Community banking

Community banking

-

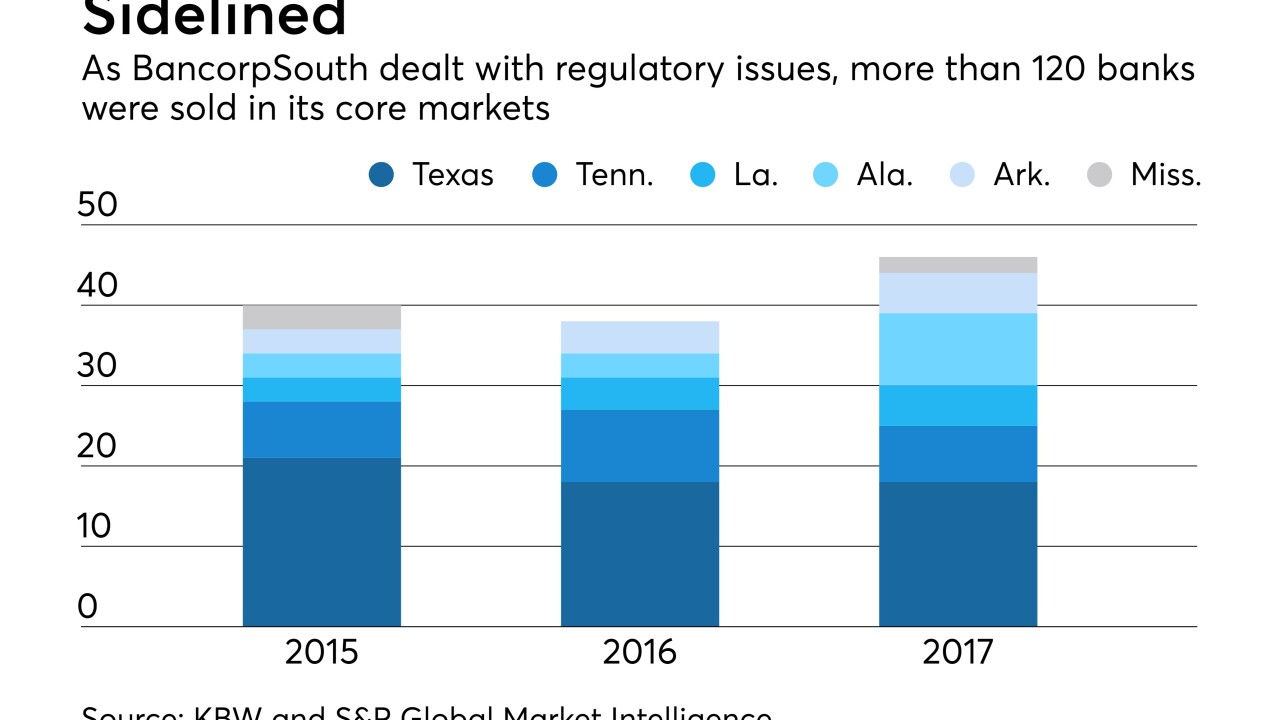

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

Putting aside the spin of both credit unions and banks, we offer some informed predictions about how the financial industry would be reconfigured if the century-old tax break were to disappear.

April 25 -

First Keystone, which gave no reason for Matthew Prosseda's abrupt departure, has formed a search committee to find a permanent replacement.

April 25 -

Buyers are scooping up many of the market's biggest banks, making it harder for others to gain scale.

April 25 -

The Missouri company reported strong loan growth that also reflected a spike in factoring activity.

April 25 -

The Florida company is also set to enter Alabama as part of the $360 million purchase.

April 24 -

Banks and credit unions have been fighting each other so long that many have forgotten how the feud started and why it may matter to the future of both industries.

April 24 -

The company agreed to buy Landmark Bancshare in Marietta, Ga., for $115 million.

April 24 -

AssetMark Trust plans to offer a product for the $1 billion in cash it holds for clients.

April 24 -

Live Oak Bancshares wants its next bank president to “step on the gas” as it accelerates growth into new industries.

April 24 -

The Seattle company has faced criticism from an investor over its commitment to the business, which lost money in the first quarter.

