Community banking

Community banking

-

From wrestling with the potential impact of Brexit to charting a course for responsible artificial intelligence, the Most Powerful Women in Banking have faced many challenges during the past year. See who earned the top spots in our ranking.

September 22 -

The Pennsylvania community bank has seen rapid growth in recent years, thanks in large part to its success in attracting women clients.

September 22 - Edit License

Thurlow recognized that if she wanted to get serious about reaching the unbanked in her community, she needed to meet people where they were. That meant providing financial products they actually need and giving them access in their native language.

September 22 -

Laura Lee Stewart, president and CEO of Sound Community Bank in Washington, is set to be the third woman to serve as chairman of the American Bankers Association. She's already aiming how to make use of her tenure.

September 22 - Edit License

Innovation in banking typically means developing or investing in some cutting-edge technology that will appeal to younger, tech-savvy customers. But to Luanne Cundiff, it can also mean finding new ways to meet the needs of senior citizens who aren't all that interested in digital banking.

September 22 - Edit License

In an increasingly competitive financial services marketplace, tiny Citizens is thriving, thanks largely to tech innovations Castilla has pioneered and the loyalty built through Castilla's relentless promotion of the bank's customers and the broader Edmond community.

September 22 -

Two newly minted CEOs, Citibank's Mary McNiff and City National Bank's Kelly Coffey, top the list of Women to Watch for 2019. Check out who else earned a spot in the ranking.

September 22 - Edit License

During the past year, Dorothy Savarese has pushed her bank's employees to think more creatively, introducing an innovation contest to facilitate the sharing of fresh ideas within the institution.

September 22 -

StreetShares, started as a peer-to-peer service for veterans, has added a platform intended to connect small financial institutions and underbanked companies.

September 22 -

See American Banker's 17th annual ranking of the Most Powerful Women in Banking and Finance.

September 22 -

Increased adoption of The Clearing House’s faster payments system could put pressure on community banks and credit unions awaiting the launch of the Fed’s competing service, FedNow.

September 20 -

The company will gain 34 branches and $1.2 billion in assets when it buys State Capital in Mississippi.

September 20 -

The decision to bring in Michael Doyle follows a quarter where the South Dakota company reported a spike in net charge-offs.

September 20 -

The Michigan company sold collateral tied to Live Well, a mortgage company that has filed for bankruptcy protection.

September 20 -

The company will buy TB&T Bancshares, which operates branches near Texas A&M University.

September 20 -

The Pennsylvania company will pay $31 million for a bank with $269 million in assets.

September 19 -

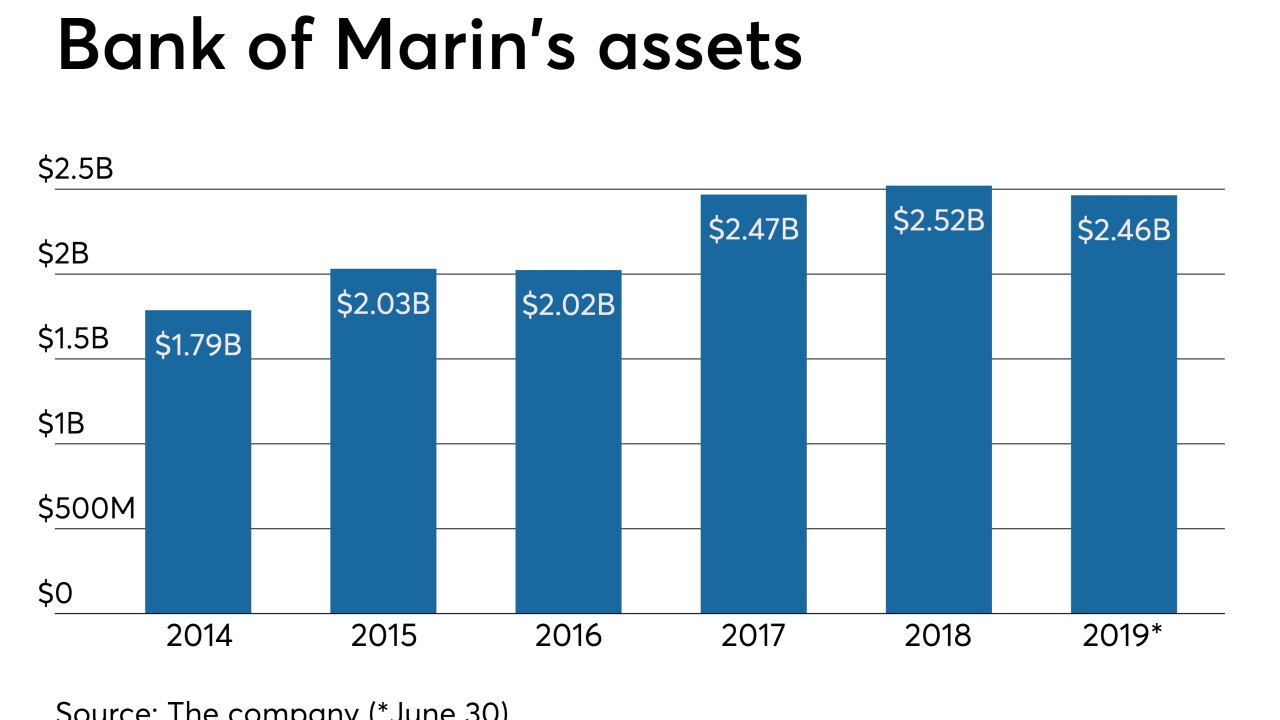

The California company said it has no timeline for Russell Colombo's expected retirement.

September 19 -

JWTT, created by former Wedbush Securities bankers, says it will use its connections to court business from other investment banks that were recently sold.

September 19 -

Nearly a tenth of the industry’s deals this year were connected to the state, which boasts a good number of sought-after small banks.

September 18 -

The company will pay $42 million in cash for the parent of Main Street Bank in southeastern Michigan.

September 18