needs to modernize.

“We’re wanting cloud economics and scale, faster innovation, open/API-enabled services, and real-time updates with omnidigital support,” said David Hunkele, head of products for the $3.4 billion-asset Live Oak Bank in Wilmington, N.C.

Hunkele said these areas need to be addressed “so we can deliver user experiences to customers directly and with partners that are appropriate for their journeys.”

Data sharing is also a notable shortcoming, he said.

“Data across all services should work together and tell a story that is exponentially more insightful and valuable,” he said. “Data should never be entered more than once and should be made available to customers, partners and internal servicing groups in a manner that is appropriate for the access device and end-user role.”

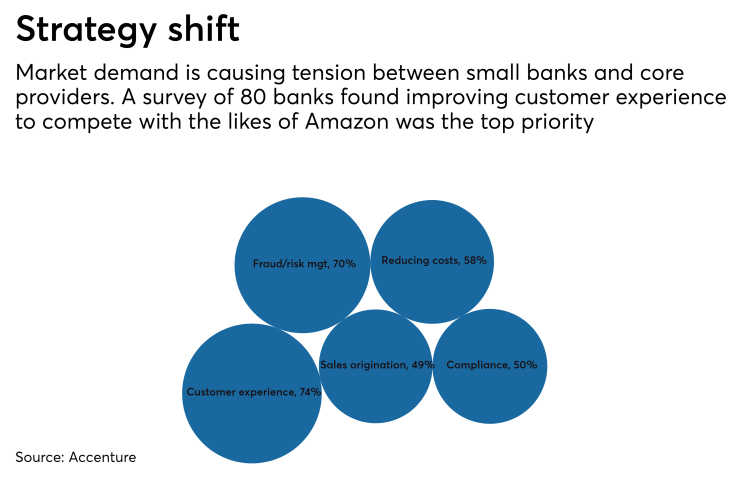

Many of those perceived shortcomings reflect changes in the market. Amazon, Credit Karma, Netflix, Simple, Uber and others are raising consumers' digital expectations. They expect their financial services institutions to keep up, said Josh Glover, executive vice president for the Americas at the fintech nCino.

“Technology is changing the world so quickly that we think that any longstanding industry should try and learn lessons from other longstanding industries that have been disrupted by technology,” Glover said.

Vielehr of Fiserv agreed.

“We have this rising set of expectations that continues to go on,” he said. “The epicenter isn’t banking. The epicenter is what’s going on in the digital world.”

Some bankers and credit union executives said it’s unfair to pin all the blame on core providers. Several said that the industry itself has not made the necessary cultural shifts and that regulators often appear skeptical of new technologies.

“The industry itself is behind,” said an executive at a community bank in the Midwest who spoke on the condition of anonymity. “There are many factors that play into this, including banks themselves not willing to adjust to customer needs and risk approach, and the regulatory burdens for financial institutions, which I would argue are slowing technology advancements more than anything.”

The executive added that while alternatives to the cores are increasing, “the unwinding of a legacy core and the functionality that has been built over several decades is a significant undertaking for any bank.”

Raphael Reznek, the chief information officer at Mascoma Bank in Lebanon, N.H., said smaller institutions need to hire personnel from outside the banking industry to force a mindset change.

“It depends on the institution,” Reznek told executives at an American Bankers Association conference in October. “These larger banks have done a much better job of embracing change, but I think they’ve also brought in people that were not in banking. They’ve brought in technology people and first-principle thinkers that are not encumbered by the traditional banking mindset.”

Reznek challenged executives to essentially fish or cut bait if they’re unsure on how to proceed.

“There are some [executives] that are taking it seriously and I think there are others waiting to retire. I think they’re scared,” he said. “Rocket Mortgage is doing a lot of business and taking business from Main Street. Those are loans that small community banks used to make and those are loans they will not be making. Small community banking is absolutely not prepared.”

Other executives said it’s not fair to compare financial institutions to fintechs, because they must be more careful about how they invest.

“I say the best we can do is position ourselves so that we can be flexible, take on new opportunities when they come in, but continue to have an eye towards sustainability,” said Aaron Frydman, the chief information officer at Partners Federal Credit Union in Orlando, Fla., at the Walt Disney Co. “And I think that’s the challenge. The balance is that you have to be able to do both those things.”

Still, pressure is building on core providers to be more agile. Rob Nichols, the president of the ABA, sent a letter to the CEOs of Fiserv, FIS and Jack Henry & Associates asking them to join a committee tasked with helping smaller institutions modernize technology. All three companies joined.

In interviews, executives say they are striving to innovate quickly.

“The bar is being set by others,” said Rob Lee, the chief product officer at FIS. “The bar is not being set by another banking application. It’s being set by everything you use on an iPhone.”

One effort core providers said they will continue to support is small institutions’ partnerships with third parties.

Each core gives banks the ability to work with fintechs to integrate products into their systems via application programming interfaces. It’s become standard practice in the industry as the processors are in constant discussions with fintechs about accessing their systems.

“You can’t be everything to everybody. We’ve realized that for years. We have a really healthy third-party community around the Jack Henry cores,” said Stacey Zengel, vice president of Jack Henry & Associates and president of Jack Henry Banking.

Fiserv’s Communicator Advantage, meanwhile, enables banks to add and manage products from third-party providers.

FIS works with the Venture Center in Arkansas on a venture capital fintech accelerator meant to challenge how business is done in financial services. Jack Henry Banking and Symitar both offer core clients access to hundreds of fintech vendors through their Vendor Integration Program. Vendors in the program have direct access to Jack Henry technical resources to integrate with the core platforms.

“We’re doing the right things and you have to continue to evolve as the market evolves,” Zengel said.

Lee said FIS will continue to keep an eye out for what’s next, and anticipate technology needs for all banks, not just smaller institutions. He identified three areas community and regional institutions are seeking to add or improve upon: lending, online account opening and Zelle integration.

“We’re continuously working on what the next thing will be,” Lee said. “No one truly knows what that will be. But it really gets back to us having the ability to rapidly integrate new capabilities as they come up, because you don’t know what the new trend might be.”