Community banking

Community banking

-

Mike Daniels has been president and CEO of Nicolet's bank since 2015.

April 28 -

The community banks join a growing list of banking companies closing locations as customer preferences shift to digital channels.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The $56 million acquisition will extend Southern California Bancorp's footprint north of Los Angeles.

April 28 -

The Massachusetts community bank, which rebranded last summer, landed on affiliate marketing as one cost-effective way of attracting choice customers to its business checking and crypto banking capabilities.

April 27 -

The Senate Banking Committee chairman told an audience of community bankers that he supports legislation to close "chartering loopholes" for industrial loan companies and financial technology firms. He also pitched a plan to give all consumers a free digital wallet backed by the Federal Reserve.

April 27 -

The Missouri company announced the deal just five months after buying Seacoast Commerce in San Diego.

April 26 -

The proposed acquisition is the second deal in as two days to involve an Atlanta-based seller.

April 23 -

Bankers say the federal tax exemption for credit unions costs U.S. taxpayers $2 billion each year. But eliminating it would prevent the not-for-profit financial institutions from channeling their savings into higher rates and lower fees that stimulate commerce — and generate additional tax income.

April 23 -

The Illinois companies agreed to merge in a transaction that is expected to close later this year.

April 23 -

The company promoted Bob Fehlman to become its president and hired Jay Brogdon from Stephens Inc. to succeed Fehlman as chief financial officer.

April 22 -

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22 -

The deal would be Independent's sixth since 2015 and would continue a wave of consolidation among Boston-area banks.

April 22 -

The Maryland company is closer to addressing claims it lacked sufficient controls under its previous management.

April 22 -

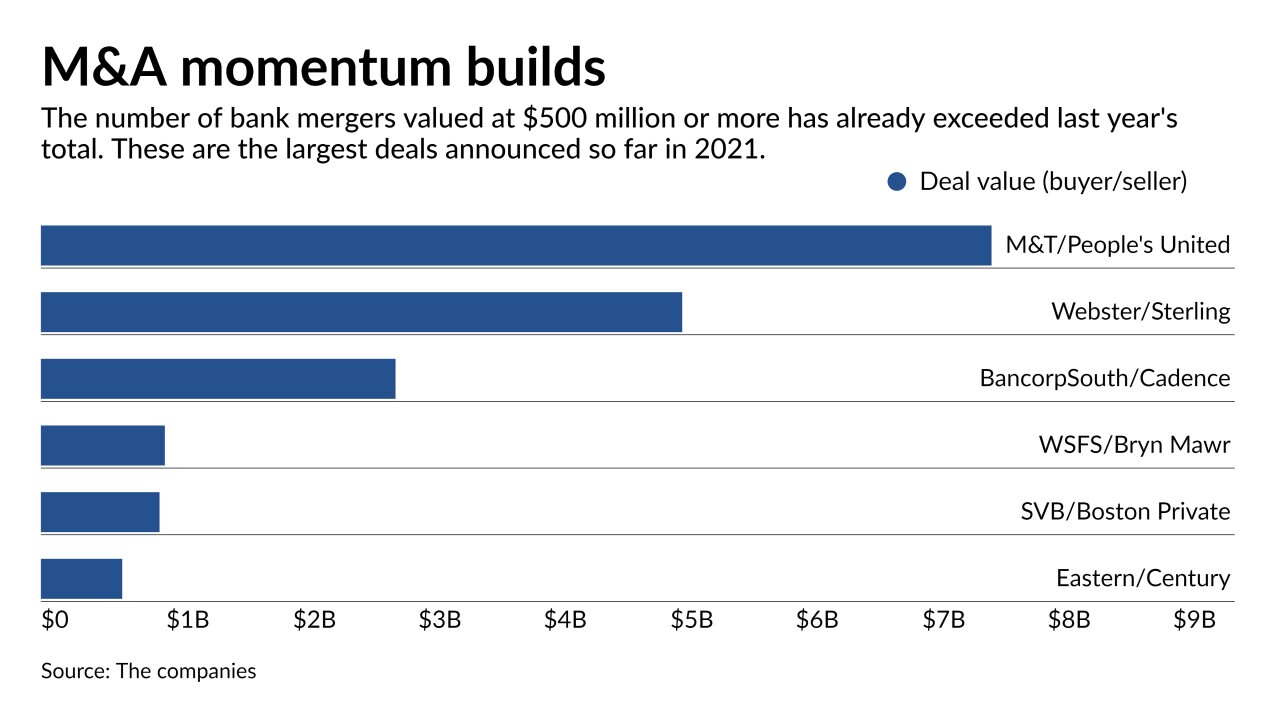

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

Queensborough National Bank and Trust in Georgia is one of several banks aiming to recruit tech-savvy interns through a network of universities and fintech companies.

April 20 -

Rhodium BA Holdings said it has proposed paying a higher price to disrupt the banking company's proposed sale to DLP Real Estate Capital.

April 20 -

Wells Fargo wants to use the real-time payments network being developed by the Federal Reserve for 24/7 liquidity management. The online-only First Internet Bank aims to use it to help customers manage their bills and cash flow.

April 19 -

Year to date through Dec. 31, 2020. Dollars in thousands.

April 19 -

Funds affiliated with HPS Investment Partners plan to buy Marlin Business Services for $282 million.

April 19