April 24 -

Nearly a third of NBT Bancorp's revenue comes from fee businesses, though it took patience, several acquisitions and a tolerance for added regulation to get there.

April 23 -

The high-profile hiring of Huntley Garriott comes a year after the North Carolina company had brought on a veteran banker to run the unit.

April 23 -

Old National Bancorp in Indiana plans to sell 10 branches to Marine Credit Union, expanding the credit union's reach.

April 23 -

The Indiana bank plans to sell 10 branches to a credit union. It will also shut down several more locations.

April 23 -

The $17 billion-asset Bank of Hawaii reported higher profits on rising interest income, even as it saw yearly declines in mortgage banking and deposit fee income, as well as losses on investment securities.

April 23 -

The California company, which also focuses on Asian-Americans, agreed to buy First American International.

April 23 -

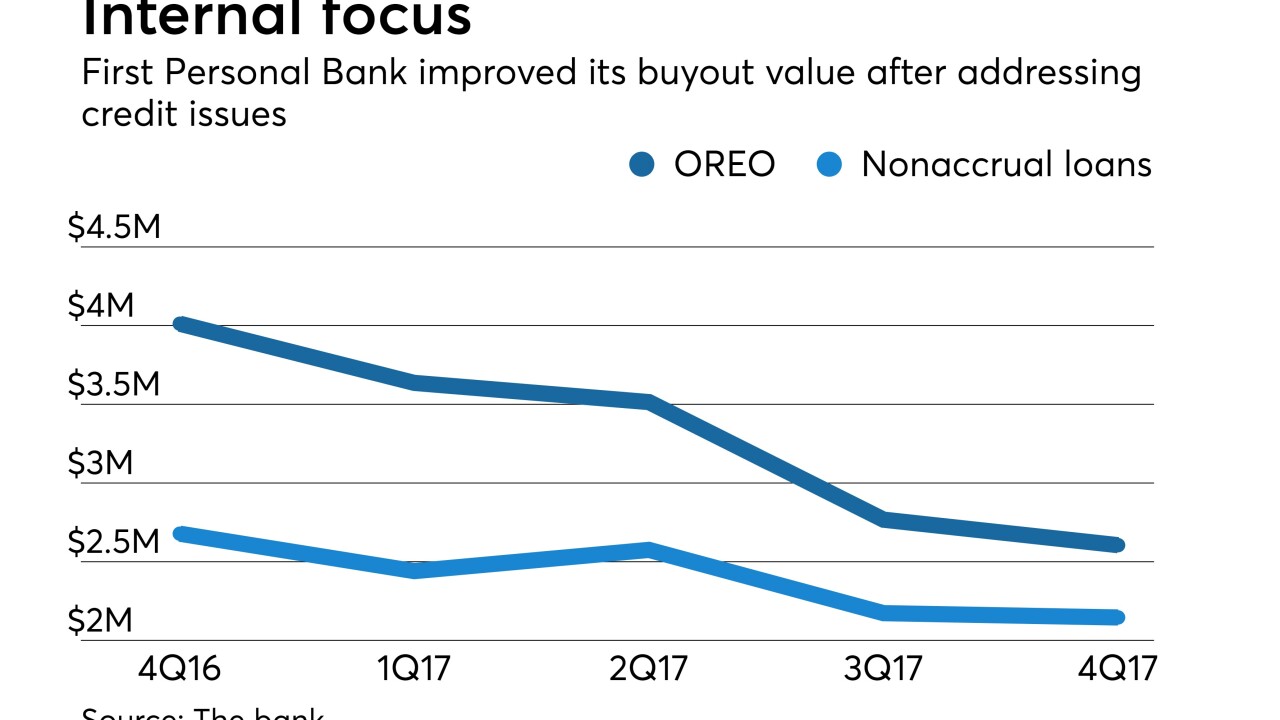

First Personal Bank in Illinois tried — and failed — to sell itself three times. The bank finally found an eager buyer after tackling several lingering problems.

April 20 -

An $378 million agreement to buy Farmers Capital will allow the West Virginia company to bridge a gap between Louisville, Ky., and Huntington, W.Va.

April 20 -

The Arkansas company's revenue increased largely due to its 2017 purchase of Stonegate Bank.

April 19